JM Smucker (NYSE:SJM) shares are trending higher today after the branded food and beverage company delivered better-than-expected earnings for the second quarter. Indeed, EPS of $2.59 outpaced expectations by $0.12. On the other hand, its revenue declined by 12.2% year-over-year to $1.94 billion, landing in line with estimates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, when excluding SJM’s pet foods divestiture and an adverse foreign currency impact, the company’s top line increased by 7% during the quarter. This increase in comparable net sales was driven by favorable volume/mix, pricing gains, and momentum in frozen sandwich sales.

The company generated $176.9 million in cash from operating activities. At the same time, higher capital expenditures resulted in its free cash flow declining to $28.2 million from $102.9 million in the year-ago period.

For Fiscal Year 2024, SJM expects comparable net sales to increase by 8.5% to 9%. In addition, EPS for the year is seen landing between $9.25 and $9.65, compared to the previous outlook in the range of $9.45 to $9.85.

What is the Stock Price Forecast for SJM?

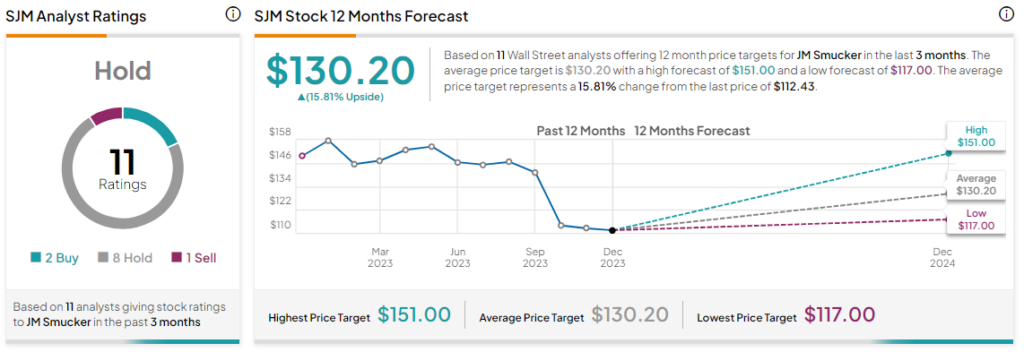

Overall, the Street has a Hold consensus rating on JM Smucker. After a nearly 27% slide in its share price over the past year, the average SJM price target of $130.20 implies a 15.8% potential upside in the stock.

Read full Disclosure