UnitedHealth (UNH) stock has declined more than 34% over the past year due to several headwinds, including concerns about high medical costs in the Medicare Advantage (MA) business and a Department of Justice investigation into the company’s billing practices. Ahead of the health insurer’s Q4 2025 earnings on January 27, 2026, most analysts remain bullish on UNH stock as they expect the company’s performance to improve in the times ahead.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

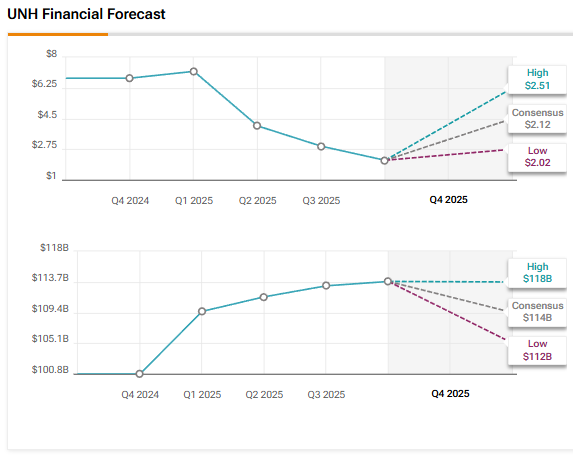

Wall Street expects UNH to report EPS (earnings per share) of $2.12 for Q4 2025, reflecting a 69% year-over-year decline. Revenue is expected to grow by about 13% to $113.8 billion.

Investors will look forward to the company’s guidance and updates on progress in its turnaround. UNH has been taking initiatives to improve its margins and streamline its business. In October 2025, the company announced that it would stop offering MA plans in 109 U.S. counties in 2026 amid multiple challenges, including a decline in government reimbursement and increased utilization.

Analysts Are Bullish on UNH Stock Heading into Q4 Earnings

Last week, Evercore analyst Elizabeth Anderson initiated coverage of UnitedHealth stock with a price target of $400. The analyst expects the company’s turnaround to be successful and views 2026 as a transition year. Anderson added that UNH’s turnaround might take 3 to 5 years, given the size and complexity of the business. The analyst expects significant improvement in UnitedHealth’s business to become more evident in 2027 and 2028, with potential upside to both her estimates and the stock’s valuation.

Meanwhile, Cantor Fitzgerald analyst Sarah James reiterated a Buy rating on UNH stock and said that she views CVS Health (CVS) and UnitedHealth as the preferred stocks to gain exposure to the Medicare Advantage space in 2026. The 4-star analyst expects a favorable regulatory backdrop to improve sentiment for the stocks in the MA space. James views CMS enrollment data, expected in mid-February, and CMS’ preliminary MA rate notice, due in late January or early February, as potential catalysts.

Likewise, Bernstein analyst Lance Wilkes raised his price target for UnitedHealth stock to $444 from $440 and reaffirmed a Buy rating. The analyst called UNH Bernstein’s top pick for 2026, given the expectation of an early-year recovery and a multi-year turnaround. Bernstein expects the government-managed care organization (MCO) sector to begin recovering in 2026, though the rebound may be uneven. Wilkes believes that all MCO sector stocks look appealing, with Medicare Advantage companies closest to earnings growth and Medicaid stocks trading at the most compelling valuations.

Is UNH a Good Buy Right Now?

Overall, Wall Street has a Strong Buy consensus rating on UnitedHealth stock based on 16 Buys and three Holds. The average UNH stock price target of $397.82 implies 16% upside.