First Published: 5:30 AM EST

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Israeli tech giants, Wix.com (WIX) and Fiverr International (FVRR) announced their Q4 earnings today, and both stocks are on a tear as market opens Wednesday.

Let us take an in-depth look at both of these companies earnings.

Wix Tops Q4 Estimates

Wix.com, the Israeli software company reported Q4 adjusted earnings of $0.61 per share beating analysts’ consensus estimate of $0.09. Total revenues increased by 6% year-over-year to $355 million, surpassing analysts’ expectations of $351.9 million.

Total bookings were up 6% year-over-year to $371.8 million.

Lior Shemesh, Wix’s CFO commented, ” Earlier this month, we began implementing further cost efficiency measures that we expect to yield an additional $50 million of cost savings in 2023 and $65 million on

an annualized basis. Combined with our original cost reduction plan, we now expect total cost savings of $200 million in 2023 and $215 million of annualized savings compared to the plan we shared at our May 2022 Analyst Day.”

Looking forward, management now expects FY23 revenues to grow between 9% and 11% year-over-year and range between $1.51 billion and $1.54 billion versus the consensus of $1.51 billion. In Q1, revenues are projected to range from $367 million to $371 million versus a consensus of $365.5 million.

As a result, Wix expects free cash flow (excluding HQ investments) to be between $152 million and $162 million in FY23. Moreover, Wix expects the FCF margin to “improve as we progress through the year and exit 2023 with a free cash flow margin of ~12-13%, driven by the new efficiencies implemented in 1H23.”

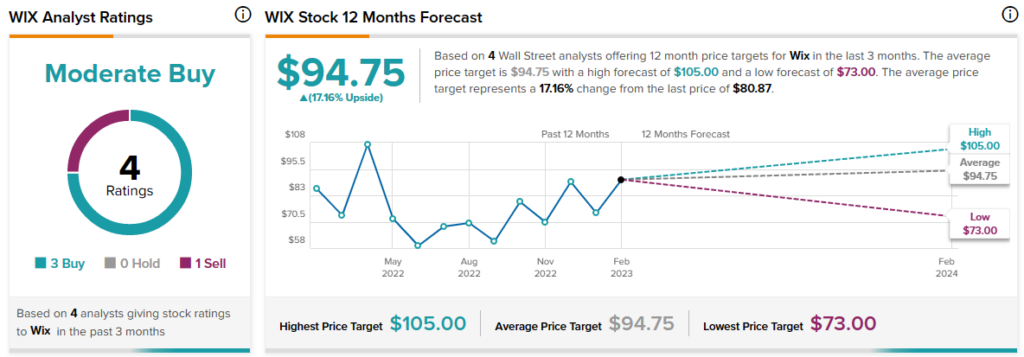

Overall, analysts are cautiously optimistic about WIX stock with a Moderate Buy consensus rating based on three Buys and one Sell.

Fiverr Delivers Mixed Q4 Results

Fiverr, the online marketplace for freelance services reported adjusted earnings of $0.26 per share, versus $0.22 in the same period last year. Analysts were expecting the company to report earnings of $0.18 per share.

Revenues in the fourth quarter increased 4.2% year-over-year to $83.1 million but fell short of Street expectations of $83.4 million.

While Fiverr’s active buyers went up by 1% year-over-year to 4.3 million at the end of Q4, the spend per buyer increased by 8% year-over-year to $262.

However, the company warned that looking forward, Q1 is likely to be “the most challenging quarter in terms of year over year growth rate” due to a difficult comparison with the Q1 of last year. Fiverr has projected revenues in the range of $86.5 million to $88.5 million versus a consensus of $87.3 million.

In FY23, the company anticipates revenues to grow in the range of 4% to 8% year-over-year to be between $350 million and $365 million versus the consensus of $365.87 million while adjusted EBITDA is projected to be between $45 million and $55 million.

Analysts are cautiously optimistic about FVRR stock with a Moderate Buy consensus rating based on three Buys and two Holds.