Palo Alto Networks (PANW) is well-positioned for long-term growth, due to rising demand for cybersecurity solutions and its next-generation security offerings. Despite some short-term headwinds such as margin pressure, Palo Alto’s remaining performance obligations rose 19% to $13.5 billion in fiscal Q3, signaling a robust pipeline. Further, technical indicators point to bullish momentum, with PANW stock rated a Strong Buy, implying further upside from current levels.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Analyzing PANW Stock’s Technical Indicators

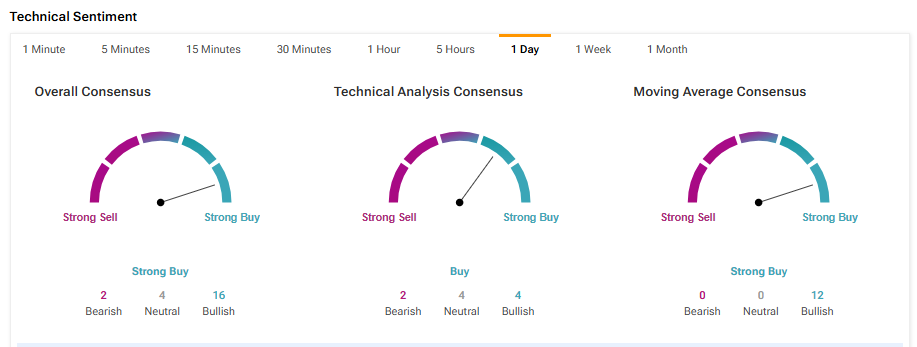

According to TipRanks’ easy-to-understand technical analysis tool, PANW stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) and shorter duration EMA (20 days) imply a bullish signal.

Moreover, the Moving Average Convergence Divergence (MACD) indicator, a crucial tool for understanding momentum and potential price direction shifts, is currently signaling a Buy.

Another technical indicator, the Rate of Change (ROC), is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. Palo Alto stock currently has an ROC of 1.98, which signals a Buy.

Is PANW a Good Stock to Buy?

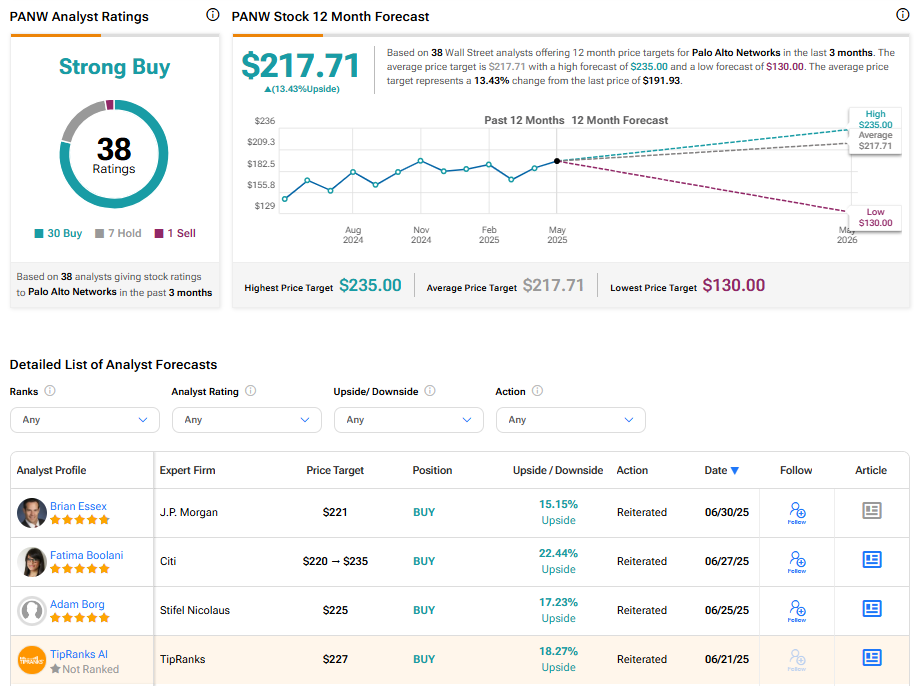

On TipRanks, PANW stock has a Strong Buy consensus rating based on 30 Buys, seven Holds, and one Sell assigned in the last three months. The average Palo Alto stock price target of $217.71 suggests an upside potential of 13.4% from its current price. In the past three months, shares of the company have gained about 22.41%.