Italy-based UniCredit S.p.A. (IT:UCG) has launched a bid worth $10.5 billion to acquire its rival Banco BPM (IT:BAMI) in a move to stabilize Europe’s banking industry. The bank made a voluntary public exchange offer for all ordinary shares of Banco BPM, subject to regulatory approvals. The move comes after UniCredit acquired a 9% stake in German bank Commerzbank AG (DE:CBK) in September. UniCredit shares declined nearly 3% as of writing.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UniCredit is an Italian banking conglomerate that provides financial services across Europe.

UniCredit Extends Offer to Acquire Banco BPM

Under the acquisition offer, Banco BPM shareholders will receive 0.175 new UniCredit shares for each Banco BPM share. The offer values Banco BPM at €6.657 per share, marking a 0.5% premium to Friday’s closing price. If completed, the deal would unite two of Italy’s largest banks.

UniCredit stated that this all-stock acquisition would enable it to enhance its competitive position, considering the expected synergies across regions and client segments. Additionally, shareholders will gain from improved performance and a strong capital position (CET1 ratio above 15% post-transaction) of the combined entity.

The offer is expected to be finalized by June 2025, with full integration expected within 12 months and most synergies achieved within 24 months.

UniCredit Confirms Commerzbank Investment

In its latest statement, UniCredit clarified that the offer for BPM has no impact on its investment in Commerzbank. The bank’s CEO, Andrea Orcel, highlighted that UniCredit’s stake in Commerzbank is a unique case, stating the bank could either increase its holding if conditions are favorable or divest and return the capital.

UniCredit now ranks as the second largest shareholder in Commerzbank, followed by the German government.

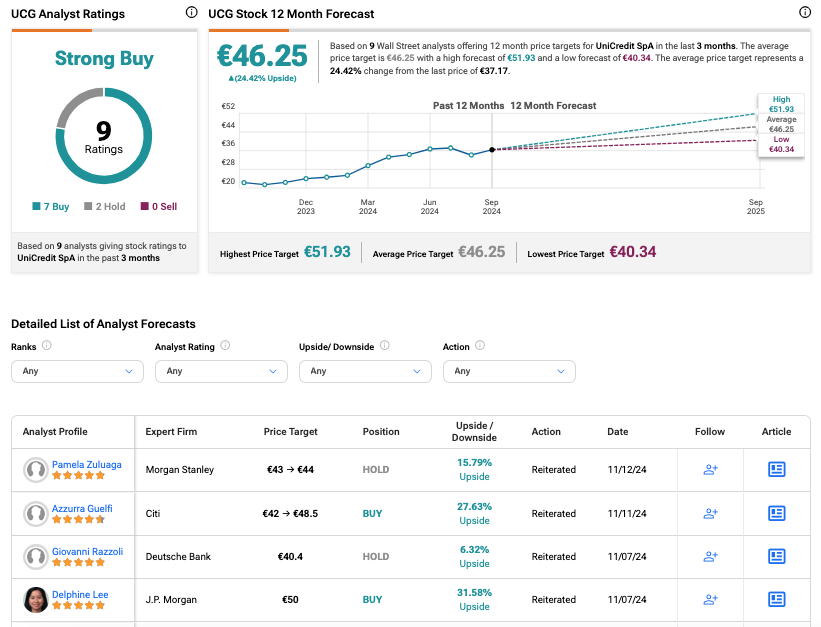

Is UniCredit a Buy or Sell?

Overall, UCG stock has received a Strong Buy rating on TipRanks, backed by seven Buy and two Hold recommendations. The UniCredit share price forecast is €46.25, which implies a growth of 24.4% from the current trading level.