Upstart Holdings (UPST) has registered an astonishing 240% stock surge over the past year, powered by an AI-driven personal loan platform that continues to evolve. Year-to-date, the stock is up 42%. But even as Upstart’s advances highlight the growing appeal of AI in consumer lending, they also raise critical questions about whether the stock’s valuation is getting ahead of its fundamentals.

An expanding product lineup and improving profitability metrics are just two positive developments fueling Upstart’s momentum. Still, the ever-present question remains: can UPST’s high valuation resist economic headwinds and the realities of the lending marketplace?

AI-Backed Momentum Drives Upstart’s Rally

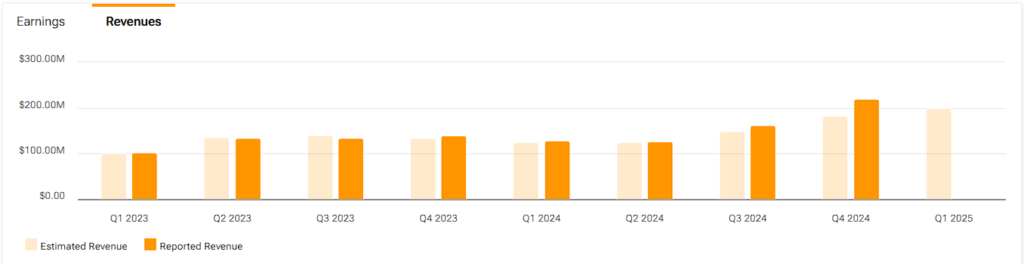

Upstart’s remarkable rally has been driven primarily by its strong growth, a trend reaffirmed in its latest Q4 earnings report on February 11. The company posted a total revenue of $219 million, marking a 56% year-over-year increase and an impressive 35% sequential growth, showcasing strong momentum.

Notably, personal loan originations surged to $2.1 billion, up 68% YoY and 33% QoQ. These figures highlight the market’s increasing demand for AI-powered lending solutions, with Upstart’s technology playing a central role in that appeal.

Model 19, the latest evolution of Upstart’s proprietary AI lending model, was paramount to the quarter’s success. Upstart refines its risk assessment far more precisely than traditional methods by introducing a “payment transition model” that factors in interim delinquency states. By pivoting from a singular focus on final loan outcomes to a more granular view of borrower behavior, the company has improved both the accuracy of default predictions and the efficiency of loan approvals.

UPST Eyes Profitability on the Horizon

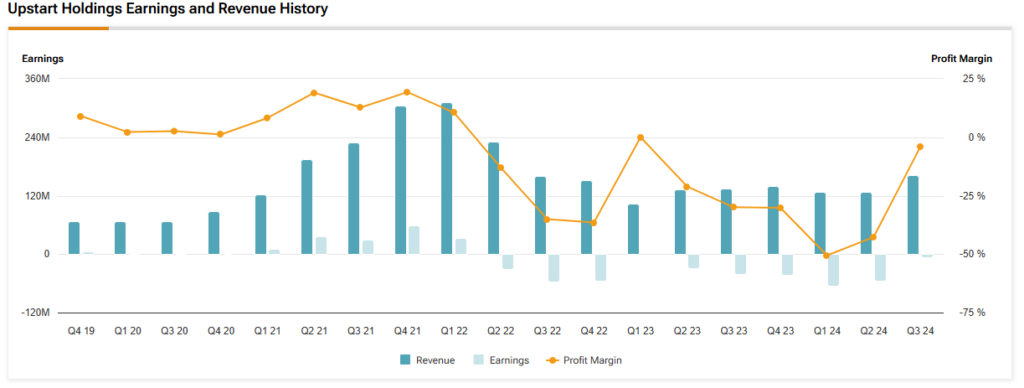

Beyond its strong revenue growth, Upstart is steadily approaching profitability. In Q4, the company reported a GAAP net loss of $2.8 million—a significant improvement from the $42.4 million loss recorded the previous year. Meanwhile, Adjusted EBITDA surged from $0.6 million to $38.8 million year-over-year, achieving an 18% margin that reflects improved operational efficiency and scalability.

Upstart’s contribution margin remained stable at 61%, while its conversion rate jumped from 11.6% in the prior year’s Q4 to 19.3%, signaling increasing borrower demand and more refined underwriting.

As a result, 2024 may have been Upstart’s final year of losses. Management projects revenue to exceed $1 billion in 2025, fueled by sustained fee growth and positive contributions from net interest income. More importantly, the company is targeting an 18% Adjusted EBITDA margin and expects to at least break even in GAAP net income for the year—a significant turnaround from previous years of losses. This marks a clear step toward sustainable profitability.

UPST’s High Valuation Bar

For many investors, the most pressing question is whether Upstart’s soaring stock price can be justified by future earnings. After all, its underlying performance has indeed been very encouraging. Unfortunately, shares are top-heavy at about 59x Wall Street’s consensus 2025 EPS estimate of $1.39. This multiple suggests the market may be pricing in near-perfect execution—everything from continued AI improvements to supportive economic conditions. Any stumble, however minor, could leave current shareholders vulnerable to a sharp pullback.

A range of macroeconomic challenges could also complicate Upstart’s growth story. While the Upstart Macro Index (UMI) showed signs of positive advancement regarding late 2024, factors like rising default rates or a broader economic downturn could quickly derail momentum. And although a potential cut in interest rates might help consumer lending, there’s no guarantee it will materialize.

Is UPST Stock a Buy?

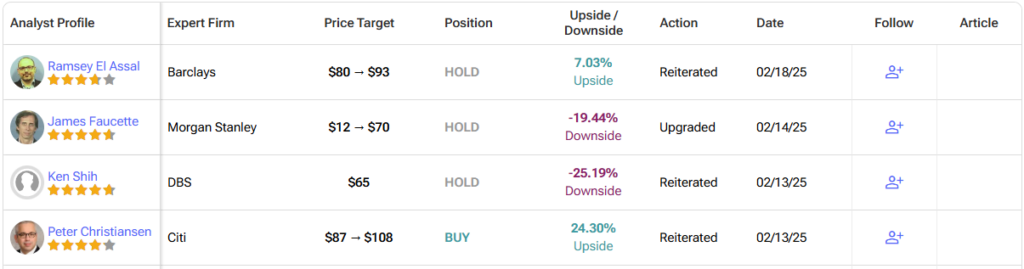

Wall Street analysts also seem skeptical about Upstart’s future prospects. UPST stock carries a Moderate Buy rating, with analyst ratings consisting of six Buy, seven Hold, and two Sell ratings over the past three months. At $81.93 per share, the average UPST stock forecast implies a ~6% downside potential.

UPST’s Impressive Growth Pushes Stock Valuation Too Far

A bullish case for UPST is understandable in current market conditions. It’s hard to deny its leading role in AI-powered consumer lending. As we saw in its latest report, the company continues to innovate, secure new funding commitments, and expand into high-potential verticals. And yet, for all its wins, the current stock price essentially assumes an almost flawless future. Given the inherent uncertainties, such as economic, operational, and competitive, I view Upstart’s valuation as stretched too thin to earn the stock a bullish stance.

Simply put, the premium on its shares is too steep, particularly when balanced against the potential risks. If you are considering an entry point, it might pay to wait until the valuation better reflects both the remarkable innovation and the realities of the lending landscape. Therefore, as it stands, I remain bearish on Upstart’s short- to medium-term prospects.