Nvidia’s stock (NVDA) climbed again Friday after Amazon confirmed it’s not slowing down on AI. With over $24 billion in Q1 capital expenditure and plans to hit $100 billion this year, Amazon’s (AMZN) push into infrastructure is fueling more than just cloud ambitions—it’s lighting a fire under the global semiconductor trade.

Amazon’s CapEx Surge Signals Real AI Commitment

Amazon’s Q1 report confirmed what markets hoped: AI is still priority number one. Capital expenditure jumped to $24.3 billion—up 75% from last year—and executives said the bulk of that is heading to AWS and AI-related buildouts. That includes chips like Amazon’s own Trainium, but also massive outlays on infrastructure to run large language models and AI services.

Why does this matter for Nvidia? Because even with Amazon designing custom chips, it still relies heavily on Nvidia GPUs for training and inference. Nvidia’s H100 and soon-to-launch B100 chips remain the most sought-after in hyperscale training environments. In short, custom silicon may complement, but not replace, Nvidia’s dominance.

AI Spending Is Global Infrastructure Spending

This isn’t just a tech story—it’s a macroeconomic one. Spending on AI infrastructure is becoming the new arms race among global tech titans, and Nvidia is at the heart of the supply chain. Analysts now view AI capex as the modern equivalent of digital industrial investment: it shapes trade flows, capital markets, and even geopolitical strategy.

The $100B Amazon budget mirrors moves from Microsoft (MSFT) and Meta (META), both of whom also pledged this week to increase AI infrastructure investment. As this spending moves downstream, it drives global demand for high-end semiconductors, memory, data center power capacity, and cooling technologies.

Confidence Returns to Growth Tech

The recent surge in capex reverses fears from last month, when rumors suggested Amazon was dialing back on AI investments. That narrative has now been torched. With confirmation that hyperscalers remain committed, Nvidia’s valuation is once again underpinned by actual multi-year demand forecasts—not just hype.

Investor confidence is also being reinforced by broader tech earnings beats, cooling inflation expectations, and signs of stable U.S. growth. Nvidia’s gain of 2.5% Thursday and another 0.8% premarket Friday signals strong appetite for risk-on AI plays heading into the summer.

Nvidia isn’t the only one benefiting. Advanced Micro Devices (AMD) rose 0.7%, and Broadcom (AVGO) gained 0.9% in premarket as investors bet on broader supply chain tailwinds. Meanwhile, Taiwan and South Korea—home to key foundries—are seeing renewed demand signals. U.S.-China tensions over chips remain a variable risk, with potential to disrupt supply chains or shift trade dynamics, but for now, the west’s AI push is tightening trade routes toward friendly manufacturing zones.

Is NVDA Stock Still a Buy?

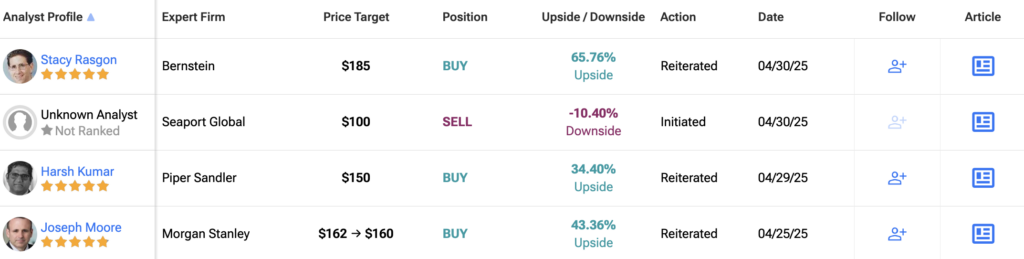

Wall Street is still all-in on Nvidia. According to TipRanks, 41 analysts currently cover the stock, with an overwhelming 35 rating it a Buy, just 5 calling it a Hold, and only one tagging it a Sell—giving Nvidia a clear Strong Buy consensus. The average 12-month NVDA price target sits at $165.22—implying a 48% upside from current levels—while the most bullish analysts see it hitting $200. That level of consensus isn’t just rare, it’s a signal: investors view Nvidia as the key beneficiary of the AI arms race.