Drug giant Moderna (MRNA) is set to release its Q2 earnings report this week. This has some investors wondering whether it is a good idea to buy shares of MRNA beforehand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Wall Street Expects

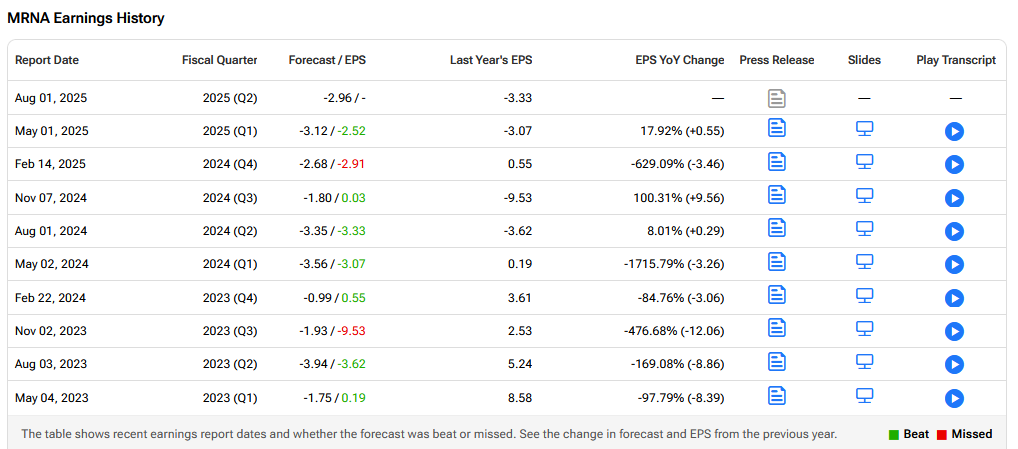

Wall Street expects MRNA to reveal a quarterly loss of $2.99 per share, indicating an increase of 10.2% compared to the same period last year. Analysts also forecast revenues of $127.17 million, representing a decline of 47.2% year-over-year.

Will MRNA be able to beat these estimates? As can be seen below, it has a strong track record of doing just that in recent quarters.

Key Insights Ahead of Earnings

In the first quarter, MRNA reported total revenues of $108 million, reflecting a 35% decrease year-over-year, attributed to the seasonal nature of the respiratory vaccines and lower vaccination rates.

It reported a net loss of $1 billion for Q1 2025, an improvement from a $1.2 billion loss in Q1 2024. Net product sales were $86 million, mainly from COVID vaccine sales, with the U.S. contributing about one-third of these sales. This was a decline from the previous year due to the transition of COVID into routine seasonal vaccination patterns.

It also announced the expansion of its oncology portfolio with the addition of the Checkpoint medicine program, showing early but encouraging data.

In Q2, Moderna is likely to have generated a major portion of its revenues from selling its COVID-19 vaccine, Spikevax. The vaccine sales are likely to be pegged at $59 million, implying a significant decline from the year-ago level due to lower demand.

However, the European Commission recently granted marketing authorization for the updated formulation of Spikevax.

Analysts also expect minimal product sales of the company’s RSV vaccine mResvia, which received FDA approval last year. mResvia sales are expected to be $2 million, far below sales of competing RSV vaccines, Arexvy, marketed by GSK (GSK), and Pfizer’s (PFE) Abrysvo.

Investors will also want to learn more about Intismeran autogene, a personalized cancer therapy which is being developed in collaboration with Merck (MRK).

Longer-term, this could be a boost to the group’s currently ailing share price.

Is MRNA a Good Stock to Buy Now?

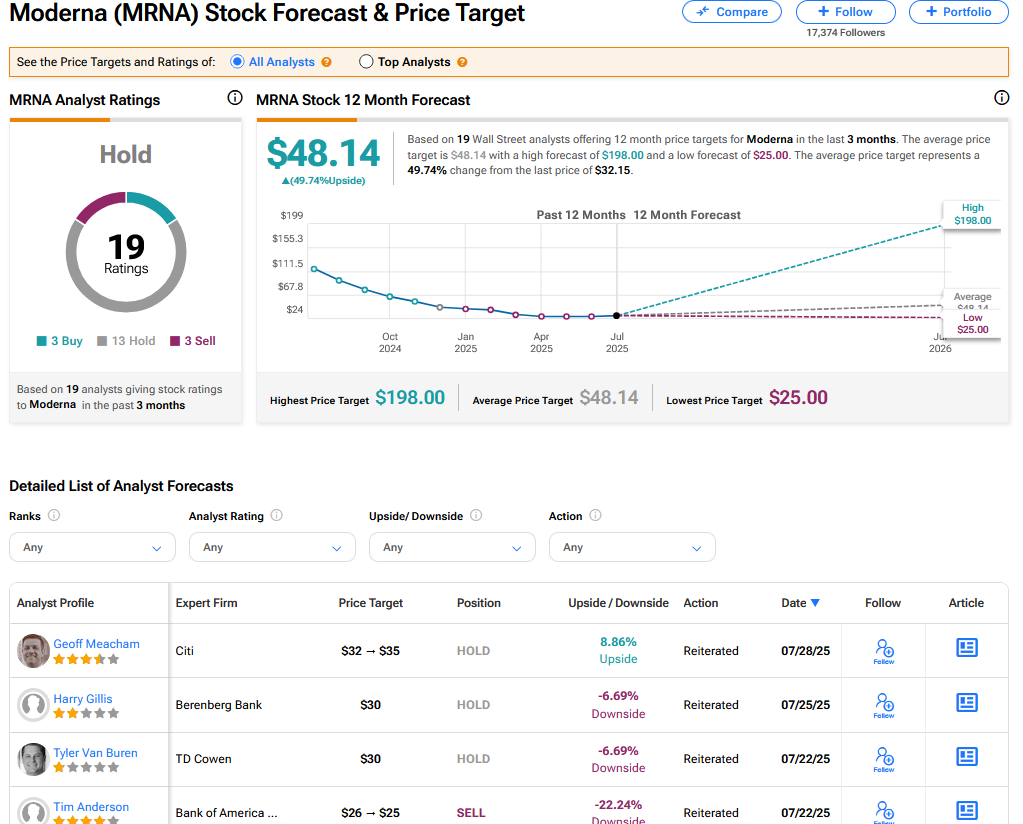

On TipRanks, MRNA has a Hold consensus based on 3 Buy, 13 Hold and 3 Sell ratings. Its highest price target is $198. MRNA stock’s consensus price target is $48.14, implying a 49.74% upside.