Amazon (NASDAQ:AMZN) stock may be gearing up to take its turn at the front of the pack among the Magnificent Seven. According to Wolfe Research analyst Shweta Khajuria, the e-commerce and cloud giant is poised to make 2026 its moment to shine. If 2024 was Meta’s year and 2025 belonged to Alphabet, Khajuria sees a clear opening for Amazon to step into the lead, with 2026 shaping up to “prove to be the year for AMZN.”

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

“We are constructive on AMZN shares because we believe AWS growth will accelerate more than not only Street estimates but also investor expectations, in addition to delivering HSD/LDD% retail growth and sustained margin expansion, with attractive valuation,” the 5-star analyst went on to say.

Khajuria expects AWS growth to reaccelerate to the mid-20%+ range in both 2026 and 2027, with her AWS revenue forecasts for those years sitting 4% (or $6 billion) and 7% (or $13 billion) above the Street, respectively. This acceleration is driven by a combination of capacity expansion and “incremental partnerships.” Khajuria reckons Anthropic will contribute approximately $4 billion in 2025 and $8 billion in 2026, while OAI will contribute $4.5–$5 billion across 2026 and 2027.

The analyst believes that a 2x increase in capacity expands the revenue opportunity by more than $40 billion annually, and that if Amazon captures demand equivalent to 15% of the incremental capacity in 2026 and 50% in 2027, AWS growth reaches the mid-20% range. Non-AI workloads should also see upside from broader enterprise adoption of Trainium and Bedrock.

Retail remains another pillar of the story. Khajuria expects at least high-single-digit retail revenue growth over the next two years, driven by Amazon’s “deep moat” and faster delivery and fulfillment capabilities relative to peers. Continued share gains are likely, in her view, as Amazon expands same-day delivery further into rural markets. That footprint already spans 2,300 cities and towns and is set to widen again in 2026.

In addition, the analyst highlights grocery as a meaningful contributor this year, with revenue expected to reach $53 billion, while advertising growth is projected to remain durable in the high-teens percentage range.

Put it all together, and Khajuria sees Amazon as a Top Pick for 2026. She assigns the stock an Outperform (i.e., Buy) rating and lifts her price target from $250 to $275. (To watch Khajuria’s track record, click here)

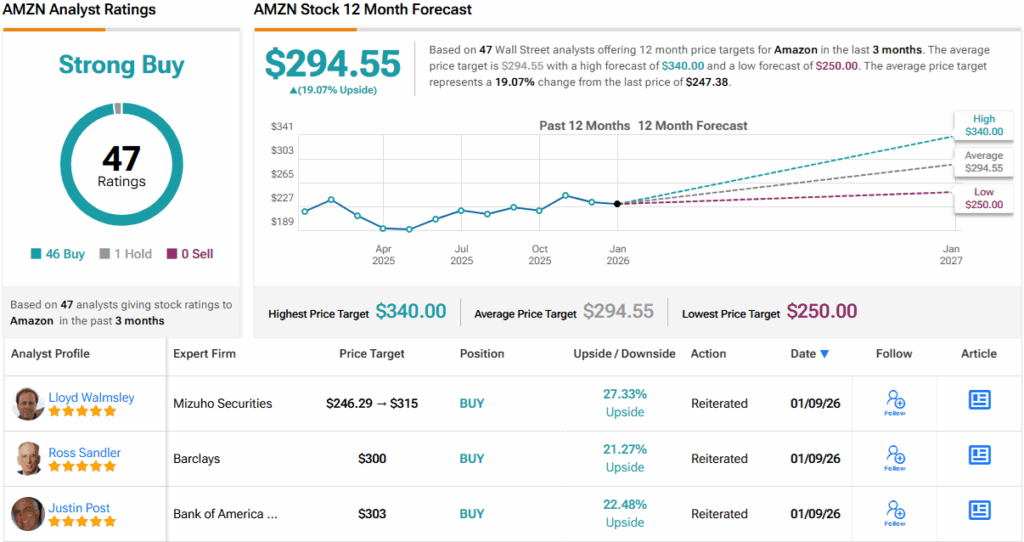

Almost all other Street analysts are thinking along the same lines; the stock claims a Strong Buy consensus rating, based on a mix of 46 Buys vs. 1 Hold. At $294.55, the average price target points toward 12-month returns of 19%. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.