NIO Inc. (NIO), one of China’s most aspiring electric vehicle (EV) manufacturers, seems to be finally finding its feet in the ever-competitive industry and may be on the path to fulfilling its untapped potential. It posted impressive numbers and ambitious plans for the future. Despite a challenging market environment, NIO has shown resilience and a clear strategy to solidify its local and global position.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

NIO Is Breaking Records

In December 2024, NIO set a new monthly record by delivering 31,138 vehicles, marking a 72.9% year-over-year growth. This achievement includes premium smart electric vehicles under the NIO brand and family-oriented vehicles from the ONVO brand. The fourth quarter saw 72,689 deliveries, a 45.2% increase from the previous year, and the total for 2024 reached 221,970 vehicles, reflecting a 38.7% rise.

Nio Sets Ambitious Targets for 2025

Looking forward, NIO has set ambitious targets for 2025. The company aims to deliver approximately 440,000 units, nearly double the sales of 2024. This goal aligns with NIO’s broader expansion strategy, which includes entering 25 overseas markets by the end of the year. Introducing new models like the flagship NIO ET9 and the high-end compact car Firefly, expected in March and April 2025, respectively, is part of this growth plan.

Going Global

NIO’s global expansion is a key component of NIO’s strategy. The company has been focusing on strengthening its presence in Europe, with successful entries into markets like Norway, Germany, the Netherlands, Sweden, and Denmark. Recently, NIO announced its entry into the Middle East and North Africa (MENA) region, starting with the UAE. This move is expected to leverage advanced autonomous driving systems and battery swap technology, placing NIO as a significant player in these markets.

Financials Are Still a Mixed Bag

After indulging in the positives, let’s move on to the shades. Despite the positive delivery numbers, NIO’s financial performance has been mixed. In the third quarter of 2024, vehicle sales declined slightly by 4.1% compared to the same period in 2023, resulting in a year-over-year revenue decline of 2.1% to $2.6 billion. Moreover, the aggregate loss for the first three-quarters of 2024 stands in the region of $2.1 billion.

On Tipranks’ Smart Score, NIO stock is rated a 3, meaning it underperforms due to negative crowd wisdom, decreased hedge fund trend, and negative stock momentum of 20 and 200 days.

Is NIO a Buy, Sell, or a Hold?

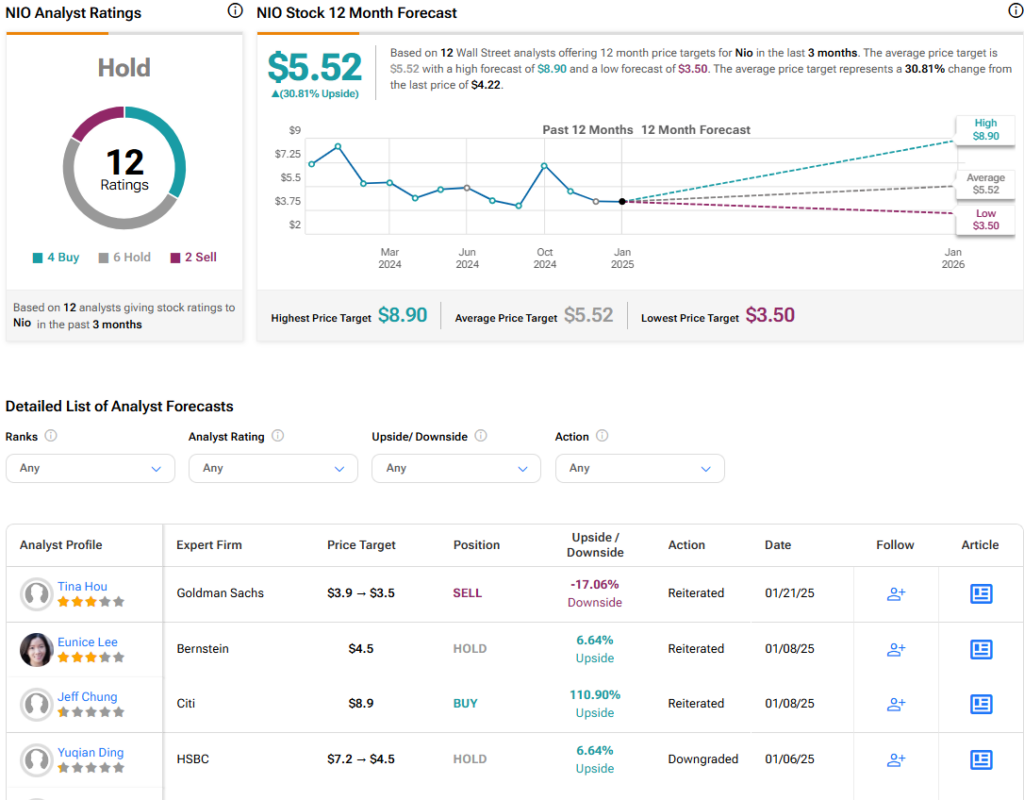

On Wall Street, Nio is considered a Hold. The price target for NIO stock is $5.52, implying a 30.81% upside potential.

To Be Continued

NIO’s recent performance and future plans indicate that it can unlock its potential in a competitive market. With record-breaking deliveries, ambitious targets, and strategic global expansion, NIO is positioning itself as a notable player in the EV industry. While challenges remain, the company’s approach and clear vision for the future suggest that NIO may finally change things around.