Linde (NASDAQ:LIN) is among the largest UK-based companies and the world’s largest industrial gas producer. However, Linde doesn’t seem to get much attention from retailer investors, especially when considering its size. But while this is a quality company with some recent impressive margin gains, I believe the valuation is a little bloated considering its growth prospects. This is why I’m neutral on this industrial gas giant.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Linde Is a Quality Company

Linde is a blue-chip stock and one of the big four producers of industrial gas. Collectively, Linde, Air Liquide (OTC:AIQUY), Air Products (NYSE:APD), and Taiyo Nippon Sanso, account for over 80% of the industrial gas sector. In FY2023, Linde reported revenues of $33 billion, ahead of Air Liquide, which reported revenues of approximately $30 billion in 2023.

The company offers diversification through its portfolio, which includes essential gases like oxygen, nitrogen, hydrogen, carbon dioxide, and argon. These are crucial to various sectors, and gases supplied by Linde are used in Healthcare (17%), Food & Beverage (9%), Electronics (9%), Chemical & Energy (22%), Manufacturing (22%), and Metals and Mining (14%) end markets.

Domiciled in Ireland and headquartered in the United Kingdom, Linde is a global company, with around a third of its gas revenues originating from the U.S., followed by Germany (9%), China (8%), and the United Kingdom (5%). This global presence also reflects positively on the company’s diverse business.

Linde’s Margin Expansion Impresses Investors

Linde’s share price has surged 17.3% over the past 12 months, and that’s despite a 1.5% decline in FY23 revenues. However, while revenues fell, Linde managed to improve its margins and grow earnings per share (EPS) by an impressive 15.5%. This growth highlights Linde’s pricing power in a competitive market and commitment to cost control.

This trend was repeated in Q1 of 2024. In Q1 2024, Linde reported a 1% decline in revenues compared to Q1 2023 but a 10% increase in EPS to $3.75. This was driven by a 2% improvement in operating margins from 26.9% to 28.9% and a 2.1% increase in the net income margin from 20.4% to 22.5%. The company also impressed investors with a 9% increase in its dividend.

One reason for this pricing power and margin growth is Linde’s strategic approach to contracts. Linde often secures clients to 10-to-20-year contracts, incorporating minimum purchase requirements and price escalation provisions. This provides visibility on revenues and room to adjust prices in response to economic conditions.

Is LIN Stock Worth the Price?

Linde is continuing to grow earnings in challenging conditions. Management has projected an 8-10% increase in FY2024 adjusted EPS despite a slowdown in Metals, Mining, and Electronics end markets. While Linde does have a habit of outperforming its own guidance, some investors may be concerned by that growth rate, especially when we consider that the stock is trading at 28.13x non-GAAP forward earnings.

Looking forward, analysts expect an annualized EPS growth rate of 10.09% throughout the medium term — the next three to five years. Once again, while that’s relatively strong for some sectors, I don’t believe it’s enough to justify this index-topping valuation.

Translating this growth rate into price-to-earnings (P/E) ratios, we can see that the non-GAAP forward P/E ratio falls to 25.5x in 2025 and 23x in 2026. This growth rate also gives us a price-to-earnings-to-growth (PEG) ratio of 2.79x, which is very stretched (1.0x or lower is generally seen as undervalued), even when considering the company’s pricing power and the 1.23% dividend yield.

The firm’s net debt stands around $15.5 billion, noting $20.3 billion in debt and $4.8 billion in cash. Still, this net debt position doesn’t seem overly concerning, given the company’s revenues and scale. Nonetheless, it’s not enough to justify this rather stretched valuation.

Is Linde Stock a Buy, According to Analysts?

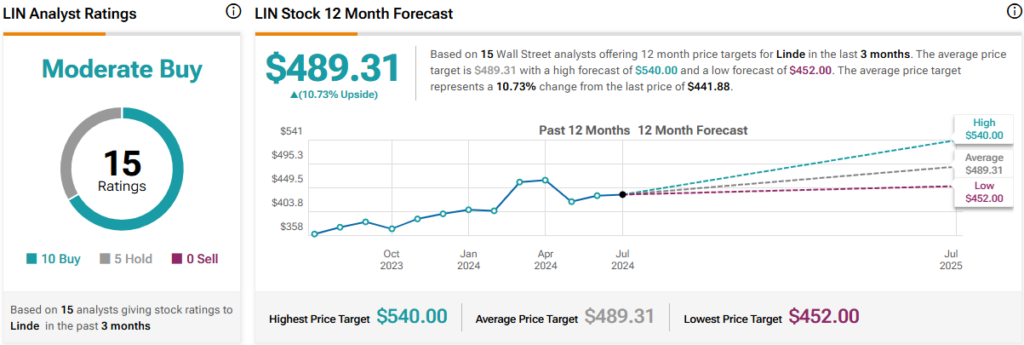

On TipRanks, LIN comes in as a Moderate Buy based on 10 Buys, five Holds, and zero Sell ratings assigned by analysts in the past three months. The average Linde stock price target is $489.31, implying 10.7% upside potential.

The Bottom Line on Linde Stock

Linde is a quality company with a strong share of the industrial gas market, pricing power (as reflected in recent margin growth), and a diversified portfolio. The company’s diversified operations provide investors stability and potential for growth across various sectors, including Healthcare, Manufacturing, and Energy, ensuring resilience against market fluctuations.

However, Linde’s valuation is starting to look a little stretched, considering the expected growth rate over the medium term. While the company has a track record of outperforming, many investors may be concerned by the 10.09% projected annualized growth rate when combined with the forward non-GAAP forward earnings ratio of 28.13x.

So, while I’m always on the lookout for quality companies, I think this giant of the industrial gas world is a little expensive.