Starting next week, the Tel Aviv Stock Exchange (TASE) will move to a Monday-to-Friday trading schedule. The change is meant to make the market easier for global investors to access.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For many years, the exchange traded from Sunday to Thursday, which matched Israel’s workweek. However, this setup often clashed with U.S. and European markets. As a result, some foreign investors stayed on the sidelines.

Under the new plan, trading will run from Monday through Thursday until 5:35 p.m. local time. On Fridays, trading will end at 2 p.m. to respect the Jewish Sabbath. According to TASE, the new schedule is designed to remove friction for overseas funds. It also helps Israel better align with global index rules.

Foreign Interest Is Already Rising

The timing of the shift follows a strong year for Israeli stocks. The Tel Aviv 35 index (IL:MORE.S7) is up 73% in dollar terms through December 19, beating many U.S. and European benchmarks.

At the same time, foreign investors have returned to the market. Over the past 12 months, overseas investors bought about $1.35 billion worth of Israeli shares, after two years of net selling.

In addition, foreign institutional holdings of non-dual-listed stocks rose by about 70% in dollar terms during the first nine months of 2025. Holdings reached a record 63.5 billion shekels in September, based on exchange data.

TASE Chief Executive Officer Ittai Ben Zeev said the exchange expects more capital inflows. He added that U.S. funds and some European investors are showing fresh interest.

Another key goal is joining the MSCI (MSCI) Europe index. Until now, different trading days made that move difficult. If included, Israel could see higher passive and active flows from global funds.

Overall, the shift brings TASE closer to how global markets already operate. In turn, that alignment could make Israeli stocks easier for investors outside the country to hold.

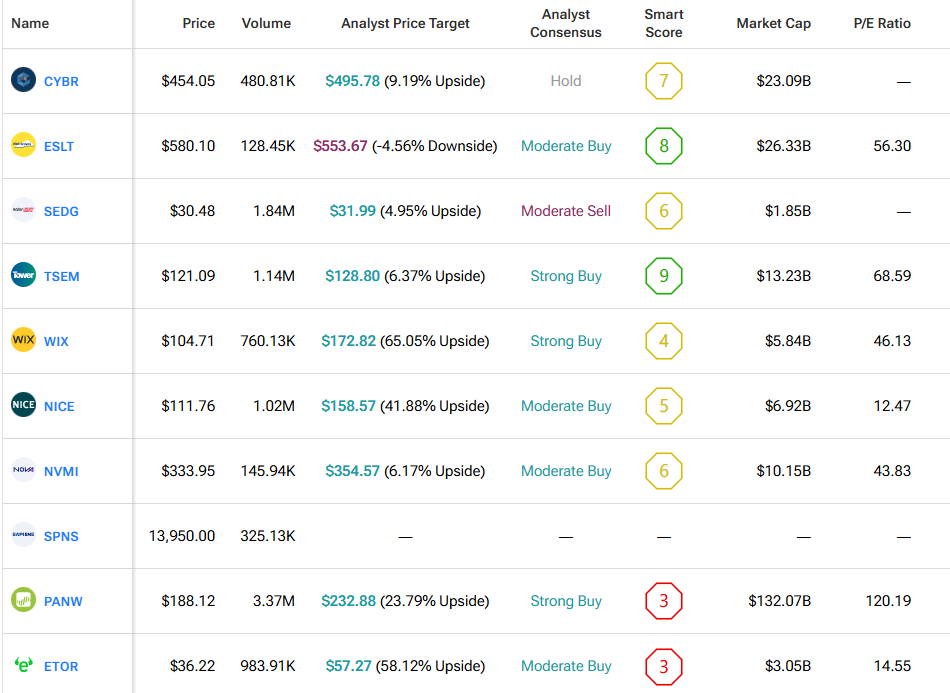

We used TipRanks’ Comparison Tool to line up some of the notable Israeli companies listed on Wall Street. It’s a great tool to gain an in-depth look at each company and the Israeli space in general.