Palantir Technologies (PLTR) has been one of the market’s standout stocks in 2025. The stock has surged 150% so far this year as demand for its AI and data software has picked up across both government and commercial customers. More recently, Palantir landed a large U.S. Navy contract, adding to a growing list of deals that show its software is being used in real world. After such a strong run, investors now want to know who is backing Palantir at these levels and whether large funds and institutions are still adding exposure.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, valuation remains a concern, with the stock trading at a steep forward P/E of 260.6x, far above the sector average of 24.5x. (Note: For a deeper look at Palantir’s upside and risks, see TipRanks’ article, “Palantir Stock: After a 150%+ Rally, Bulls and Bears Weigh the Road to 2026.”)

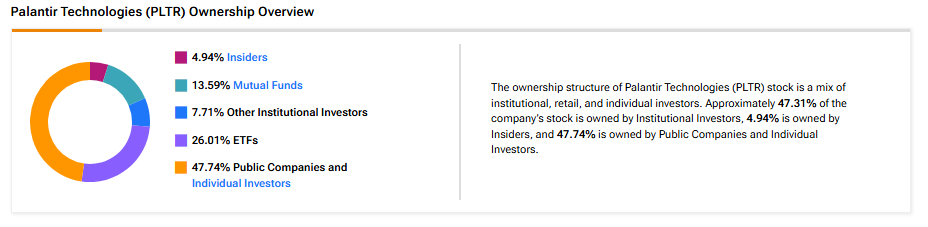

Now, according to TipRanks’ ownership page, public companies and individual investors own 47.74% of PLTR. They are followed by ETFs, mutual funds, other institutional investors, and insiders, at 26.10%, 13.59%, 7.71%, and 4.94%, respectively.

Digging Deeper into PLTR’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in PLTR at 8.07%. Next up is Vanguard Index Funds, which holds a 6.55% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.97% stake in Palantir stock, followed by the Vanguard S&P 500 ETF (VOO) with a 2.48% stake.

Moving to mutual funds, Vanguard Index Funds holds about 6.55% of PLTR, whereas Fidelity Concord Street Trust owns 1.62% of the stock.

Is PLTR a Good Stock to Buy Now?

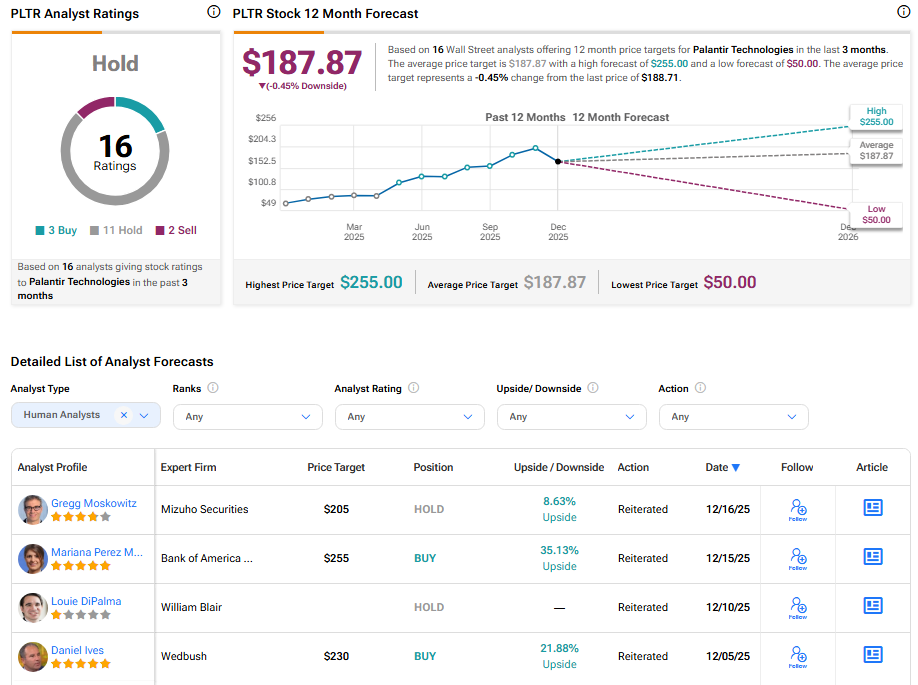

Overall, Wall Street is sidelined on PLTR stock, with a Hold consensus rating based on three Buys, 11 Holds, and two Sell recommendations. The average PLTR stock price target of $187.87 implies 0.45% downside risk from current levels.