Quantum computing stocks, including Rigetti Computing (RGTI), saw a notable surge after Alphabet (GOOG) announced a breakthrough with its Willow quantum chip. However, subsequent speculation by tech leaders that the technology is a decade away from practical use has led to volatility and a prudent “wait-and-see” attitude among investors. Despite being in its early development stage with minimal current revenue, the market is anticipating over 40% revenue growth by 2025, thanks largely to the scheduled launch of its 36-qubit and 108-qubit systems. Still, the company must address factors like scalability risks and stiff competition from industry leaders like IBM (IBM) and Google. In recent news, Rigetti debuted its 84-qubit Ankaa-3 system and has confirmed collaborations to enhance qubit efficiency. However, investors should tread carefully, as the company’s stock could continue to see sharp fluctuations based on changing market perceptions and technological progress. The stock is a high-risk, high-potential-reward lotto ticket for long-term investors willing to take a wild ride.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

On the Road to Scalable Quantum Computing

Rigetti is a quantum computing company aiming to build the world’s most powerful computers. It created the first multiple-chip quantum process and started selling quantum computers in 2023. The company is vertically integrated, owning its manufacturing facility, which serves as a competitive advantage despite higher capital costs.

The company’s roadmap for 2025 includes the introduction of a new modular system architecture and a 36-qubit system release by mid-year. By the end of the year, they aim to launch a system with over 100 qubits. This follows significant improvements to the technology stack, including an all-new cryogenic hardware design, an optimized qubit chip, and implementation of the Alternating-Bias Assisted Annealing technique, which results in higher fidelity.

Regetti has recently unveiled its new flagship quantum computer, the 84-qubit Ankaa-3 system. The company’s latest hardware redesign aims to provide superior performance with two-qubit gate fidelity milestones of median 99.0% iSWAP gate fidelity and 99.5% median fidelity fSim gates. The Ankaa-3 system can be accessed via the Rigetti Quantum Cloud Services platform and will be available on Amazon Braket and Microsoft (MSFT) Azure in the first quarter of 2025.

In joint research with QphoX B.V., a Dutch quantum technology startup, and Qblox, a quantum control stack developer, Rigetti has shown that superconducting qubits could be read with an optical transducer. This significant achievement was published in Nature Physics and could have far-reaching implications for quantum computing. The microwave-to-optical transduction technology developed by QphoX could potentially replace cryogenic components with optical fibers, solving some challenges linked to using large numbers of qubits and leading to a potentially more scalable path for developing and launching quantum computing.

Cash Burn, but Confidence in Delivering on Its Roadmap

In the third quarter of 2024, the company recorded total revenue of $2.4 million. However, these gains were offset by the significant total operating expenses, which stood at $18.6 million for the same period. This resulted in an operating loss of $17.3 million and a net loss for the quarter of $14.8 million.

The CEO has given recent guidance that with around $225 million in cash and no debt, the company is confident in delivering its 2025 roadmap.

Analysts Are Bullish

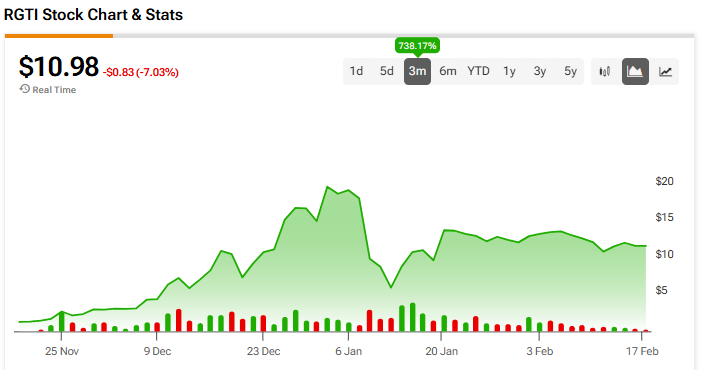

The stock has been on a rocket ride since late last year, climbing over 731% in the past three months. But the ride hasn’t been smooth, with the stock roughly three times as volatile as the general market. It trades at a heady P/S ratio of 161.97x. Such a rich valuation carries the risk of considerable, often rapid, adjustment if perceptions shift or if there’s any shortfall in the company’s growth or technological advancements.

Analysts following the company have been bullish on the stock. For example, B. Riley’s Craig Ellis recently reiterated a Buy rating on the shares and raised the price target to $15 (from $8.50), noting quantum computing is “what’s next” after artificial intelligence uptake, and company developments could elevate demand for the stock.

Rigetti Computing is rated a Strong Buy overall, based on the recent recommendations of four analysts. The average price target for RGTI stock is $15.67, which represents a potential upside of 43.89% from current levels.

RGTI in Review

Despite recent turbulence in the quantum computing sector, Rigetti Computing stands out with its ambitious plans and significant technological advancements. Future growth is anticipated, with the company’s commitment to enhancing the power of its quantum systems, as demonstrated by the recent launch of the 84-qubit Ankaa-3 system and collaborations aimed at improving qubit efficiency. However, Rigetti faces challenges like scalability concerns and competition with tech giants like IBM and Google. Still, the company maintains a confident outlook on delivering its 2025 roadmap, and analysts are optimistic about Rigetti’s future. While it may be a wild roller coaster ride, it might be one worth taking for long-term investors.