Is Sony (SONY) stock worth investors’ time after the entertainment company’s latest earnings report? As a reminder, the company surpassed Wall Street’s revenue and operating profit estimates, but earnings per share of 41 cents just missed the average target of 42 cents. These mixed results might leave traders seeking more professional insight into SONY shares.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

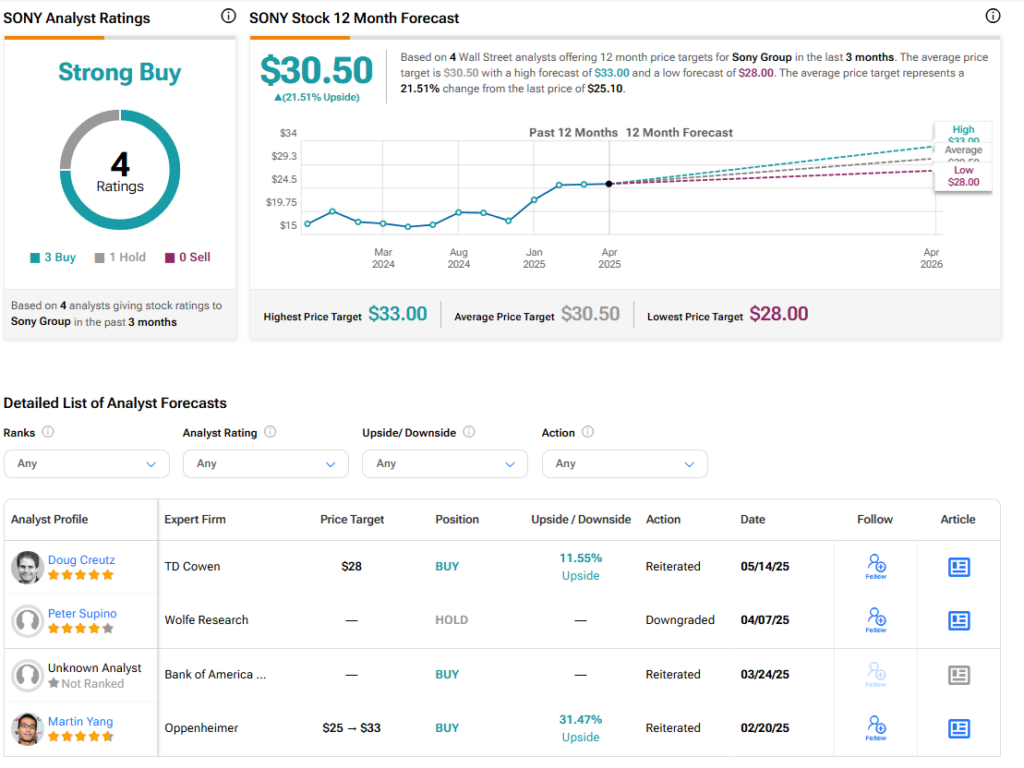

Sony’s Fiscal Q4 2024 earnings report sparked updated coverage from analysts, including five-star TD Cowen analyst Doug Creutz. He reiterated a Buy rating for SONY stock and set a $28 price target for the shares, which represents a potential 11.64% upside.

Five-star Jefferies analyst Atul Goyal also updated his coverage of Sony (JP:6758) stock following its latest earnings report. He maintained a Buy rating and increased his price target from ¥4,800 to ¥4,910, implying a possible 33.35% upside for the Japanese shares.

Why the Bullish Stances on SONY Stock?

Creutz was impressed by Sony’s revenue performance in its earnings report, as well as its ability to manage profits. He also highlighted a strong 2025 financial guidance despite the impact of tariffs and foreign exchange rates.

For Goyal, Sony’s Games and Music segments are key reasons for a bullish stance on the stock. He put a spotlight on strong operating profit increases, and the company’s positive 2025 outlook. These reasons were enough to warrant a Buy rating from the analyst.

SONY stock was up 0.84% on Thursday morning, adding to its 18.57% rally year-to-date.

Is SONY Stock a Buy, Hold, or Sell?

Turning to Wall Street, the analysts’ consensus rating for Sony stock is Strong Buy, based on three Buy and one Hold ratings over the last three months. With that comes an average SONY stock price target of $30.50, representing a potential 21.51% upside for the shares.

See more SONY stock analyst ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue