Diversified tech and manufacturing company Honeywell (HON) is set to report its Q3 earnings results on October 23 before the market opens. Analysts are expecting earnings per share to come in at $2.57 on revenue of $10.15 billion. This compares to last year’s figures of $2.58 and $9.73 billion, respectively. Interestingly, Honeywell has a strong track record when it comes to beating earnings. In fact, it has done so in each of its last 16 quarters. However, analysts have mixed opinions on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

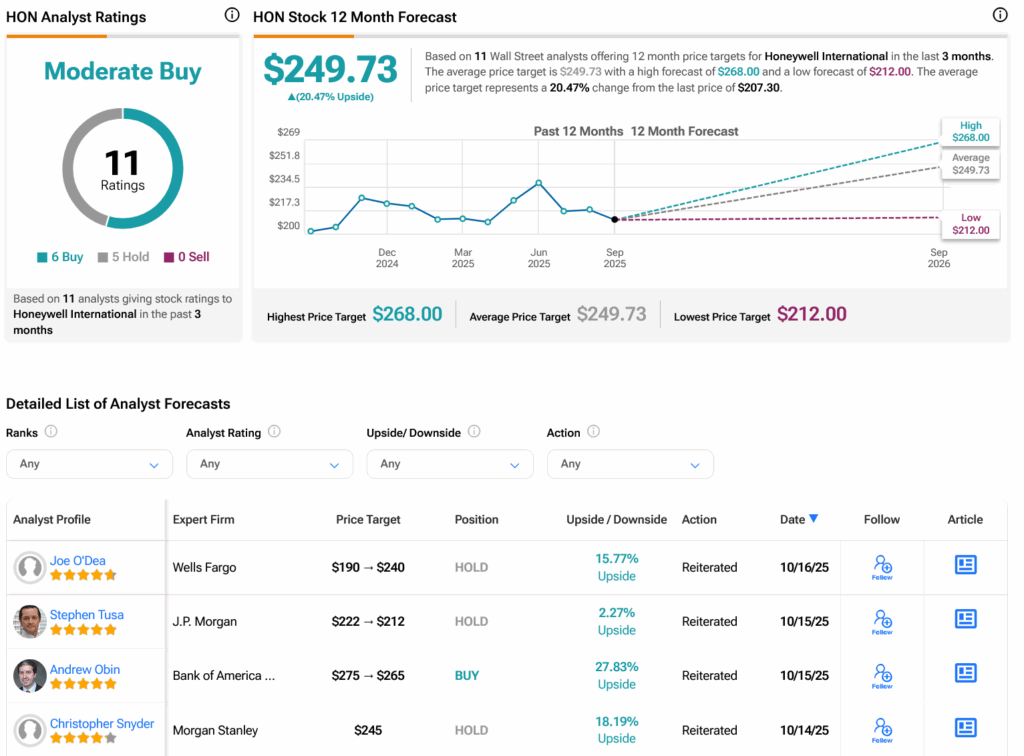

For instance, Bank of America, led by five-star analyst Andrew Obin, has cut its price target on Honeywell to $265 from $275 but continues to rate the stock as a Buy. The firm updated its estimates to reflect the spin-off of Honeywell’s Advanced Materials unit, Solstice, which will be removed from its projections as of October 31. It also added $2 billion in payment transfers from Solstice to Honeywell’s balance sheet and expects Honeywell to revise its guidance to reflect two fewer months of Solstice revenue this year. Nevertheless, Bank of America believes Q3 is still “broadly on track.”

At the same time, five-star JPMorgan analyst Stephen Tusa lowered his price target on Honeywell to $212 from $222 and kept a Hold rating. As part of his Q3 preview for the broader electrical equipment and multi-industry group, Tusa said he’s slightly more cautious in the near term but sees valuations improving. Notably, JPMorgan is now leaning toward value stocks that are under pressure heading into earnings, which suggests that some other names in the sector could present better buying opportunities.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 4% move in either direction.

Is HON Stock a Buy?

Overall, analysts have a Moderate consensus rating on HON stock based on six Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average HON price target of $249.73 per share implies 20.5% upside potential.