Shares of branded foods and beverages provider J. M. Smucker Company (NYSE:SJM) are trending higher today after its robust second-quarter performance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue rose 7.8% year-over-year to $2.21 billion, outperforming estimates by $30 million. EPS at $2.40 comfortably cruised past estimates by $0.22.

The company continues to see business strength and brand demand and has upped its fiscal 2023 outlook. It now expects net sales to increase between 5.5% and 6.5% versus earlier estimates of growth between 4% and 5%.

Further, EPS is now seen landing between $8.35 and $8.75. SJM had earlier expected the figure to range between $8.20 and $8.60.

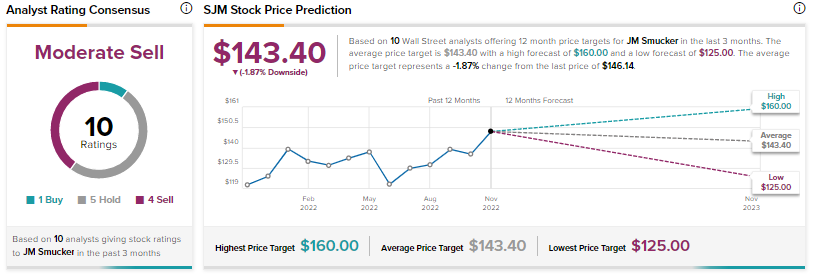

SJM shares have now gained nearly 14% over the past six months. Meanwhile, analysts have a consensus rating of Moderate Sell on the stock based on a Buy, five Holds, and four Sells.

Read full Disclosure