Palantir Technologies’ (PLTR) sales are rising fast. The company’s Q4 2024 revenue surged 36% year-over-year, reaching $828 million. But what’s driving the jump? Is the software company expanding its client base or are current ones just spending more? Let’s dive into some figures from Main Street Data to know what’s fueling the growth.

PLTR stock has soared from under $20 at the start of 2024 to over $100 in 2025. The stock gained over 230% in the past 12 months, fueled by AI hype and strong Q4 earnings.

Palantir’s Customer Growth

According to Main Street Data, Palantir’s total customer count rose to 711 in Q4 2024, reflecting a 43% increase year-over-year. However, quarter-over-quarter growth slowed to around 13%.

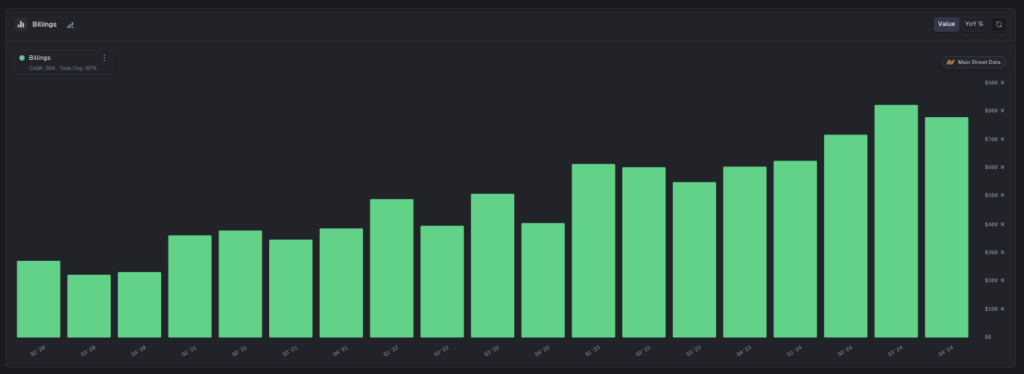

Meanwhile, if we look at the chart below for billings, they declined from $823 million in Q3 2024 to $779 million in Q4 2024. On a year-over-year basis, however, billings grew by 28.8%. This quarterly drop could indicate fewer new deals signed in Q4 or shorter, less aggressive contract terms.

Additionally, Palantir reported a net dollar retention rate of 120% in Q4 2024, indicating that existing customers spent 20% more than they did a year ago. This reflects strong customer loyalty and growing usage.

Is PLTR a Good Stock to Buy?

Wall Street analysts remain cautious on PLTR stock amid the uncertainty regarding its contracts with the U.S. Army. Moreover, Palantir’s high valuation and insider sales have raised more concern among analysts.

Overall, Wall Street has a Hold consensus rating on PLTR stock, based on four Buys, 11 Holds, and four Sell recommendations. The average share price target for Palantir is $92, which implies an upside potential of 18% from current levels.