Artificial intelligence (AI) data cloud company Snowflake (SNOW) is scheduled to announce its results for the third quarter of Fiscal 2026 on December 3. SNOW stock has rallied about 61% year-to-date, driven by continued product momentum due to the AI boom, growing enterprise adoption, and a consistent track record of outperforming Street expectations. Wall Street expects earnings per share (EPS) to rise 55% year-over-year to $0.31 and revenue to grow 25% to $1.18 billion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Analysts’ Views Ahead of SNOW’s Q3 Earnings

Heading into Q3 earnings, Oppenheimer analyst Ittai Kidron maintained a Buy rating on the stock and increased the price target to $295 from $275 per share. The 5-star analyst expects another solid quarter supported by broad customer demand and growing interest in newer products like Snowpark and Cortex.

Kidron also noted rising AI and machine learning workloads and more large deal discussions. He believes Snowflake could grow revenue around 29–30%, above the current 25.6% consensus estimate, and sees guidance as beatable. With strong momentum and healthy customer spending trends, he continues to view Snowflake as a ‘top pick.’

Meanwhile, Guggenheim analyst John DiFucci reiterated a Hold rating on Snowflake. He said partner checks were positive, and Snowflake’s Q3 targets look achievable with some room for upside. Snowflake is also pushing more partnerships, which is helping expand its ecosystem and support its core data-warehousing business.

However, DiFucci noted that AI monetization is still early and the stock remains expensive at current valuation levels. As a result, he prefers to remain on the sidelines for now.

Here’s What Options Traders Anticipate Ahead of SNOW’s Q3 Earnings

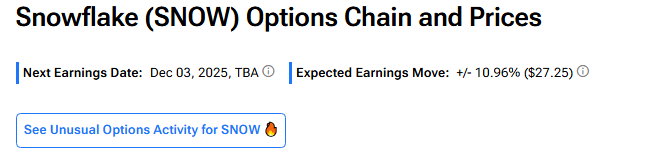

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 10.96% move in either direction in SNOW stock in reaction to Q3 FY26 results.

Is SNOW a Good Stock to Buy Now?

Overall, Wall Street has a Strong Buy consensus rating on Snowflake stock based on 33 Buys and three Holds. The average SNOW stock price target of $277.23 indicates 11.49% upside potential from current levels.