Tilray Brands (TLRY), a cannabis company, is set to report its Q2 FY26 results on January 8. The stock has lost 32% year-to-date, weighed down by ongoing losses, slow revenue growth, and continued pressure across the cannabis sector. Recently, the stock got a brief lift after President Trump confirmed that his administration is considering reclassifying marijuana as a less dangerous drug. While that news improved sentiment, it has not been enough to change the stock’s overall downtrend.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Looking ahead to earnings, analysts remain moderately bullish. Their optimism is driven mainly by hopes for U.S. policy changes and growth in Tilray’s alcohol business. Still, weak cannabis sales and continued losses remain key risks heading into the report.

What to Expect from TLRY on January 8

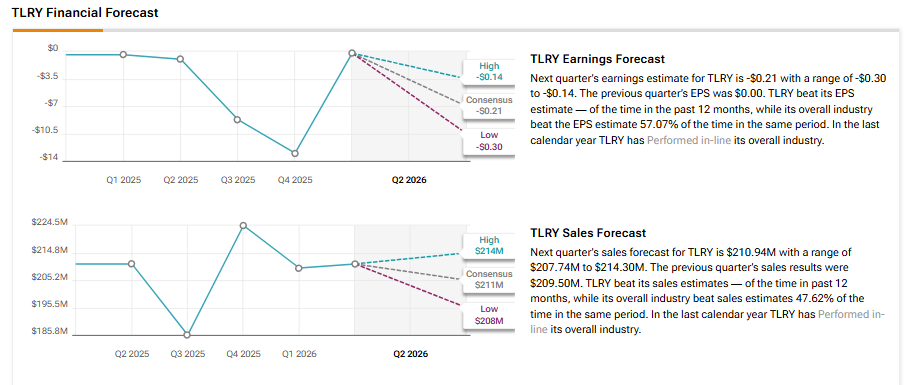

Wall Street analysts expect Tilray to report a loss per share of $0.21 in Q2, compared with break-even results in the same period last year.

At the same time, revenue is expected to stay mostly flat at around $210.9 million, based on estimates from the TipRanks Forecast page.

Analyst Insights Ahead of the Q2 Print

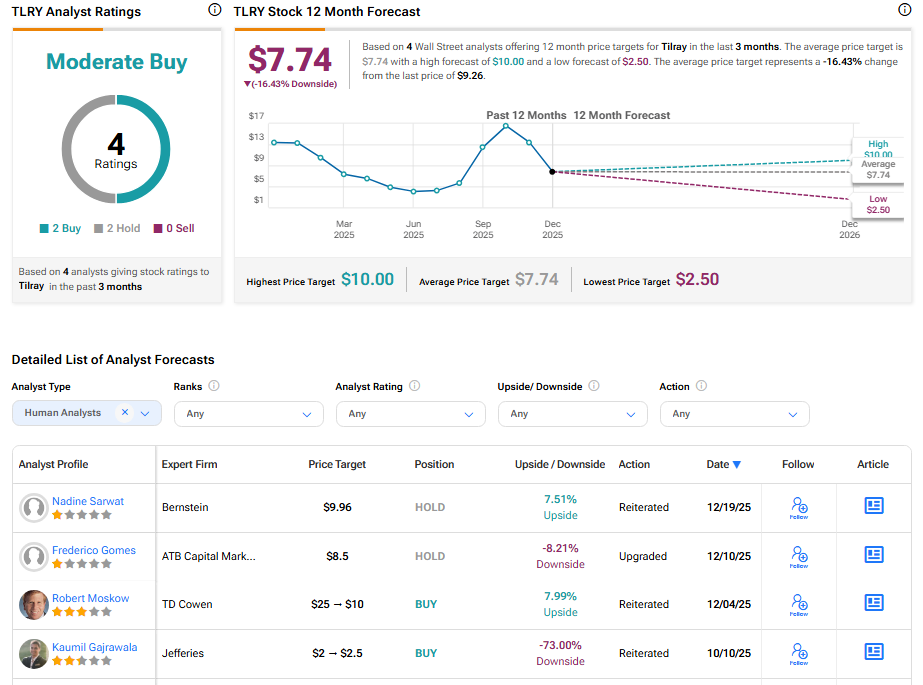

Following new policy signals from Washington that could affect the U.S. cannabis market, Bernstein analyst Nadine Sarwat raised her price target on Tilray to $10 from $1, while keeping a Market Perform rating. She pointed to a recent executive order from President Trump that directs the Justice Department to move cannabis from Schedule I to Schedule III and calls for clearer rules for hemp-based products.

Even so, Sarwat cautioned that rule changes do not ensure any “long-term winners.” While Tilray has launched Tilray Medical USA, she said it is still unclear which companies can turn new rules into steady growth. As a result, execution risks remain despite better sentiment.

Is Tilray a Good Stock to Buy Now?

Turning to Wall Street, TLRY stock has a Moderate Buy consensus rating based on two Buy and two Hold ratings assigned in the last three months. At $7.74, the average Tilray price target implies 16.43% downside potential.