Tilray Brands (TLRY), a cannabis company, will release its Q1 FY26 results on October 9. The penny stock has surged 222% over the past three months, fueled by optimism around potential regulatory changes in the U.S. cannabis market. The main driver was speculation that Donald Trump may reclassify cannabis to Schedule III, a move that could ease restrictions and create new opportunities for established players. For context, Schedule III reclassification would not fully legalize marijuana but would recognize it as having accepted medical use and lower its federal risk level.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Even so, the stock is still down about 2% over the past year, weighed down by ongoing losses, slow revenue growth, and persistent challenges in the cannabis sector. Ahead of Q1 earnings, analysts stay moderately bullish on the stock, citing hopes for U.S. policy reform and growth in Tilray’s alcohol unit, though weak sales and continued losses remain key concerns.

What to Expect from TLRY on October 9

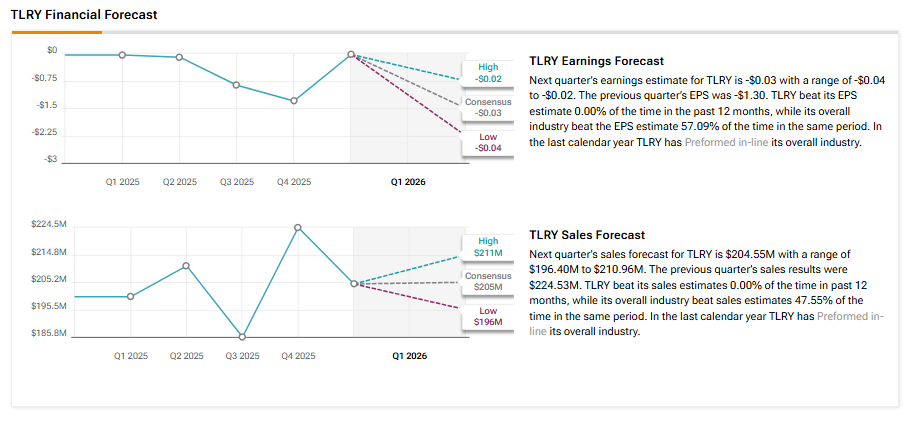

Wall Street analysts expect Tilray Brands to report a loss per share of $0.03, versus a loss of $0.04 per share in the year-ago quarter. Meanwhile, revenues are expected to increase modestly by 2% from the year-ago quarter to $204.6 million, according to data from the TipRanks Forecast page.

Analyst Insights Ahead of the Q1 Print

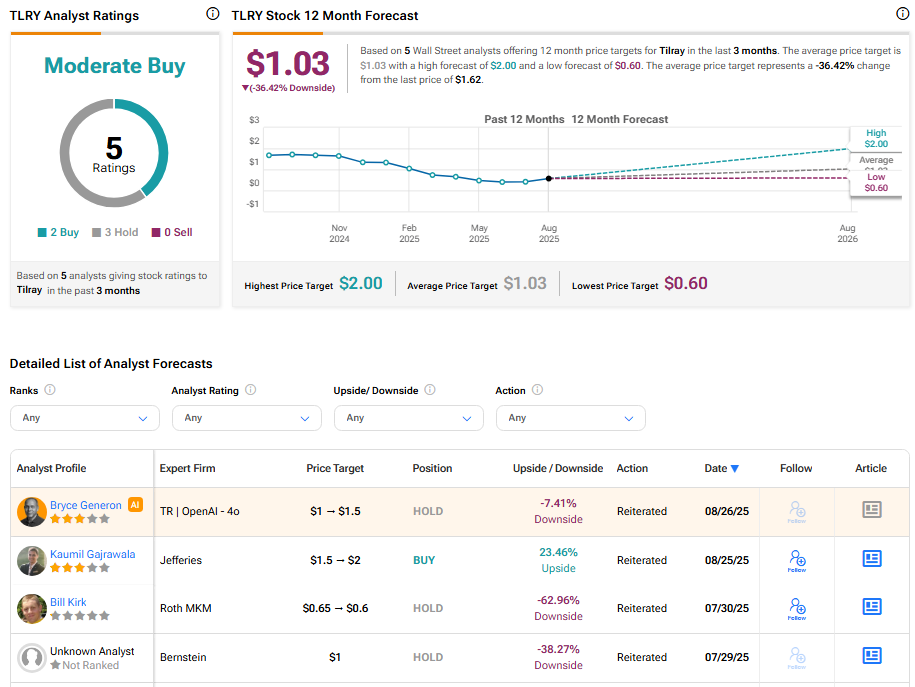

In August, Jefferies analyst Kaumil Gajrawala raised his price target on Tilray from $1.50 to $2 while maintaining a Buy rating. He pointed out that recent comments from President Trump about reclassifying marijuana from Schedule I to Schedule III could act as a key tailwind for the sector.

Gajrawala added that Tilray’s strong brands, growing scale, and solid balance sheet position the company well to benefit if policy changes move forward.

Is Tilray a Good Stock to Buy Now?

Turning to Wall Street, TLRY stock has a Moderate Buy consensus rating based on two Buys and three Hold ratings assigned in the last three months. At $1.03, the average Tilray price target implies 36.42% downside potential.