Tech giant Microsoft (MSFT) has been on a bit of an expansion tear of late, trying to put together the kind of infrastructure required to make it a powerhouse in cloud and in artificial intelligence (AI) as well. But some are wondering if, perhaps, Microsoft is going a bit too far, building more than it really needs. The idea is a compelling one, if a bit speculative. Investors would have none of it, though, as shares ticked upward fractionally in Wednesday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Microsoft, reports note, currently has one of the largest capital budgets in AI. That alone is a bit of a red flag, though not a particularly large one. Someone has to be the biggest, after all, and Microsoft’s sheer scale allows it to comfortably spend on nearly any task. But a lot of that spending depends heavily on OpenAI (OPAIQ), which agreed to buy $250 billion worth of Azure services.

That is a huge buy, and anywhere else, would justify a healthy budget to ensure that the demand could be met. But OpenAI has a similar, slightly larger deal with Oracle (ORCL) at $300 billion. So how is OpenAI going to meet bills that add up to better than half a trillion dollars? This is leading some to believe that, perhaps, Microsoft is building infrastructure to meet a demand that will, ultimately, become phantom demand.

Cloud Expansion

But then, Microsoft may be able to find alternate uses for some of that infrastructure. It recently announced that it is bringing Xbox Cloud Gaming to Amazon (AMZN) Fire TV systems. Some of them, anyway; “select” Amazon Fire TVs will get access to the platform, allowing anyone with a compatible television and Xbox controller to get in on the games.

The Fire TV 4 and the Fire TV Omni QLED are the two in particular that will run the Xbox platform, reports note. It also goes to show that Microsoft may not need consoles for console gaming after all, a point which some have wondered would be underscored with Microsoft’s future gaming plans.

Is Microsoft a Buy, Hold or Sell?

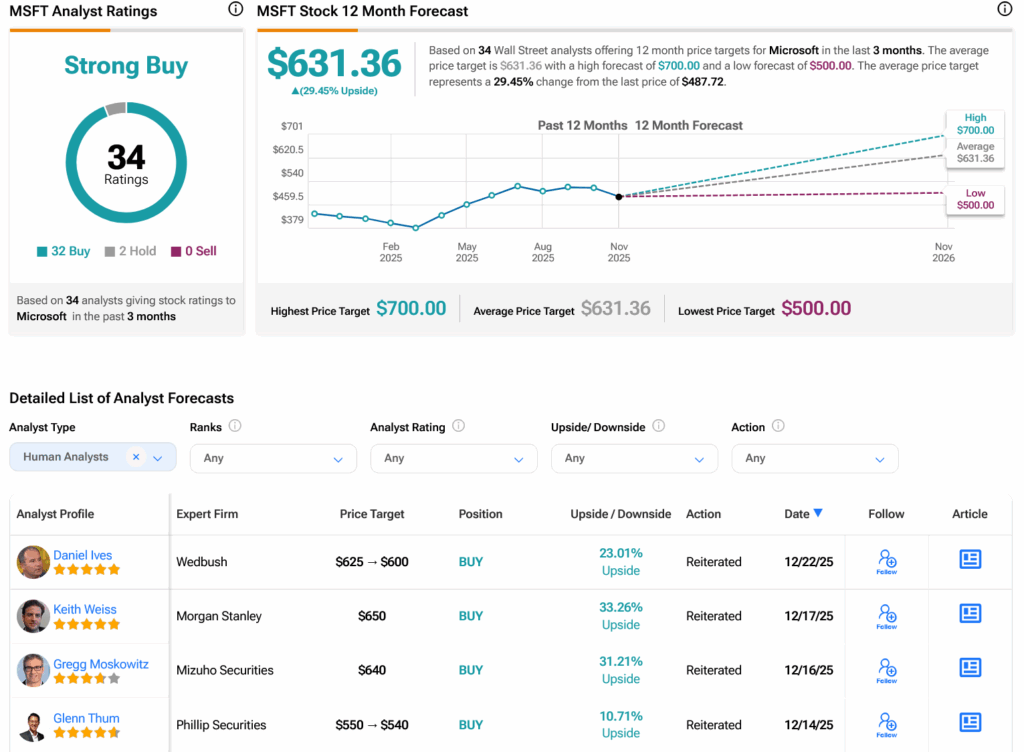

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 11.13% rally in its share price over the past year, the average MSFT price target of $631.36 per share implies 29.45% upside potential.