AI giant Nvidia (NVDA) is set to report its Q1 FY26 earnings on Wednesday, May 28, after the market closes. Over the past year, the stock has risen more than 28%, fueled by its leadership in AI hardware and record financial results. In addition, Nvidia’s strategic partnerships with companies like Microsoft (MSFT), Alphabet (GOOGL), and Meta (META), along with new initiatives in regions such as the Middle East, have helped expand its market reach. Although Nvidia’s near-term growth may be limited by the China AI chip ban and supply challenges with its high-end GB200 systems, most analysts remain optimistic about the company’s long-term potential and continue to maintain a strong Buy rating ahead of Q1 earnings.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

What to Expect from Nvidia’s Q1 Earnings

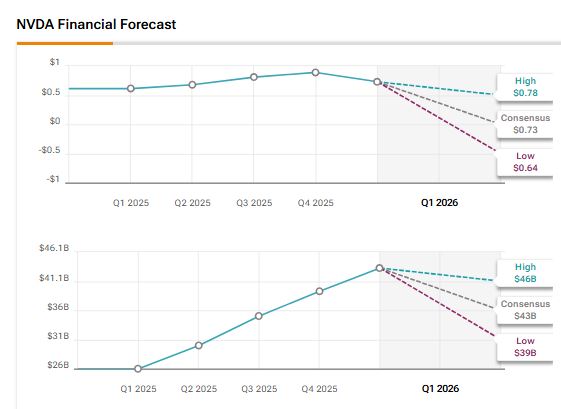

Wall Street analysts expect Nvidia to report earnings of $0.73 per share for the first quarter of Fiscal 2026, up 20% from the year-ago quarter. Meanwhile, analysts project Q1 revenues at $43.3 billion, according to the TipRanks Analyst Forecasts Page. This marks a year-over-year increase of over 66%.

Analysts Stay Bullish Despite Short-Term Setbacks

Five-star analyst Christopher Rolland of Susquehanna reiterated a Buy rating on the stock with a $180 price target, emphasizing the company’s robust demand in AI and data center markets. While he acknowledges a roughly $1 billion revenue loss from recent China restrictions and expects some inventory-related margin pressures in Q1, Rolland remains confident that Nvidia’s long-term growth drivers are intact. He highlights robust spending by the top five hyperscale cloud providers, who are expected to increase capital expenditures by 40% year-over-year in 2025. Moreover, Nvidia’s ramp-up of new AI products like the Blackwell GPUs, along with continued momentum in gaming and professional visualization segments, supports his bullish outlook.

Similarly, Top analyst John Vinh of KeyBanc also maintains a Buy rating on Nvidia stock, pointing to the company’s strong long-term growth potential despite near-term challenges. He notes that the ongoing China AI chip ban and supply constraints with Nvidia’s high-end GB200 systems may limit upside in the upcoming quarters. However, Vinh is optimistic about Nvidia’s plans to launch a China-compliant AI GPU using GDDR7 memory, which could help recover some of the lost revenue.

Nvidia’s Strategy to Overcome Supply and Regulatory Challenges

Nvidia faces short-term hurdles, including the China AI chip ban, which restricts access to a key market, and ongoing manufacturing issues with its GB200 high-performance systems. These challenges have led to shipment delays and revenue impacts, raising concerns about meeting ambitious production goals.

However, the company is actively working to overcome these obstacles by developing new AI GPUs that comply with export rules, potentially offsetting some revenue losses. In addition, Nvidia’s strong partnerships with major cloud providers and expansion into emerging regions like the Middle East further boost its growth prospects.

Analysts believe that these efforts, combined with continued strong demand for AI technology, position Nvidia well for steady growth despite the near-term headwinds.

Is NVDA a Good Stock to Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $164.51 per share implies 23.85% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue