Tesla (NASDAQ:TSLA) stock came under pressure on Tuesday, sliding about 5% as headlines out of CES 2026 unsettled investors and reignited doubts around the company’s long-term edge. The pressure followed an announcement from Nvidia, which revealed plans to develop and sell a comprehensive autonomous driving system for both personal vehicles and robotaxis, raising concerns about intensifying competition in autonomous driving software – an area where Tesla has long been viewed as a leader.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

So what does Nvidia’s move mean for Tesla’s advantage in self-driving? Unlike Tesla’s vertically integrated Full Self-Driving software, Nvidia’s platform – combining vision, radar, and advanced AI – is built to be licensed across a broad range of automakers. That approach could allow Nvidia to scale faster and amass a far larger installed base. If autonomy becomes broadly accessible rather than vertically controlled, its value as a key differentiator in Tesla’s long-term growth story could diminish.

Few critics have been louder on this front than Gordon Johnson of GLJ Research. The analyst argues that Nvidia’s move could represent a “lights-out moment” for Tesla’s autonomy narrative, which has been a central pillar of the stock’s valuation for years. In his view, pairing Nvidia’s autonomy stack with Uber’s global network gives competitors a scale and immediate demand infrastructure that Tesla simply doesn’t have. That’s “No factory build-out, no slow geographic rollout, no regulatory brinkmanship – just software layered onto an existing, global demand network,” Johnson opined.

Johnson doesn’t pull punches on Tesla’s robotics ambitions either. He’s dismissed Tesla’s Optimus as nothing more than “Carefully curated/faked demos… closer to 1980s Chuckie Cheese animatronics than AI.” That criticism echoes his broader bearish stance – Tesla’s lofty valuation hinges heavily on future revenues from robotaxis and humanoid robots, which today generate exactly zero quarterly revenue, he notes.

In Johnson’s view, the real value Tesla has built so far is its Level 2 driver-assistance system – tangible today, but not the paradigm-shifting moat investors were promised. If Tesla no longer leads in autonomy or robotics, “the story collapses – and the story is the stock,” the analyst argues.

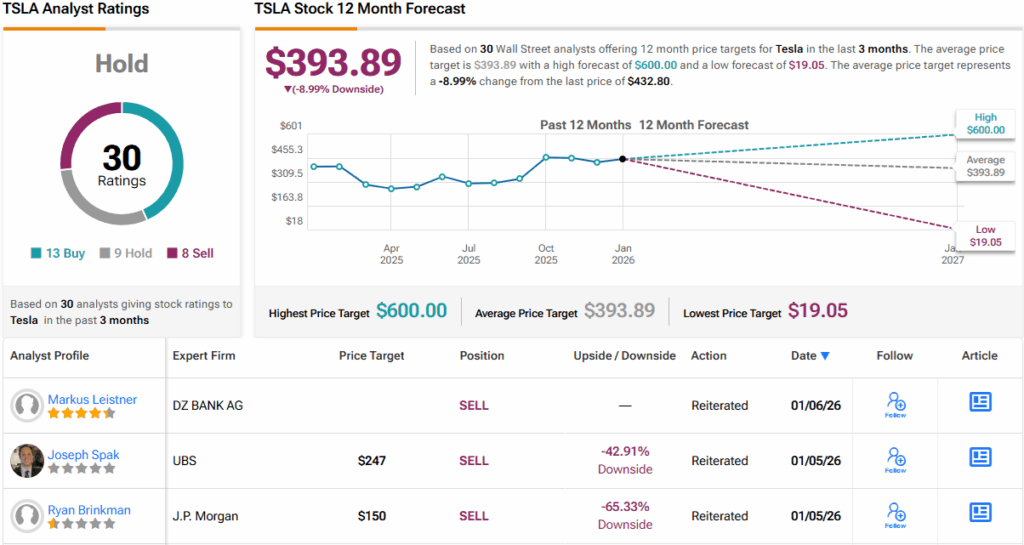

Reflecting that view, Johnson rates TSLA shares a Sell and assigns a $19.05 price target, implying a staggering 95% downside from current levels. (To watch Johnson’s track record, click here)

Yet, beyond the loudest critics, Wall Street’s view is far more restrained. TSLA currently carries a $393.89 average price target, and with 13 Buys, 9 Holds, and 8 Sells, the stock sits squarely in Hold, or Neutral, consensus territory. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Education

About Us

Working with TipRanks

Follow Us

‘It’s Only Just the Beginning,’ Says Analyst as Tesla Stock Slides on Nvidia Threat

1