Remember yesterday, when I suggested that fighting a call to appear before a Senate committee was a bad idea? Apparently, it is not so bad an idea if you are legacy automaker Ford (F). Ford took on Congress over what it considered unfair treatment, and the Senate backed down. Ford shares gained nearly 3% in Tuesday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yesterday, we heard that Ford CEO Jim Farley was planning to miss the hearings due mainly to Tesla (TSLA), and who got invited to testify from that company. While Ford’s CEO was called in, as were the CEOs of other firms, Tesla got off with a functionary who was still high up, but certainly not the CEO. Rather, Tesla’s vice president of vehicle engineering was invited on that one. Apparently the Senate found Ford’s objections reasonable, because the hearings are now postponed.

It also did not help matters that the hearings were scheduled during the same time as the Detroit Auto Show, which is set to start January 14. But the hearing will likely be rescheduled, and perhaps the list of invitees will be edited as well to reflect issues of seniority and rank.

A Big Sales Jump

Meanwhile, Ford released sales numbers for 2025, and the news was amazing. Ford’s sales were up 6% in 2025, and were up 2.7% just in the fourth quarter alone, fueled by a combination of hybrid vehicles and truck sales. Normally, Ford’s F-Series trucks lead the way in sales, though they were actually down 3.1% in the fourth quarter. They were, however, up 8.3% for the whole year, so a little loss in the fourth quarter is reasonable enough when you gain that hard the rest of the year.

It did not help matters that the F-Series’ aluminum parts were supplied by Novelis, which suffered two separate fires at the plant. Ford responded to this by “…backfilling lost production and adding a third crew at the plant in Q1.”

Is Ford Stock a Good Buy Right Now?

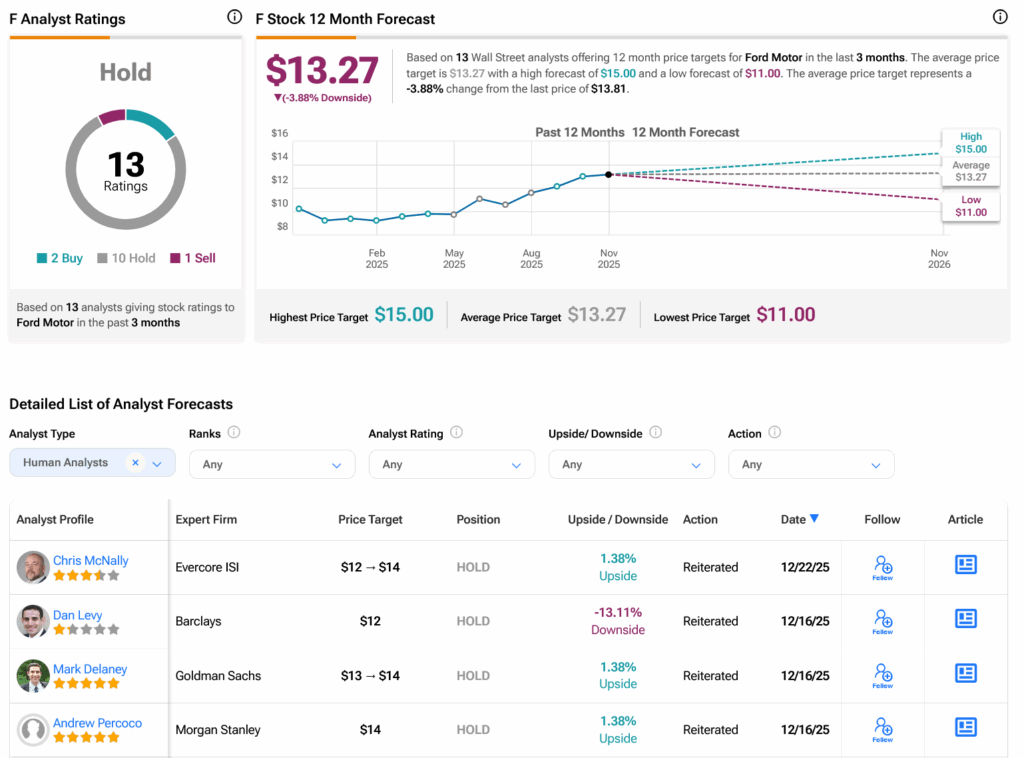

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 38.01% rally in its share price over the past year, the average F price target of $13.27 per share implies 3.88% downside risk.