We all love kicking back with some Netflix (NFLX) in our downtime—but how many of us actually own the stock? Truth is, your wallet would probably thank you more for buying shares than binge-watching TV. With strong subscriber growth, expanding margins, and a clear roadmap for returns, I’m bullish on Netflix—even with its high P/E ratio of nearly 50. I believe the stock has the momentum to break past $1,100 in the second half of 2025.

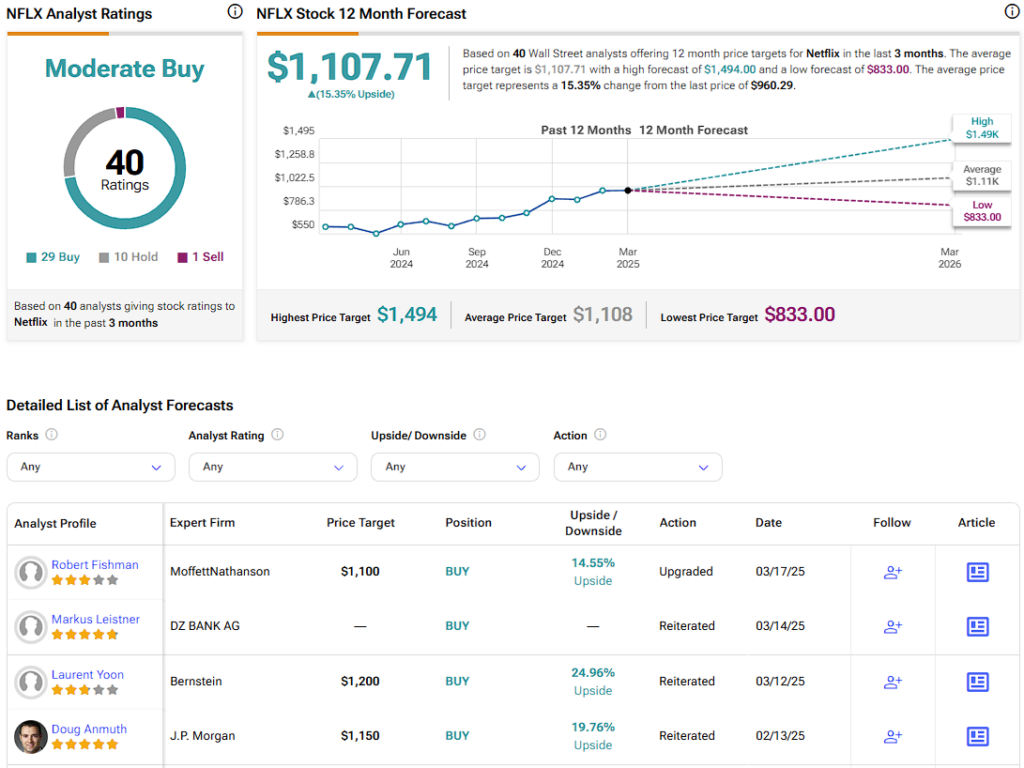

J.P. Morgan analyst Doug Anmuth reiterated his Buy rating earlier last month with an accompanying price target of $1,150. In a research note, the investment bank also stated Netflix should prove “relatively defensive” against macro headwinds, thereby adding to its future bullish chances despite the recent outperformance. Meanwhile, Bernstein analyst Laurent Yoon concurs, setting a $1,200 price target two weeks ago.

A Wide Moat with Booming Fundamentals

Netflix now has over 300 million paying members worldwide—and in Q4 alone, it added a staggering 19 million subscribers. That puts it ahead of rivals like Disney+ (DIS), Apple TV+ (AAPL), and HBO Max. Interestingly, the best return on investment hasn’t come from big Hollywood productions but from localized content across different languages and genres. That shift also helps margins since relying less on expensive Hollywood talent means lower production costs.

It’s clear Netflix isn’t in “growth at all costs” mode anymore. In FY 2024, revenue rose 16% year-over-year, and management expects 12–14% growth in 2025. That’s why smart moves like cracking down on password sharing and being more selective with content spending really matter now. We’re seeing the payoff—Netflix’s operating margin jumped from around 21% in 2023 to 27% in 2024, showing how efficiently it’s scaling its massive subscriber base.

And here’s where it gets even more compelling: after years of investing heavily in content, often funded by debt, Netflix is now generating serious cash. Free cash flow hit $6.9 billion in 2024, and management expects that to grow to $8 billion in 2025. For long-term investors, rising free cash flow is one of the most apparent signs of a company with a durable moat—and Netflix looks committed to keeping that momentum going. With fundamentals like these, it’s hard to be bearish on the stock.

Exceptional NFLX Price History

Netflix’s stock has been on a tear, more than doubling from around $480 in late 2023 to a peak near $1,000 by early 2025. Even with a slight dip recently—falling to about $860 during the March market correction—it’s already bounced back and is trading close to $960. The long-term trend is still clearly up.

Despite my bullishness, Netflix isn’t cheap. It trades at nearly 40x forward earnings, well above peers like Disney (around 20x) or Apple (under 30x). But it’s not just about the multiple—it’s about what you’re paying for. Netflix is a pure play on streaming, and its smart moves on margin expansion and operational efficiency help justify that premium. I wouldn’t be surprised to see normalized earnings growth in the 20–25% range over the next three years. That kind of strength is unlikely to be achieved by Disney or even Apple.

As for competition, Amazon (AMZN) Prime Video is probably Netflix’s closest challenger. It has over 200 million global users, which is impressive, but it is still shy of Netflix’s numbers. Amazon stock trades at a forward P/E of around 30, with expected earnings growth of 15–20% in the near term, thanks partly to AI-driven efficiency gains. I’m long-term bullish on Amazon, but I think Netflix has the edge when it comes to potential outperformance over the next couple of years.

It’s a reasonable target for Netflix to break past $1,100 in the next 12 months. All it needs is to hit around $30 in normalized earnings per share and trade at a non-GAAP P/E of 37. That feels pretty realistic, even in a fairly conservative base case.

Netflix Is Charting Its Own Path

Co-CEOs Ted Sarandos and Greg Peters have clarified that Netflix plays by its own rules. The company doesn’t chase trends just because competitors are doing it—and that discipline helps them avoid low-ROI decisions. Take sports, for example. Netflix has flat-out said it’s not interested in shelling out billions for massive league rights like NFL Sundays or full NBA seasons. They’re happy to let Amazon or Apple take that route.

Instead, Netflix is being smart—focusing on one-off events, live comedy specials, and award shows. It’s a strategy built on maximizing margins, not showing off. Add to that their emphasis on delivering a top-tier user experience rather than just being the cheapest option, and you can see they’re building something different—and pretty powerful. Simply put, Netflix is going toe-to-toe with big-budget Hollywood–and coming out on top.

So, it’s no surprise that Netflix’s leadership is just as focused on keeping shareholders happy as crafting innovative content deals. Their approach feels almost military in its precision. With the company reaffirming its commitment to returning excess cash through an expanded buyback program, investors can feel confident their capital is in good hands—even if there’s no dividend on offer (yet).

Is Netflix a Buy, Sell, or Hold?

On Wall Street, Netflix stock has a consensus Moderate Buy rating based on 29 Buys, 10 Holds, and one Sell over the past three months. NFLX’s average price target is $1,107.71 per share, which indicates a 15% upside potential over the next 12 months. This aligns closely with my own outlook, making Netflix a worthy addition to conservative portfolios looking for tech exposure.

Netflix Is a Buy for Conservative Tech Investors

Currently, I’m mainly focused on stocks that I think have 30% or more upside over the next year. Netflix doesn’t quite fit that high-alpha profile, but to be fair, it offers something that might be even more valuable for more hands-off investors: consistency. With strong leadership, a durable competitive edge, solid long-term growth, and innovative margin strategies, Netflix stands out as a reliable performer. That’s why I’m bullish—especially for portfolios that aim to steadily outperform the market without constantly chasing the next big thing.