Salesforce’s (CRM) is set for strong growth, driven by AI-powered automation, industry-specific solutions, and ecosystem expansion. CRM is heavily investing in AI tools like Einstein GPT to improve automation and predictions. Also, the company’s ecosystem is expected to add $1.6 trillion in new business revenues by 2026, boosting its position in the market. Despite the share price gain, technical indicators suggest that Salesforce stock is a Buy, implying further upside from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

CRM is a cloud-based software company known for its customer relationship management platform and enterprise applications.

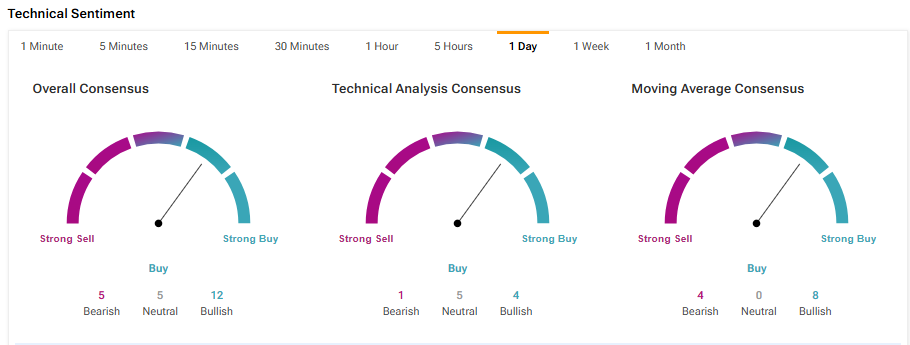

Analyzing CRM Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, Salesforce stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 278.35, while its price is $288.06, implying a bullish signal. Further, its shorter duration EMA (20 days) also signals an uptrend.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. CRM stock currently has an ROC of 7.2, which signals a Buy.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For Salesforce, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Is CRM a Good Stock to Buy?

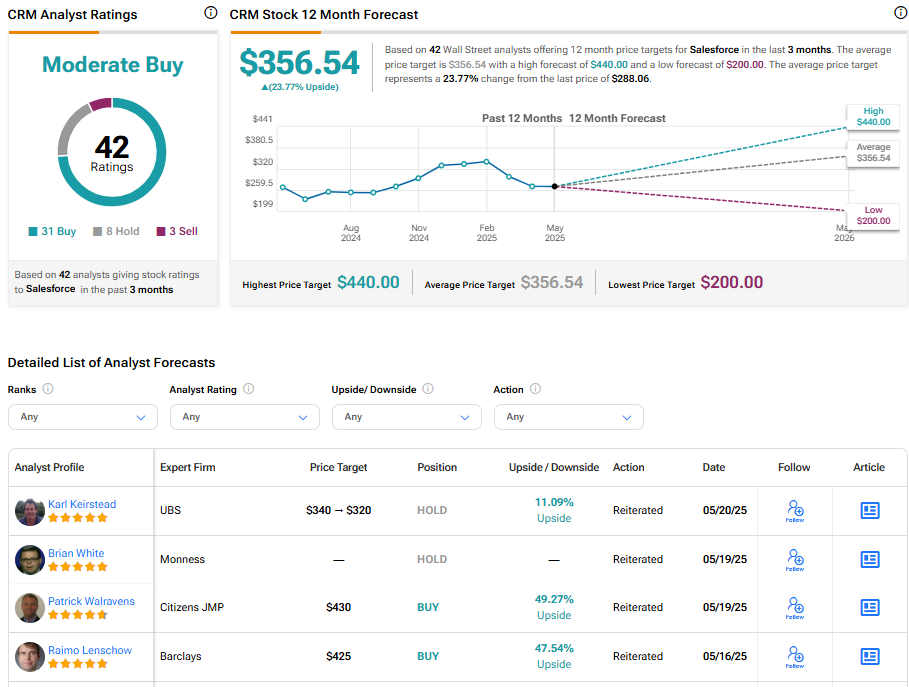

On TipRanks, CRM stock has a Moderate Buy consensus rating based on 31 Buys, eight Holds, and three Sells assigned in the last three months. The average Salesforce stock price target of $356.54 suggests an upside potential of 23.77% from its current price. Year-to-date, shares of the company have declined about 13.7%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue