Video game software developer Unity Software (U) is set to report its fourth-quarter earnings results on February 20 before the market opens. Analysts are expecting earnings per share to come in at $0.15 on revenue of $432.5 million. This equates to 68.1% and 29% year-over-year decreases, respectively, according to TipRanks’ data.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Unity has been facing challenges for several years. Indeed, a major setback was a change to its pricing model in 2023. The company started charging game developers fees for downloads and installs, rather than just purchases. This move upset many developers, which led to boycotts and a loss of trust in Unity. Despite later revising its pricing model, Unity has struggled to regain its footing.

Interestingly, though, Unity has surpassed earnings estimates for seven consecutive quarters, and usually by a wide margin. Therefore, it is possible that the year-over-year decline might not be as bad and could potentially turn out to be very close to the prior year’s figure.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see that options traders are expecting a 13.4% move from Unity stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

It’s worth noting that HOOD’s after-earnings price moves in the past 12 quarters have mostly been smaller than the 13.4% that is expected. This implies that current option prices might be overvalued.

Is Unity Stock a Buy, Sell, or Hold?

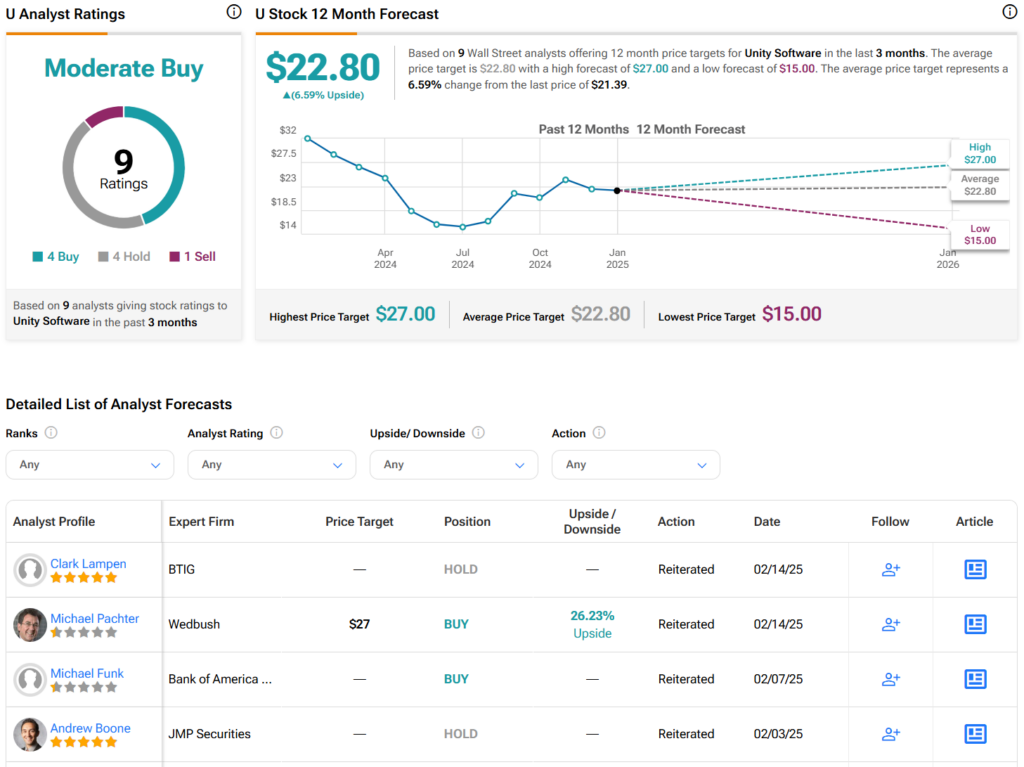

Overall, analysts have a Moderate Buy consensus rating on Unity stock based on four Buys, four Holds, and one Sells assigned in the past three months, as indicated by the graphic below. After a 33% decline in its share price over the past year, the average Unity price target of $22.80 per share implies 6.6% upside potential.