Intuit (INTU), the parent company of TurboTax, QuickBooks, Credit Karma, and Mailchimp, will report its third-quarter earnings for fiscal 2025 on Thursday, May 22, after the market closes. Analysts expect the company to post adjusted earnings per share of $10.91 and revenue of $7.56 billion. That would be an increase from the same quarter last year, when Intuit earned $9.88 per share on $6.74 billion in revenue.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In the previous quarter, Intuit beat expectations by reporting adjusted EPS of $3.32 and revenue of $3.96 billion, which were both higher than analyst estimates. This was the 12th consecutive quarter where EPS beat projections. Interestingly, the company credited its success to strong demand for its financial software and growing use of AI features. However, its forecast for the upcoming quarter—EPS of $10.92—was slightly below Wall Street’s EPS expectation of $11.51.

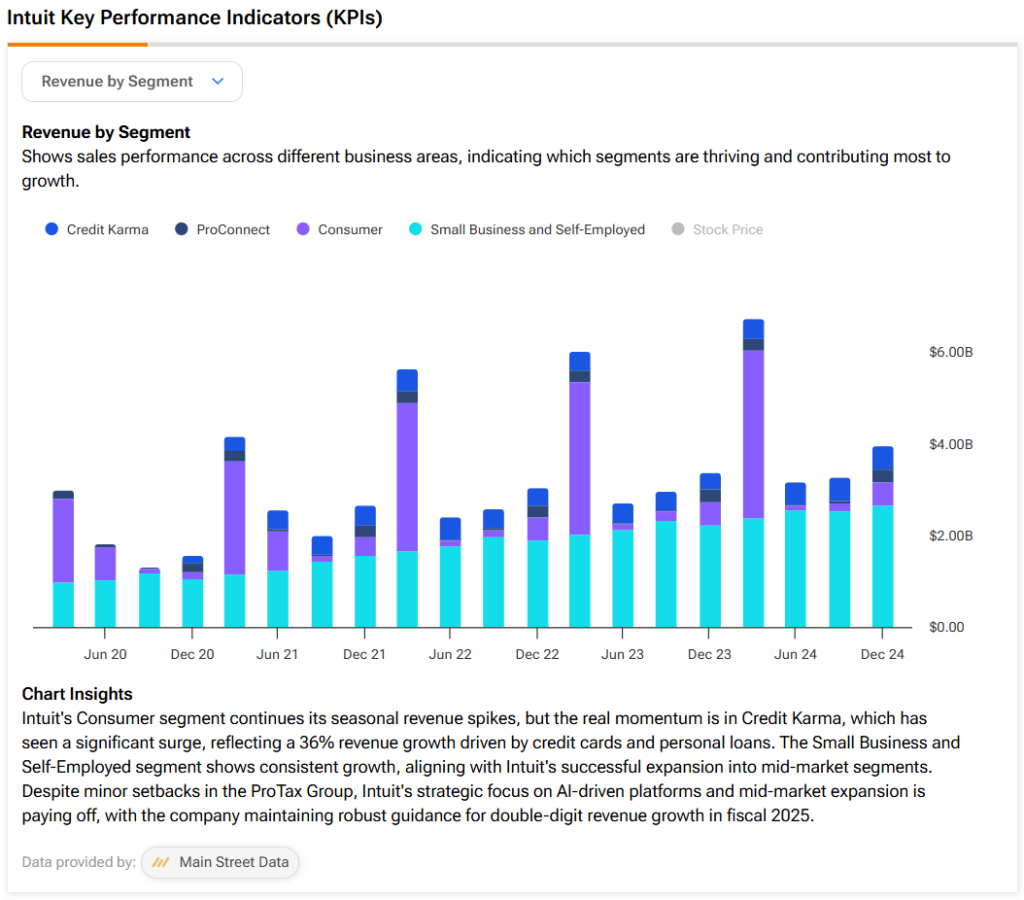

This time around, investors will be watching closely to see how Intuit’s main business units, especially Credit Karma and its small business software group, perform. Indeed, these areas have shown strong growth recently, as demonstrated by the image below.

Intuit’s investments in AI and automation are also key, as the company uses them to improve its products. In addition, investors will be looking for updates on Intuit’s guidance for the rest of the year, especially since there is a lot of uncertainty in the economy right now, along with growing competition.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 5.2% price move in either direction. This estimate is derived from the $672.50 strike price, with call options priced at $17.45 and put options at $17.85.

Is INTU Stock a Buy, Sell, or Hold?

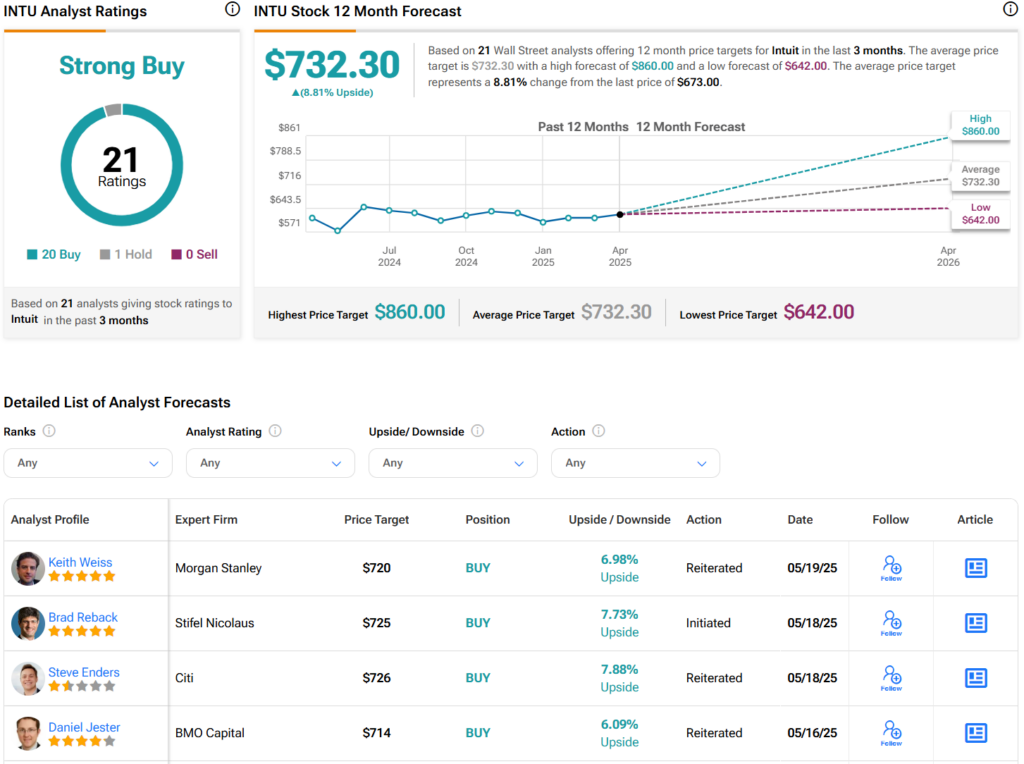

Overall, analysts have a Strong Buy consensus rating on INTU stock based on 20 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average INTU price target of $732.30 per share implies 8.8% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue