NVIDIA (NVDA) continues to draw strong support from Wall Street following its recent tie-up with Groq. Two top-ranked analysts reiterated Buy ratings on the stock, saying the move strengthens Nvidia’s position in AI inference and supports its outlook heading into 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At UBS, five-star analyst Timothy Arcuri kept a Buy rating with a $235 price target. Also, top analyst William Stein of Truist Securities reiterated a Buy and maintained a higher $275 price target.

Both analysts view the Groq tie-up as a positive step for Nvidia’s AI strategy. Their views reflect continued confidence that Nvidia can adjust its platform as AI demand shifts heading into 2026. Other top analysts have also weighed in on the deal. (Read more here: ‘Nvidia’s Latest AI Deal Gets a Nod from Wall Street: Top Analysts Weigh In.’)

UBS Sees a Boost in Inference

Arcuri said the Groq agreement could help Nvidia better serve high-speed inference, an area where standard GPUs are not always the best fit. He noted that inference workloads often run into memory limits, and Groq’s technology could help ease that issue.

He also said industry experts have long viewed Groq’s approach as stand-out among AI chip startups. In his view, the deal fits Nvidia’s wider shift toward offering more custom chip designs, alongside its main GPU lineup.

Looking ahead, Arcuri said he remains bullish on Nvidia heading into 2026. He expects further gains in the stock to come mainly from upward EPS revisions.

Truist Focuses on Competitive Edge

Meanwhile, Stein said the tie-up is aimed at strengthening Nvidia’s position in inference, especially against rival chip designs such as Google’s (GOOGL) TPU. He believes the move helps Nvidia defend its lead as AI use expands beyond training and into real-time deployment.

While media reports have pointed to a $20 billion cost, Stein said the size of the deal is manageable given Nvidia’s strong cash balance and steady cash generation. He added that the long-term strategic benefits of the Groq tie-up outweigh the upfront spending.

What Is a Good Price for NVDA?

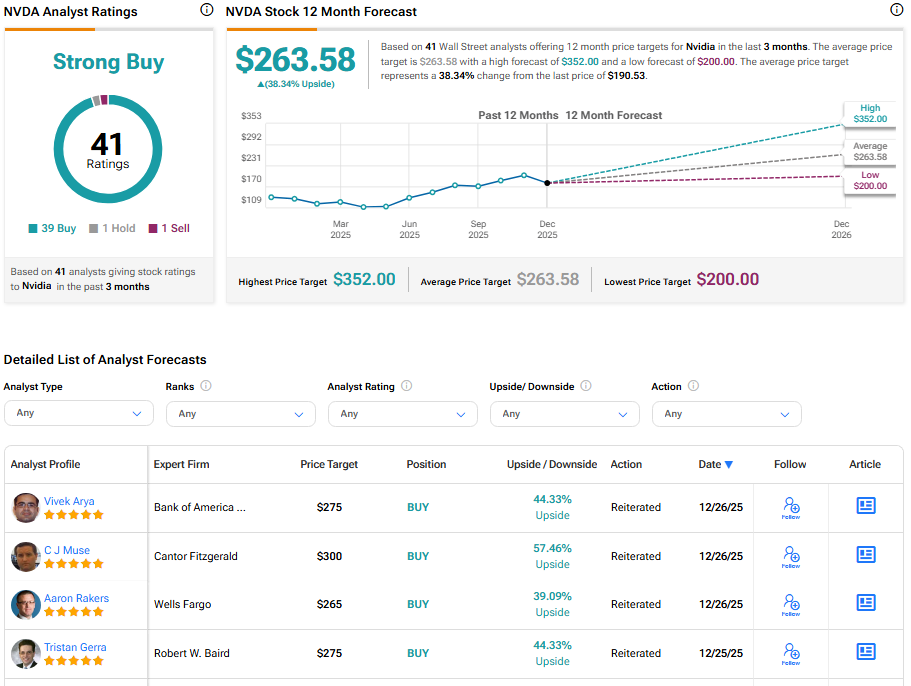

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $263.58 per share implies 39.8% upside potential.