Japanese multinational pharmaceutical corporation Astellas Pharma (OTC:ALPMF) announced the acquisition of Iveric Bio (NASDAQ:ISEE), a biopharma company focused on developing treatments for retinal diseases, for an equity value of $5.9 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

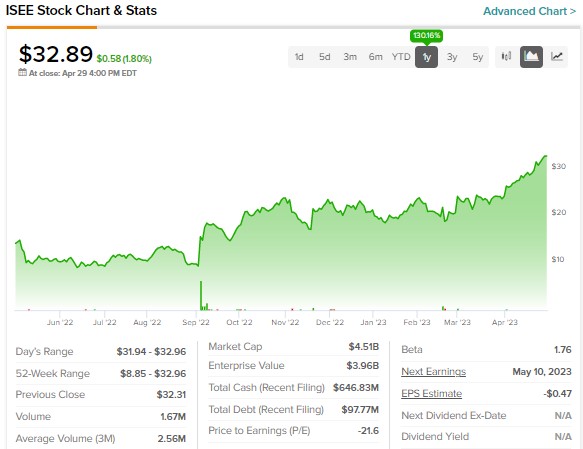

Astellas, through its wholly-owned subsidiary Berry Merger Sub, has agreed to acquire the outstanding shares of Iveric for $40 a share in cash. The buyout price represents a premium of approximately 22% from ISEE’s closing price of $32.89 on April 28.

After the completion of the deal, Iveric Bio will operate as an indirectly wholly-owned subsidiary of Astellas. The acquisition has received approval from the Boards of both companies.

Iveric Bio stock has gained more than 130% over the past year as its lead pipeline candidate, Avacincaptad Pegol (ACP), a drug for treating geographic atrophy (GA) secondary to age-related macular degeneration, has the potential to deliver solid revenues.

In February, Iveric Bio announced that the U.S. FDA (Food and Drug Administration) accepted an NDA (New Drug Application) for ACP. Furthermore, the NDA has been granted a priority review.

Astellas expects that the addition of Iveric Bio will contribute to its top line in 2025 and support future sales growth. Also, the acquisition will strengthen Astellas’ ophthalmology-focused capabilities.

ISEE stock is expected to rise following the announcement of the buyout.