Li Auto (LI) stock has underperformed expectations over the past 12 months and slumped almost 17%. This was mainly due to a reversal in sales growth at the beginning of 2024 and the disappointing release of its first all-electric vehicle. With troubles mounting, Wall St. remains enamored with the stock, with not a single analyst tracked by Tip Ranks recommending a Sell despite the recent woes. There is more than meets the eye with this plucky Chinese EV manufacturer.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Li Auto appears to be a slam-dunk investment on paper, with impressive growth prospects and a strong financial position. While I remain bullish on the valuation, I remain concerned by the lack of momentum and broader concerns about the auto industry.

On Paper, LI is a Slam Dunk Buy

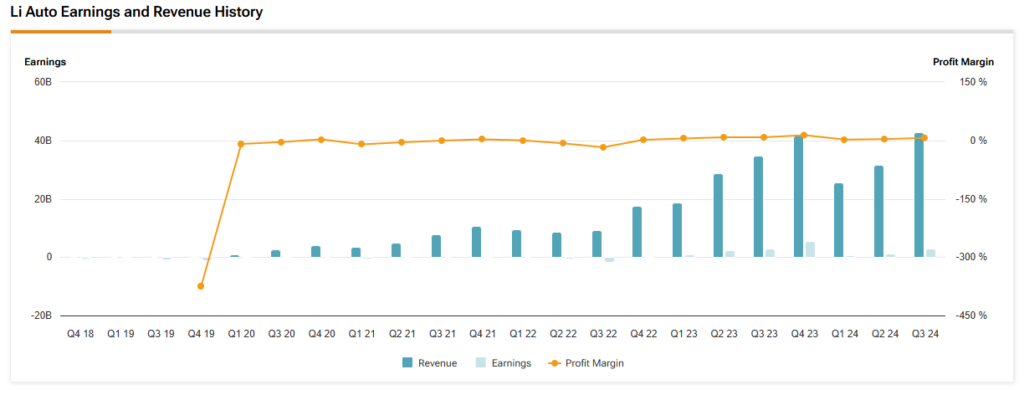

The company’s earnings trajectory shows a temporary dip in 2024, but forecasts indicate a robust recovery and acceleration in the following years. The consensus earnings per share (EPS) growth estimates paint a compelling picture, with projected growth rates of 33% in 2025 and an impressive 39% in 2026.

What truly sets Li Auto apart is its exceptional EV-to-EBITDA ratio, primarily due to its substantial cash reserves. The company’s financial strength is undeniable, with net cash accounting for half its market value. This cash position provides a safety net and significant potential for future investments and growth. It may also allow the company to start paying dividends in the foreseeable future.

Li Auto has a market cap of $26 billion, total debt of $2.24 billion, and cash reserves of $15 billion. As such, Li Auto’s enterprise value of $13 billion isn’t tremendous compared to its income.

Looking ahead to 2026, Li Auto is poised to trade at a remarkably low multiple of around 4x earnings when adjusted for cash. This projection assumes continued cash growth, which seems likely given the company’s strong performance and market position. Current forecasts show the price-to-earnings (P/E) ratio decreasing from 22.2x in 2024 to 12x in 2026, further highlighting the potential undervaluation of the stock.

Not So Fast for Li Auto

The global automotive industry has seen intensifying competition amid economic pressures and regulatory shifts, particularly in the EV sector. Manufacturers grapple with supply chain fragility, rising battery material costs, and evolving emissions standards, which strain profitability across the board. Legacy automakers and newer entrants confront margin compression as they balance R&D investments in electrification with stagnant consumer demand in key markets.

Even though Li Auto distinguishes itself through industry-leading vehicle margins of 20.9% in Q3, typically higher than all its peers, all competitors struggle with oversupply and discounting. The market is rather crowded, and Li Auto is in danger of being crowded out.

Subsidies and Tariffs Serve as Market Hazards for LI

I’m also concerned about the shifting policy outlook. LI defied subsidy cuts with record December 2024 deliveries (58,513 units) and 33% annual sales growth, buoyed by tax exemptions through 2025 and falling battery costs. However, complete subsidy elimination by 2027 could pressure margins, necessitating continued innovation or scaling of production. For now, at least, the exact impact of the removal of subsidies to the end of 2027 is unknown.

As with the ongoing dialogue about subsidy removal in the U.S. and how it will impact dominant forces and newcomers alike, we must ask the same questions in China. The subsidy environment has seen a host of companies enter the market, including those with very different business models, and the removal of subsidies would likely cause the most damage to those yet unable to carve out a position in the market.

What is the Price Forecast for LI Stock?

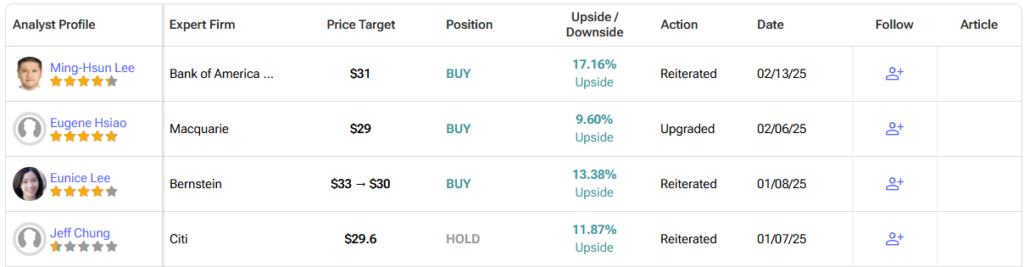

LI stock carries a Strong Buy consensus rating on Wall Street based on four Buy, one Hold, and zero Sell ratings over the past three months. LI’s average price target of $29.72 per share implies approximately 13% upside potential over the next twelve months.

Li Auto is More a Risky Ride Than a Growth Opportunity

Li Auto looks like a powerhouse investment on paper—booming growth, solid financials, and enviable vehicle margins. Its valuation suggests a significant upside, with a low earnings multiple that catches the eye.

But not so fast. Industry headwinds, fierce competition, and unpredictable subsidy shifts overshadow its future. The long-term potential is undeniable, yet these uncertainties make it a tough call. Li Auto could be a big win for patient investors, but the road ahead feels too foggy for a confident medium-long-term investment case right now.