Since 2016, Walt Disney (NYSE:DIS) has faced various challenges that have constrained operating income growth. The steady decline of its traditional linear TV business, streaming losses, and the severe disruption from COVID-19 – which shut down parks, film production, and theatrical releases – have all weighed on profitability.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, now Jefferies analyst James Heaney believes the company has “finally righted the ship and the drivers ahead can change this dynamic.”

So, what are these drivers? For one, Heaney had previously been worried about growth in Disney’s Experiences segment – which accounts for roughly 60% of the company’s operating income – given a “tough macro environment” and the anticipated competitive pressure from the opening of Universal’s Epic Universe. However, more recent data on trends at Walt Disney World support management’s upbeat commentary in May, particularly regarding forward bookings, thereby “reducing slowdown risks” in FY25. And looking ahead to FY26, the Experiences segment appears “well-positioned,” with two new cruise ships set to launch and Epic Universe potentially shifting from a headwind to an “Orlando traffic tailwind.” The analyst believes this “creates a fundamentally stronger set-up,” projecting ~10% operating income growth in FY26 and 8% in FY27, compared to just 3.6% in FY24.

Next, Heaney sees potential for a meaningful revenue boost from Disney’s cruise business, estimating that the launch of two new ships in the first quarter of 2026 could generate an incremental $1 billion to $1.5 billion in annualized revenue (based on comparisons with Norwegian Cruise Line Holdings). As a result, the analyst is now calling for 14% year-over-year growth for the Resorts and Vacations segment, up from the previous forecast of 8%.

Third, Heaney thinks that Disney’s DTC (direct-to-consumer) segment will be a key driver of operating income growth, estimating a CAGR (compound annual growth rate) of over 130%, with margins expanding from just 0.6% in FY24 to more than 13% by FY28. In FQ2, Disney outperformed modest expectations around subscriber losses, helped by the success of Moana 2. The company continues to lean into its “key differentiations” – including bundling, theatrical releases, and sports content – and early indicators suggest this approach is gaining traction. Visits to Disney+ have grown more than 40% YoY for three consecutive months.

“Stronger user growth and content coupled with advertising (new Amazon partnership) should drive enhanced scale and margins,” Heaney went on to say.

Lastly, Disney’s content and sports are “on the right path.” Recent successes like Moana 2, Lilo & Stitch, and Andor have helped build a foundation, but the upcoming slate – including The Bear, Fantastic Four, Zootopia 2, and Avatar 3 – suggests a pipeline of strong releases. On the sports side, the analyst expects the launch of ESPN’s direct-to-consumer service this fall will significantly increase ARPU (average revenue per user) in the Sports segment – anticipating a 25% YoY gain – that should “serve as a catalyst to driving higher overall DIS CTV ad rev.”

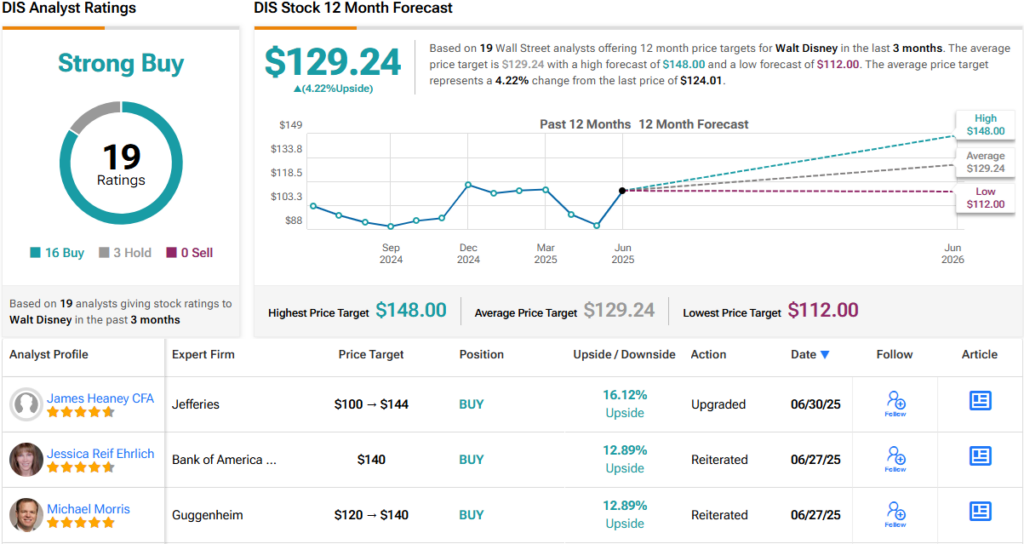

Taking all of this into account, Heaney is ready to shift gears, upgrading his rating on Disney stock from Hold to Buy. He’s also lifting his price target from $100 to $144, pointing to a potential upside of 16% from here. (To watch Heaney’s track record, click here)

Heaney joins plenty of his colleagues in the bull camp; 15 others see the stock as a Buy while the addition of 3 Holds can’t detract from a Strong Buy consensus rating. Going by the $129.24 average price target, shares will gain 4% in the months ahead. (See Disney stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.