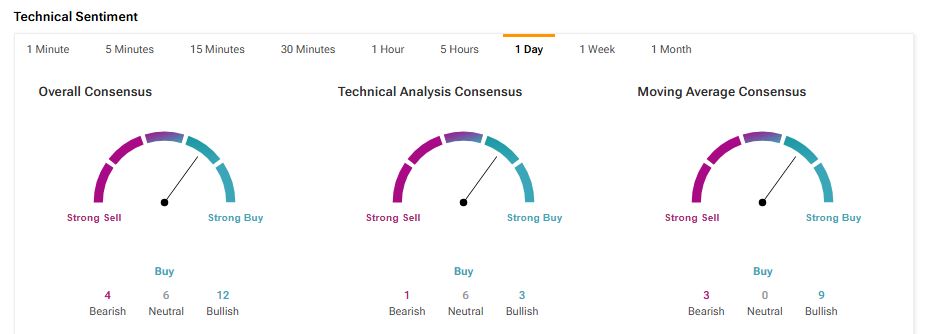

Nvidia (NVDA) continues to be a powerhouse in the chip sector, thanks to its strong position in AI and advanced computing. Its GPUs power key areas like data centers, self-driving cars, and AI tools, placing the company at the heart of new technologies. Amid this momentum, the company is set to report its results for the first quarter of Fiscal 2026 tomorrow. Most analysts remain upbeat on the company’s growth outlook, backed by solid demand for its GPUs used to build and train AI models. Wall Street expects Nvidia’s Q1 FY26 earnings per share to jump 20% to $0.73, while revenue is expected to climb about 66.5% to $43.3 billion. With steady demand and ongoing progress, technical indicators suggest Nvidia stock is a Strong Buy, pointing to more gains ahead.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Analyzing NVDA Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, NVDA stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 119.80, while its price is $131.29, implying a bullish signal. Its shorter duration EMA (20 days) of 124.87 also signals a Buy.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. Nvidia stock currently has an ROC of 15.35, which signals a Buy.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For NVDA, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Is NVDA a Good Stock to Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $164.51 per share implies 25.30% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue