One important facet of my investing strategy is to buy businesses that are closely tied to the American Dream. To quote the legendary investor Warren Buffett in his 2020 Letter to Shareholders, one should “Never bet against America.” Home Depot (HD), a hot spot for both homeowners and professional contractors, is one of the most prominent companies in the country. In just the last 12 months, shares of the home improvement retailer have surged almost 40%. This rally has pushed HD stock’s current valuation up to levels that I believe price in most of the near-term upside, even after taking into consideration the solid Q3 and tailwinds on the horizon. This explains why I believe that Home Depot stock is a Hold.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Home Depot Defied Expectations in Q3

True to the scrappy American spirit, Home Depot outperformed analysts’ consensus in its Fiscal third quarter ended October 27, 2024. The company’s sales grew 6.6% year-over-year to $40.2 billion during the quarter. For perspective, that was approximately $900 million ahead of the analyst consensus for the quarter. Resiliency in Home Depot’s comparable sales (-1.3%) and the acquisition of the leading residential specialty trade distribution company SRS Distribution in June contributed to these results.

Home Depot’s adjusted diluted EPS dipped 1.8% over the year-ago period to $3.78 in the Fiscal third quarter. For context, this exceeded the consensus estimate by $0.13. Higher operating expenses (+9.2%) led to a 70 basis point contraction in the company’s adjusted operating margin to 13.8% for the quarter. This was only partially offset by a lower share count, which explains why adjusted diluted EPS decreased despite higher sales in the quarter.

Catalysts Are Forming for Home Depot

After more than two years of operating in a rising interest rate environment, things are starting to look up again for Home Depot. That’s because the current market consensus is that the federal funds rate is most likely to be cut by anywhere between 50 and 100 basis points between now and December 2025. As a result, the chief economist for the National Association of Realtors, Lawrence Yun, expects a 9% increase in home sales in 2025 and a 13% boost in 2026.

Rising home sales mean that more homeowners will also be looking to do renovations, whether those come from the do-it-yourself route or the professional contractor route. Either way, that’s a win for Home Depot.

The delayed impact of interest rate cuts working their way through the economy means that Home Depot will probably face marginal bottom-line declines for another quarter or two. In the meantime, the company can focus on streamlining the acquisition of SRS Distribution to take full advantage of the housing rebound that’s just around the corner. For these reasons, the consensus is that adjusted diluted EPS will rise by 4.2% to $15.73 in FY 2026. Another 9.4% growth in adjusted diluted EPS to $17.20 is expected in FY 2027.

A Battle-Tested Dividend Payer with an A-Rated Balance Sheet

Another positive fundamentally for Home Depot is that its 2.2% dividend yield is higher than the S&P 500 Index’s (SPX) 1.2% yield. Better yet, this market-beating starting income also comes with a 15-year dividend growth streak. That includes the COVID-19 pandemic, which was a time of great uncertainty for many dividend stocks. Home Depot’s adjusted diluted EPS payout ratio is expected to be in the high-50% range for the current Fiscal Year (2025), which is manageable. That should position the payout to grow in the mid to high-single-digit range annually in the next few years.

Home Depot’s financial positioning is another aspect of why I’m confident that dividend growth can persist. This is supported by the fact that the interest coverage ratio was 11.3 through the first three quarters of Fiscal 2025. That’s precisely what rating agencies like to see for Home Depot’s industry, which explains the A credit rating from S&P Global (SPGI) on a stable outlook.

Upside Is Mostly Priced into Home Depot Stock

Despite the positives discussed above, I am sidelined on Home Depot stock as the optimistic market sentiment is arguably reflected in its current valuation. In other words, Home Depot’s upcoming business recovery is already being recognized by the market. In my view, this neutralizes the various positive elements of the stock that I have highlighted to this point. That’s because the stock’s forward P/E ratio of 26x is situated moderately above its 10-year average P/E ratio of 22.1x.

I’m sure Home Depot will surpass analysts’ current expectations for the next couple of Fiscal Years, but by how much is likely the only question. Home Depot’s growth story is about the same as it has been in recent years, so I don’t think the current multiple of 26x can be justified. That’s why I believe the P/E ratio is set to revert to a fair value of around 22b. Overall, Home Depot is a great business, with a stock valuation that’s overextended.

Is Home Depot a Buy, According to Analysts?

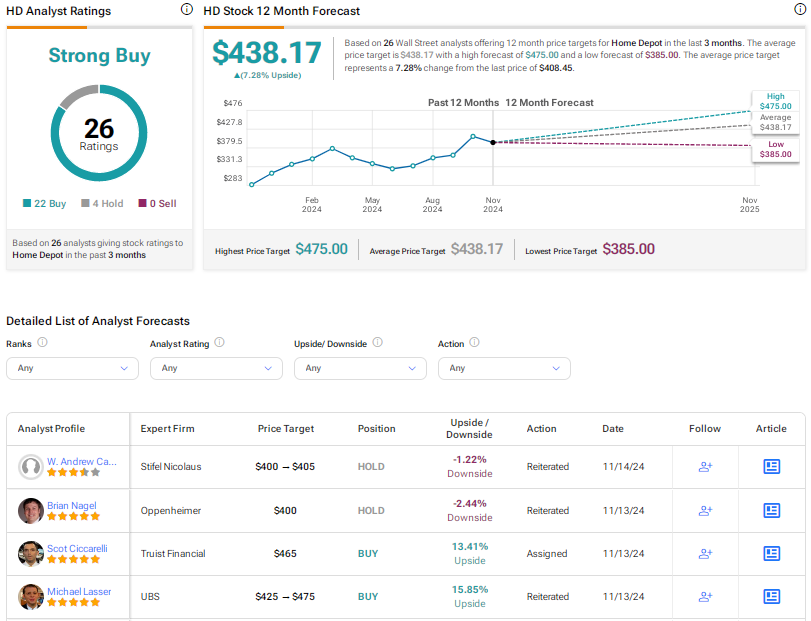

Turning to Wall Street, analysts have a Strong Buy rating on Home Depot. Among 25 analysts, 22 have assigned Buy ratings in the last three months versus four Hold ratings. At $438.17, the average HD stock price target implies 7.28% upside potential from the current share price.

The Takeaway

As the leading home improvement retailer, Home Depot is admirably positioned to cash in on the upcoming housing market growth. This bodes well for its growth prospects in the coming years. Combined with a viable payout ratio, dividends paid to shareholders are also expected to continue to grow. Until the valuation comes down to tilt the risk-reward dynamic a bit more in favor of future capital appreciation, I’m going to merely hold my Home Depot stock rather than buy more.