Concentrated solar power provider Vast Renewables (VST) could be the next big short squeeze, according to data from Fintel. The market analysis platform shows that short interest currently accounts for an unusually high percentage of the stock’s float. This has earned it the top score on Fintel’s leaderboard, a platform that ranks stocks on their short-squeeze likelihood. The fact that VSTE stock has surged 62% over the past month also suggests a potential short squeeze.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Is a Short Squeeze Coming for Vast Renewables Stock?

A quick look at Fintel’s data suggests that a short squeeze is likely. Short interest currently accounts for almost 40% of the stock’s float. Since 20% is considered high, 40% is definitely noteworthy. On top of that, short sellers currently have less than a day to cover their positions, which also suggests rising short interest.

VSTE currently has a short squeeze score of 98.40 out of 100. This overall score is calculated by a “proprietary, multi-factor model that uses a number of factors, including Short Interest % Float, Short Borrow Fee Rates, and others.” While VSTE stock has been trending downward all day, this high short interest is grounds for speculation that a short squeeze could be taking place.

Is VSTE Stock a Buy, Sell, or Hold?

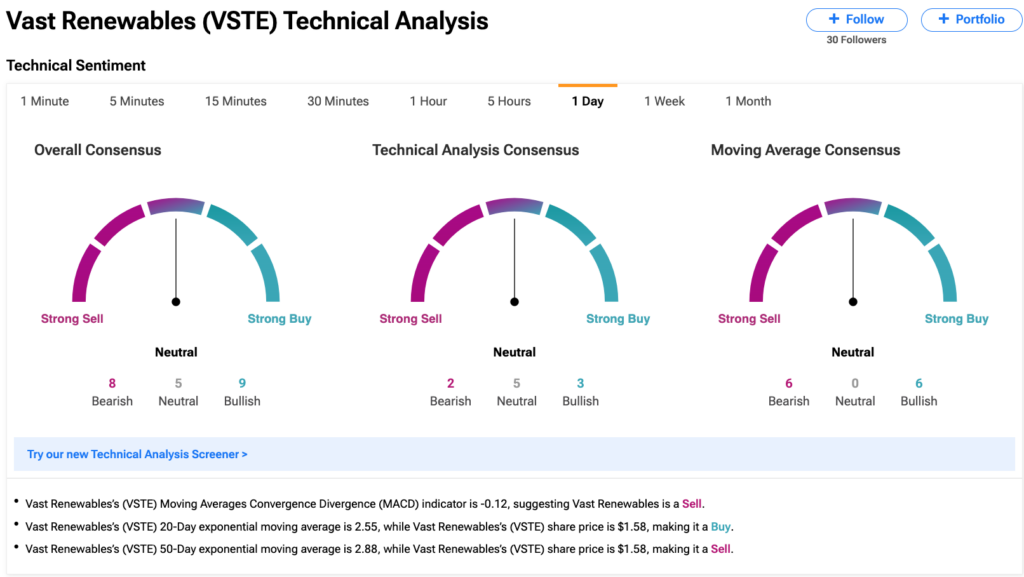

Since no Wall Street analysts follow VSTE stock, it is hard to properly assess which rating it deserves based on expert opinions. That said, the TipRanks technical analysis tool suggests a Sell signal on the one-day timeframe based on overall bearish sentiment.