Decoupling is something which can be quite common during times of stress including, it seems, between countries.

According to an article in the South China Morning Post, concerns are mounting in China that U.S. tech giant Microsoft (MSFT) is getting ready to part ways with the world’s second largest economy.

Abrupt Suspension of Services

It appears that Microsoft has abruptly suspended some commercial services for a number of clients in mainland China. It was reported that Guangzhou-based Sun Yat-sen University sent a notice to faculty and students earlier this week stating that Microsoft 365 services – including OneDrive, OneNote, and SharePoint – would cease operations today.

The university told students to: “Please log in to Microsoft 365 as soon as possible to retrieve personal data and files.”

The move comes hot on the heels of BGI Group, a Chinese genomics company, reportedly losing access to its own Microsoft services, including the Outlook email system and OneDrive cloud storage platform.

Indeed, two employees of the company were apparently “caught off guard” by the sudden service suspension, which forced it to scramble for alternatives, including the emergency use of the WPS Office suite, from Beijing-based Kingsoft.

Geopolitical Shifts

It also follows the move by Wicresoft, a Microsoft joint venture, earlier this week to cease its operations in China and lay off hundreds of staff.

It stated then that the decision was down to “geopolitical shifts” and indeed Microsoft’s strategy has raised fears that further ‘decoupling’ between U.S. tech and China could be on the horizon.

That is largely down to the ongoing tariffs trade conflict between the world’s two largest economies which has left China facing a huge 125% tax on its imports into the U.S. It is also partly due to concerns over data security and an intensely competitive AI development race between the two nations.

Is MSFT a Good Stock to Buy Now?

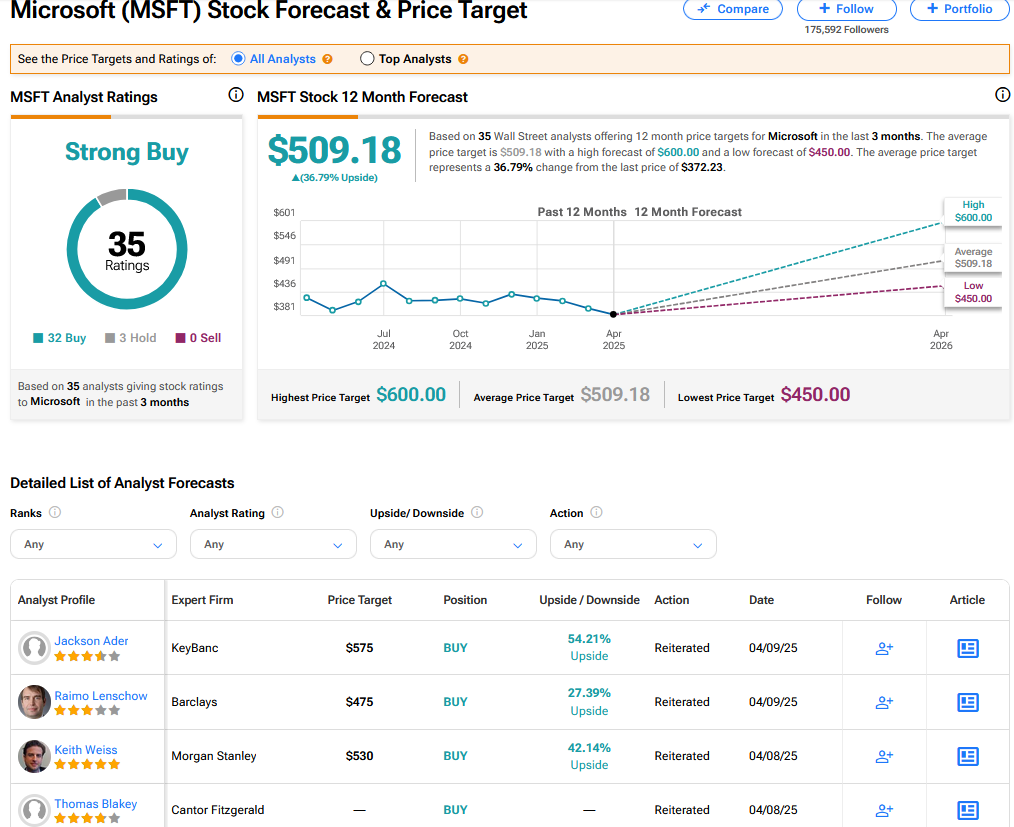

On TipRanks, MSFT has a Strong Buy consensus based on 32 Buy and 3 Hold ratings. Its highest price target is $600. MSFT stock’s consensus price target is $509.18 implying an 36.79% upside.