Quantum computing has recently attracted much attention, especially after Google (GOOG) revealed its ‘Willow’ quantum chips, which claimed to execute unimaginable tasks. We’re just getting used to a new AI era. Still, there’s no room for lingering these days, and scientists, engineers, and others are already preparing for the next tech evolution, sparking excitement and intrigue simultaneously. Quantum technology promises to revolutionize all industries with its unparalleled processing power.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While many small-cap quantum stocks such as Rigetti Computing (RGTI) or IonQ (IONQ) have bloated their value, they present high volatility, risk, and unrealistic valuation. Just take a look at Rigetti’s P/S ratio to get an idea. In contrast, International Business Machines (IBM), the oldest tech company trading on Wall Street, offers a more stable way to gain exposure to this new-born industry.

If you wish to read more about IBM’s fortunes, you can check out what our analyst at Tipranks, Mike Byrne, wrote about the company right here. Now, let’s explore three key reasons why IBM stands out as a better choice for investors looking to invest in the quantum realm:

- Experience and Technological Leadership: IBM has been a pioneer in quantum computing since the 1990s. The company already provides access to high-performance quantum computers with over 100 qubits and charges customers $96 per minute!!! To use these powerful machines. IBM’s extensive experience and established infrastructure in quantum computing give it a significant edge over newer, less-proven companies.

- Reasonable Valuation and Financial Stability: Unlike many small-cap quantum stocks positioned years from profitability, IBM is already a profitable company with a reasonable valuation. It trades at 22 times earnings, slightly below the broader market average, and at just 3.5 times revenue. This contrasts with companies like Rigetti Computing and IonQ, which trade at astronomical valuations of 392 and 250 times sales, respectively. IBM’s financial stability and diversified business model provide a safer investment with exposure to quantum computing’s potential upside.

- Strong Dividend and Long-Term Growth Prospects: IBM has a long history of paying dividends, making it a rare quantum stock offering investors income. The company has paid dividends for 35 consecutive years and has increased its payout for the past 25 years, earning it the status of a Dividend Aristocrat. With a current yield of 2.99%, IBM provides a steady income stream significantly higher than the S&P 500’s average yield. Additionally, IBM’s involvement in significant quantum research projects and its recent unveiling of the Condor processor, the first to surpass 1,000 qubits, position it well for future growth in the quantum computing market.

Is IBM a Buy or a Sell?

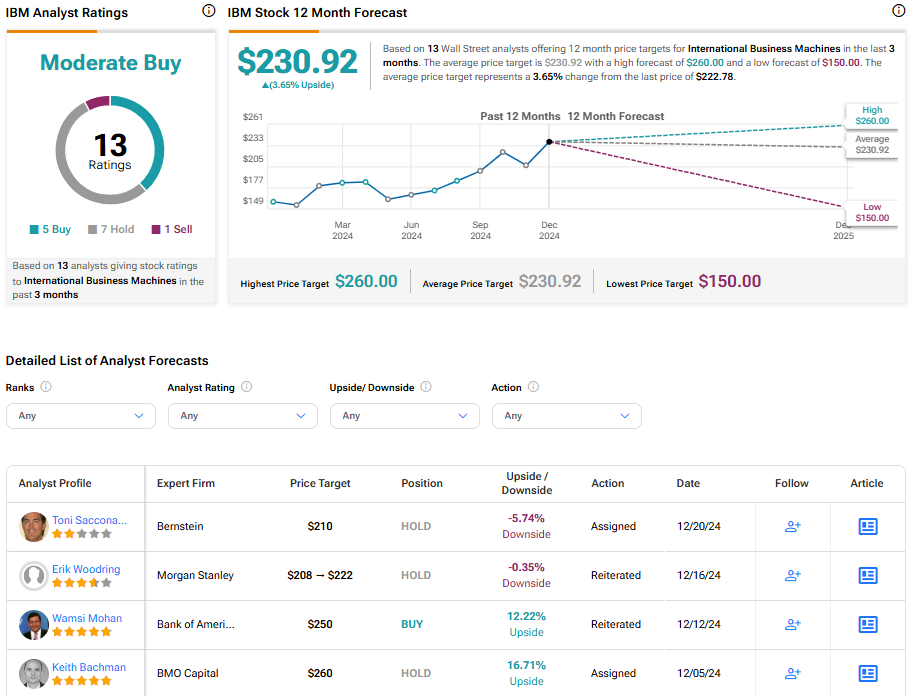

On Wall Street, IBM is considered a Moderate Buy. The average price target for IBM stock is $230.92, suggesting a 3.65% upside potential.

Takeaway

Since Google released its new quantum chip, Willow, the new-born industry has become the newest sensation for investors wanting to get a ticket before the prices skyrocket to unreasonable amounts. Small companies like Rigetti and IonQ have enjoyed growing enthusiasm and increasing their value. However, their valuation still seems unwarranted, considering they are not close to being profitable. Enter IBM.

The technological veteran has been working in the quantum field since the 1990s and is one of the leading forces in quantum computing and AI. It is also a profitable business that offers a nice quarterly dividend as a bonus. When we combine all this, we get a solid, even if unspectacular, option to invest in the new and exciting quantum industry.