Tech giant Google (GOOGL) is set to report its Q3 earnings results on October 29 after the market closes. Analysts are expecting earnings per share to come in at $2.27 on revenue of $99.95 billion. This compares to last year’s figures of $2.12 and $88.25 billion, respectively. Unsurprisingly, Google has a strong track record when it comes to beating earnings, as it has done so in each of its last 10 quarters. And analysts seem to believe this streak will continue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

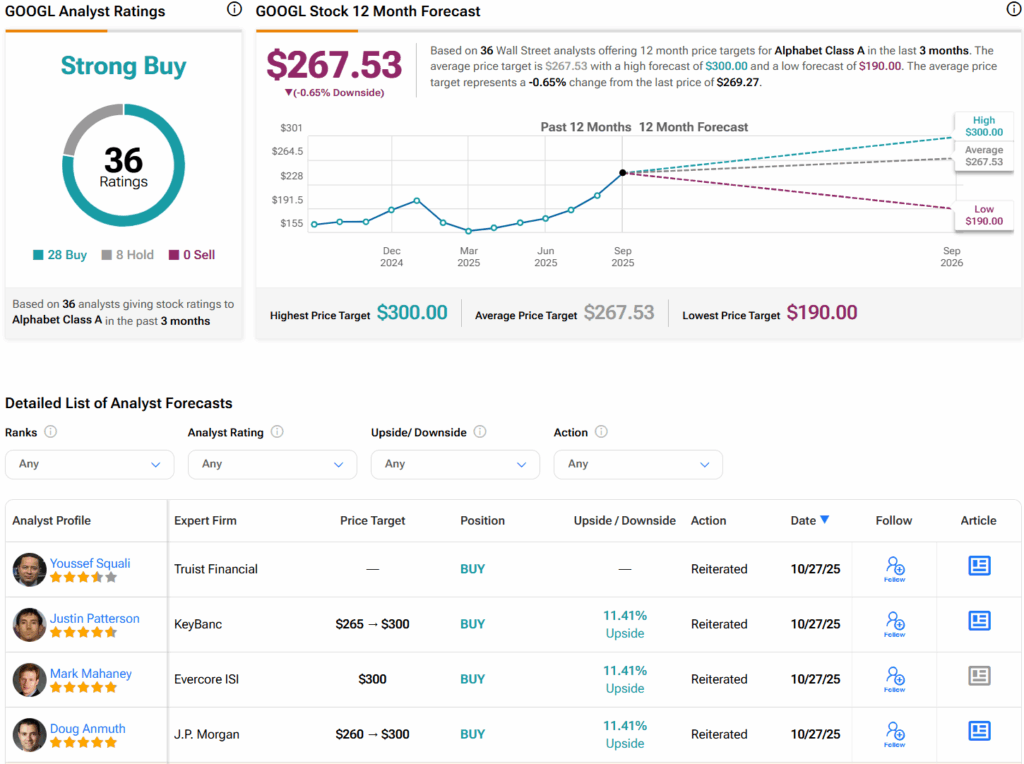

As a matter of fact, five-star JPMorgan analyst Doug Anmuth recently increased his price target on Google from $260 to $300 while maintaining a Buy rating. Interestingly, he said that a major risk had been removed after Google won its trial with the Department of Justice over search agreements. On top of that, the company continues to deliver strong financial performance and is a leader in AI innovation. Additionally, even though Google’s stock is now valued more like Meta’s (META), the firm still sees plenty of reasons to be optimistic and believes that the stock could rise much further.

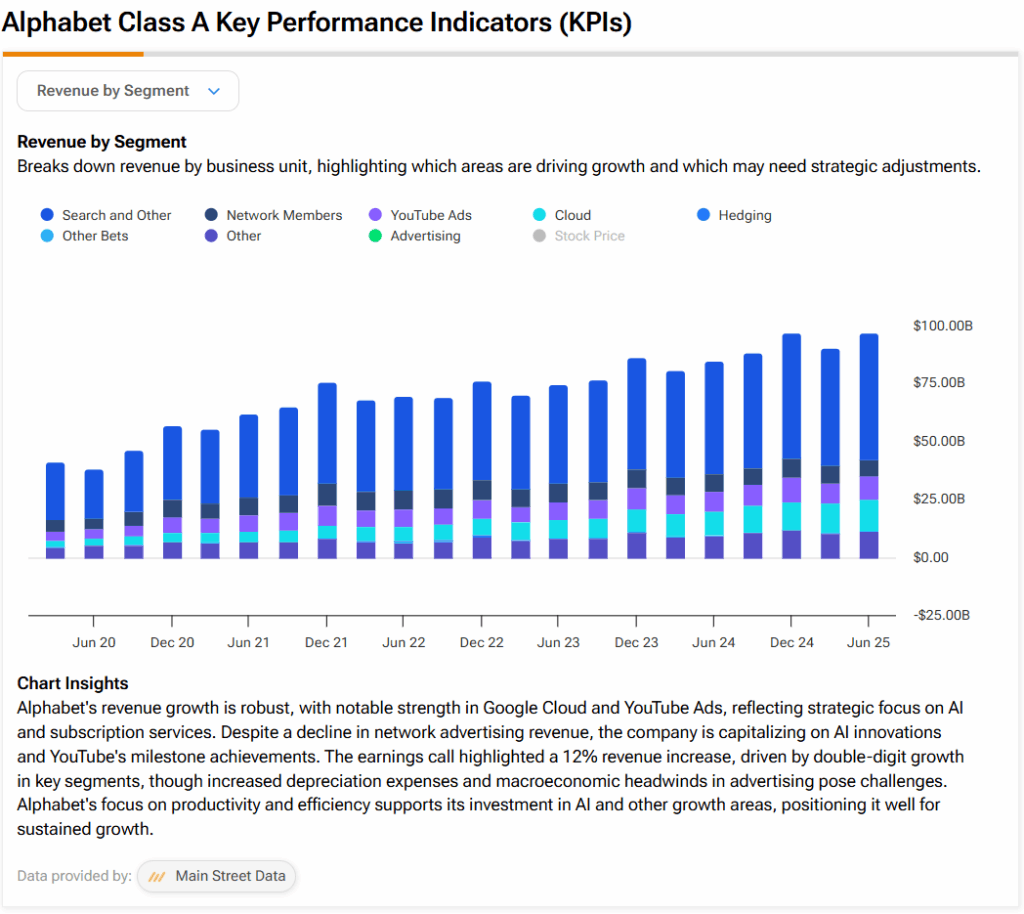

Similarly, KeyBanc, led by five-star-rated Justin Patterson, also raised its price target on Google to $300 from $265 and kept a Buy rating. The firm expects Q3 results to show strong momentum across the Search, Cloud, and Waymo business units, thanks to faster product development. Indeed, Google’s Search and Cloud segments have been the company’s main growth drivers over the past several years, as indicated by the image below. KeyBanc also pointed out that Google’s stock doesn’t look overpriced, since it’s trading at only a 1.5x forward earnings premium compared to the S&P 500 (SPY). This suggests there’s still room for the stock to grow.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 6.6% price move in either direction. This estimate is derived from the $270 strike price, with call options priced at $8.60 and put options at $9.13.

Is Google Stock a Good Buy?

Overall, analysts have a Strong Buy consensus rating on GOOGL stock based on 28 Buys and eight Holds assigned in the past three months. Furthermore, the average GOOGL price target of $267.53 per share implies that shares are trading near fair value. At the same time, TipRanks’ AI analyst has an Outperform rating with a $302 price target.