Space flight exploration stock Virgin Galactic (SPCE) will report its Q3 earnings later this week. Should investors hop on board the stock ahead of the results or is time to open the capsule and explore other brave new worlds in the investment universe?

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

What Wall Street Expects

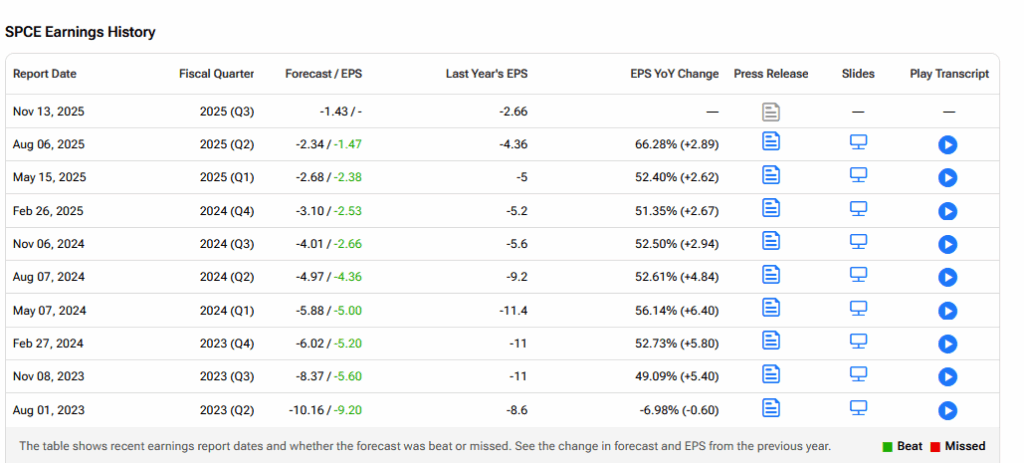

Wall Street expects SPCE to report a Q3 earnings per share loss of $1.43, compared with a loss of $2.66 this time last year. Revenues are tipped to come in at $0.315 million, down from $0.4 million in the same period in 2024. Can SPCE beat these estimates? As can be seen below, it has a good recent track record of doing just that.

Key Issues Ahead of Earnings

In Q2 Virgin Galactic reported revenue of $0.4 million, compared to $4.2 million in the second quarter of 2024. It said that the decrease was driven by the pause in commercial spaceflights to focus efforts on the production of its Delta Class SpaceShips. It posted a net loss of $67 million, compared to a $94 million net loss in the second quarter of 2024, with the improvement primarily driven by lower operating expenses.

It said that it plans to reopen ticket sales in the first quarter of 2026 and that commercial spaceflight is on track for 2026, with both research and private astronaut flights expected to commence next fall. However, it also noted a reduction of contract engineering workforce by 85% and overall company headcount by 7% due to lower demand for resources.

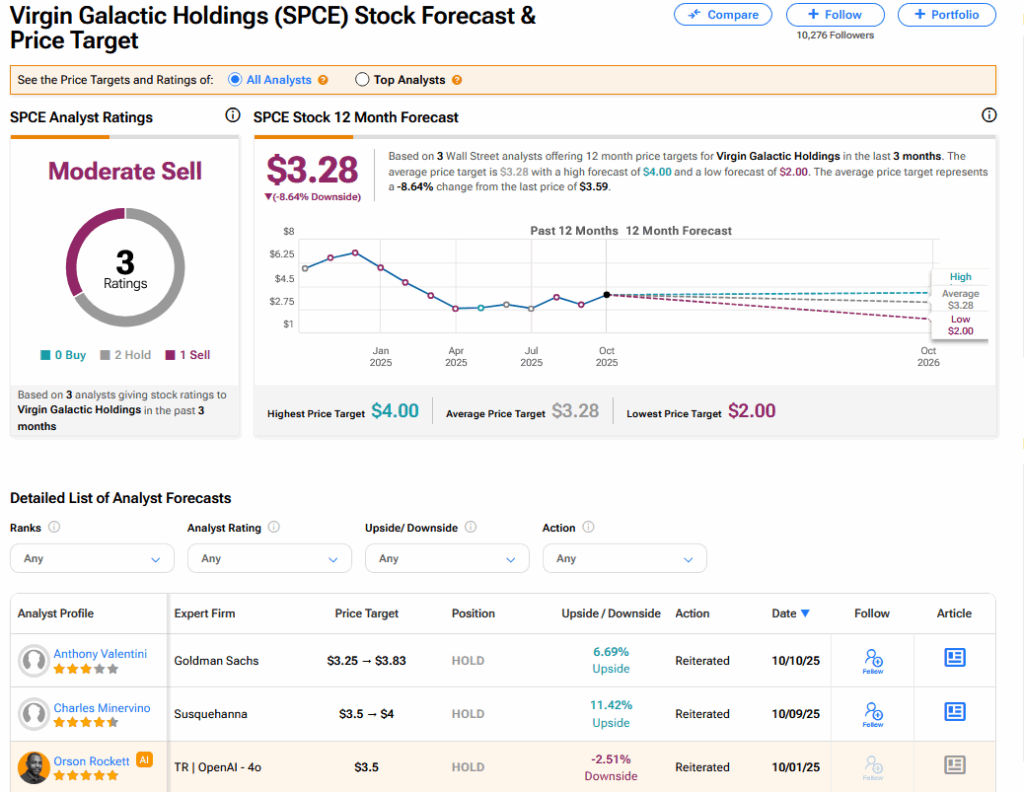

Douglas Harned from Bernstein recently maintained a Sell rating on Virgin Galactic Holdings, with a price target of $2.00. He believes that the company’s high cash consumption is concerning, especially as the company continues to invest heavily in the production of new spaceships, leading to an all-time high in capital expenditures.

Additionally, the timeline for commercializing the Delta class spaceships and launching the research ship program has been delayed, raising concerns about the company’s ability to ramp up its flight operations as planned.

Morgan Stanley analyst Kristine Liwag has a $2.50 price target and an Underweight rating on the shares. She likes the company’s long-term potential, but sees a limited near-term catalyst path until spaceflights resume.

Is SPCE a Good Stock to Buy Now?

On TipRanks, SPCE has a Moderate Sell consensus based on 2 Hold and 1 Sell ratings. Its highest price target is $4. SPCE stock’s consensus target price is $3.28, implying an 8.64% downside.