Food manufacturer McCormick & Company (MKC) is set to release its Q3 earnings report this week. This has some investors wondering whether buying shares of MKC stock beforehand could add some spice to their portfolios.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Wall Street Expects

Wall Street is expecting McCormick & Company to report earnings per share of $0.81, down 2.4% on the same period last year. Its revenues are tipped to come in at $1.71 billion, up by 2.1% year-over-year.

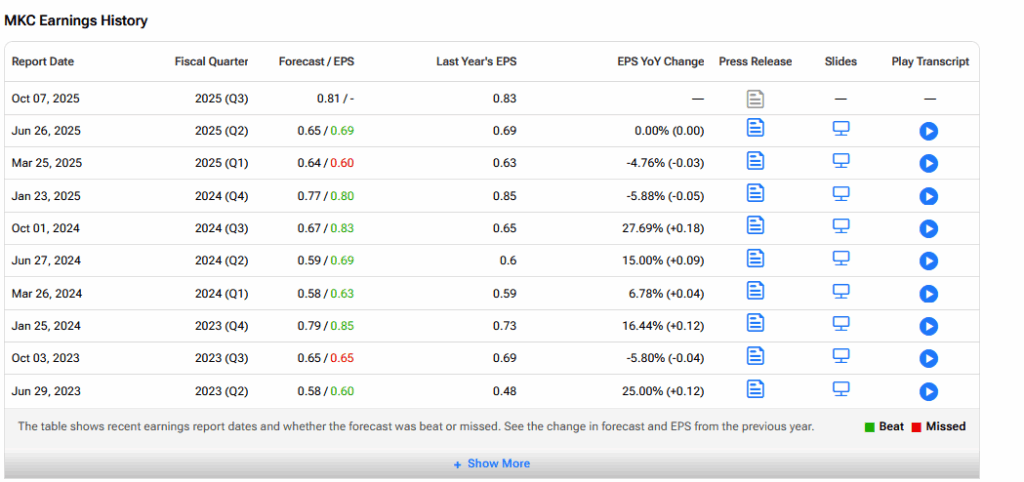

Will MKC be able to beat these estimates? As one can see below, it has a good recent track record in doing just that.

Key Issues Ahead of Earnings

In Q2, McCormick reported a 2% increase in total organic sales, driven primarily by a more than 3% volume growth in the Consumer segment, although partially offset by declines in Flavor Solutions.

Overall, it benefited from strong consumer demand across its core categories of spices, seasonings, sauces and condiments. This has been supported by innovation and more marketing spend. In addition, its emphasis on health-conscious and flavor-driven cooking continues to resonate with households preparing more meals at home.

However, in its Flavor Solutions segment, McCormick may have continued to experience softness related to sluggish volumes among its large customers. The segment has also faced challenges from muted demand in fast-food outlets, particularly in Europe and the Middle East, because of geopolitical tensions.

It has also had to contend with tariff and commodity price pressures.

That tariffs exposure recently led JPMorgan analyst Thomas Palmer to lower his price target on the stock to $82 from $83. However, he kept an Overweight rating on the shares ahead of the Q3 report. He continues to view the company’s tariff exposure as manageable but is more cautious on its Q4 earnings due to stepped up reciprocal tariffs.

Is MKC a Good Stock to Buy Now?

On TipRanks, MKC has a Moderate Buy consensus based on 5 Buy, 3 Hold and 1 Sell ratings. Its highest price target is $102. MKC stock’s consensus price target is $81.67, implying an 18.86% upside.