There are growing worries on Wall Street about how much of the stock market’s gains are concentrated in just a few tech giants. Indeed, according to The Information, some investors are concerned that this heavy dependence could backfire if a company like Nvidia (NVDA) or Microsoft (MSFT) were to falter. With Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Meta Platforms (META), and others now making up over 30% of the S&P 500 (SPY)—three times what they did a decade ago—the fear is that any stumble could drag the entire market down.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, some think that these worries are overblown and argue that market rallies have often been driven by a small group of dominant stocks. Indeed, Citi’s Scott Chronert believes that these tech firms have earned their dominance due to strong sales and earnings growth. In Q2, the five biggest names—NVDA, MSFT, AAPL, GOOGL, and AMZN—grew profits by 26%, compared to the 15% expected, while the S&P 500’s overall earnings only rose by 11%. As a result, Chronert argues that valuations aren’t unreasonable when adjusted for growth, with the PEG ratio for these firms not much different from the broader market.

Still, the level of concentration is risky, as NVDA alone now makes up nearly 8% of the S&P 500. Interestingly, many hedge funds are responding by underweighting top tech stocks relative to the index. Analysts like Emily Roland of John Hancock warn that while these firms are fundamentally strong, letting a handful of stocks dominate portfolios could lead to trouble. Therefore, she and others suggest looking toward mid-cap stocks, which offer better value, more diversification, and exposure to sectors like industrials.

Which Tech Stock Is the Better Buy?

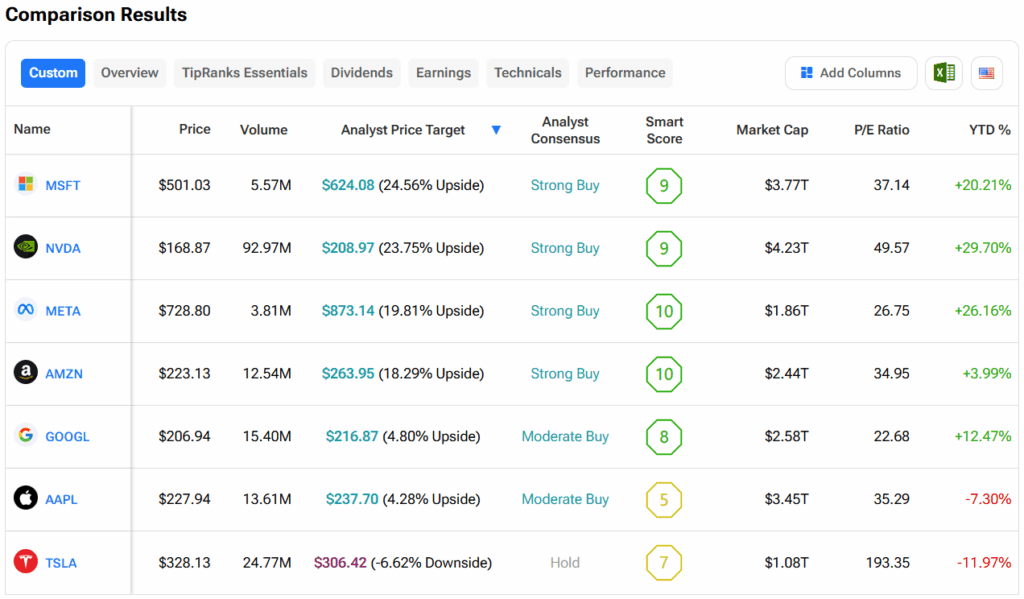

Turning to Wall Street, out of the Magnificent Seven stocks, analysts think that MSFT stock has the most room to run. In fact, MSFT’s average price target of $624.08 per share implies more than 24% upside potential. On the other hand, analysts expect the least from TSLA stock, as its average price target of $306.42 equates to a loss of 6.6%.