Home improvement giant Home Depot (HD) has had its ups and downs of late, with new sales and substantial controversy serving as both headwind and tailwind alike. Further, many compare it to one of its biggest competitors, Lowe’s (LOW), and not without reason. But who is the better play in this market? One analyst took a look at the pair and came back with an oddly definitive answer: Home Depot. The news proved little help for Home Depot stock, though, as shares slid over 1.5% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The calculus behind such an assessment came from considering Home Depot and Lowe’s position in the market, reports noted. Home Depot has already outperformed Lowe’s stock over the last three years by a significant margin. Lowe’s stock has gained 33% in that time frame, reports note, while Home Depot has added 46.2%. Some here might think that that means Lowe’s has more room for growth, but this analyst passed on that theory.

The analyst also noted that Home Depot has more stores than Lowe’s does, and higher annual sales figures. Home Depot’s 2,347 stores generated a combined total of $159.5 billion in sales for the 2024 fiscal year, while Lowe’s 1,748 stores could only yield $83.7 billion. That’s a very wide margin of difference, and for Lowe’s to come back from that assumes that it would suddenly generate about twice the revenue from fewer stores.

Community Standing

One point not mentioned was a matter of community standing. Home Depot recently reasserted its standing in the community by setting up a program to get kids to learn fire safety directly from area firefighters. The Howland Township Fire Department in Ohio brought kids into Home Depot Safety Day in a bid to teach kids about preventing fires.

The kids not only got fire safety lessons, but also got to work fire extinguishers and even fire hoses, a move which undoubtedly caught the kids’ attention. The exact impact on Home Depot is debatable, but chances are it built up at least a little community goodwill as a result.

Is Home Depot a Good Long-Term Buy?

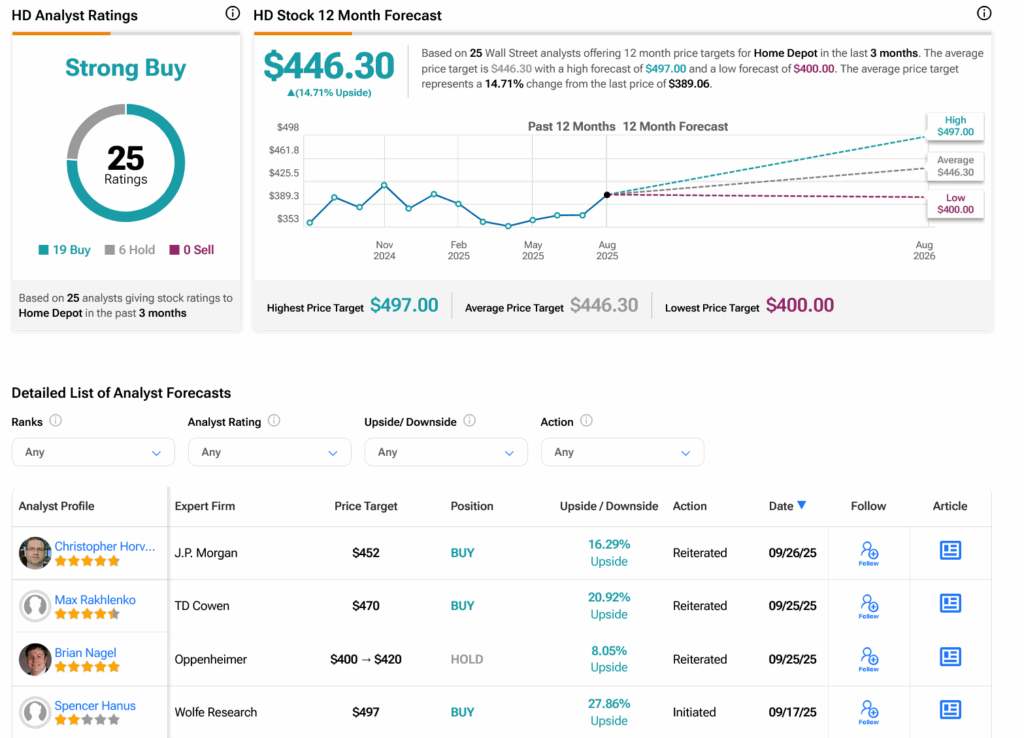

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 19 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 3.19% loss in its share price over the past year, the average HD price target of $446.30 per share implies 14.71% upside potential.