Against all odds. Israeli tech firms raised $3.43 billion from October through mid-December 2025. That marked a 45% jump from the previous quarter and the best result since early 2022. The pickup followed a U.S.-brokered ceasefire in Gaza that took effect on October 10. The improved security helped bring capital back after two years of war-related uncertainty.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, this is not just an end-of-year trend; Israeli startups raised $15.6 billion in private capital throughout 2025. That figure rose 24% from 2024 and 68% from 2023. However, the number of funding rounds fell to 717 in 2025, the lowest level in 10 years. Median deal size reached $10 million, up 67% from the year before.

According to industry leaders, this is not just a bounce back. It indicates a shift in how money flows. Investors are making fewer bets but putting more behind each one. Mature startups with real growth and global traction are getting most of the attention.

Cybersecurity and AI Pull in the Majority of Capital

Cybersecurity and AI companies made up around 70% of capital raised in 2025. That came despite accounting for only 40% of funding rounds. Two big rounds stood out: Armis raised $435 million in November at a $6.1 billion value, and Cyera raised $400 million in December at a $9 billion value. Both rounds were led by global investment giants.

One reason for the focus is the demand for safer AI. As more companies adopt AI, there is a growing need to protect data and systems. Israeli firms are known for deep strength in this area. That is drawing in buyers and investors from around the world.

Among them is Nvidia (NVDA), which announced in December that it will build a large new site in northern Israel. The chipmaker already has about 5,000 staff in the country and plans to add 8,000 more.

ServiceNow Expands Cyber Bet with Armis Deal

In the latest news, ServiceNow (NOW) has taken a significant step in this area as well. In one of the largest recent software deals, the company agreed to buy Armis for $7.75 billion in cash. The deal is expected to close in the second half of 2026. Armis is known for helping companies manage risk across a wide range of connected devices.

The startup has surpassed $300 million in annual recurring revenue, growing by more than 50% in the past year. With this deal, ServiceNow aims to combine Armis’ device data with its own workflow tools. It says this will expand its security platform and create more value in managing assets, threats, and fixes.

Shares of ServiceNow fell 1.5% on the news, as investors noted the hefty price tag. Still, the company says the deal could triple its reach in security and risk markets.

Public Markets Are Reopening

Private firms are not the only ones gaining steam. Seven Israeli companies went public in 2025, raising a total of $14.6 billion. That compares to just $781 million in 2024. Notable names included Navan (NAVN) valued at $6.2 billion, and eToro (ETOR), valued at $4.4 billion.

Meanwhile, large buyers continued to drive deal value higher. Total M&A reached $74.3 billion across 150 deals. This was led by Alphabet (GOOGL), which paid $32 billion for Wiz, and Palo Alto Networks (PANW), which paid $25 billion for CyberArk (CYBR).

Markets, Currency, and Outlook All Point Up

Additionally, the Tel Aviv 35 Index (IL:MORE.S7) hit record levels in 2025. The Israeli shekel rose 26% against the dollar, the best gain among 31 top currencies. The spread between Israeli bonds and U.S. Treasuries dropped back to pre-war levels.

Investor interest followed. The iShares MSCI Israel ETF (EIS) raised $194 million in fresh capital, the most since its 2008 launch. Big buyers included Korea Investment Corp. and Monument Capital.

Looking ahead, economists expect Israel’s economy to grow faster than other developed countries. Forecasts show GDP could rise 4.3% in 2026 and 3.8% in 2027.

While early-stage startups are still facing tight conditions, global firms are leaning into Israel. With strong research spending and steady global demand for AI and security, investors see long-term strength in the market.

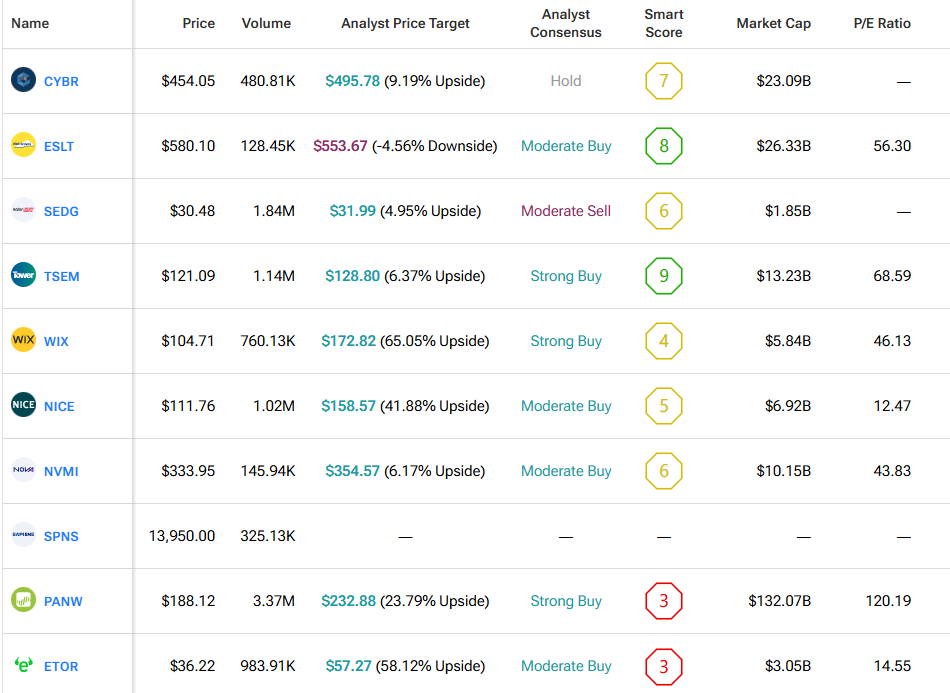

We used TipRanks’ Comparison Tool to line up some of the notable Israeli companies listed on Wall Street. It’s a great tool to gain an in-depth look at each company and the Israeli space in general.