Estee Lauder’s (EL) growth prospects depend on its new “Beauty Reimagined” strategy, which aims to restore sustainable sales growth. The company is focused on cost efficiencies and supply‑chain improvements to rebuild margins. Also, management expects these moves, along with geographic expansion in markets like India and the Middle East, to support a return to growth over the next few years. Currently, EL stock is a Strong Buy, according to the technical indicators, implying further upside from current levels.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Analyzing EL Stock’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, Estee Lauder stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 100.29, while its price is $110.27, implying a bullish signal.

Further, the Moving Average Convergence Divergence (MACD) indicator, which helps understand momentum and potential price changes, signals a Buy.

Another technical indicator, Williams %R, helps traders see if a stock is overbought or oversold. For EL stock, Williams %R currently shows a Buy signal, suggesting the stock is not overbought and has room to run.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, an ROC above zero confirms an uptrend. Estee Lauder currently has an ROC of 7.44, which signals a Buy.

What Is the Price Target for EL Stock?

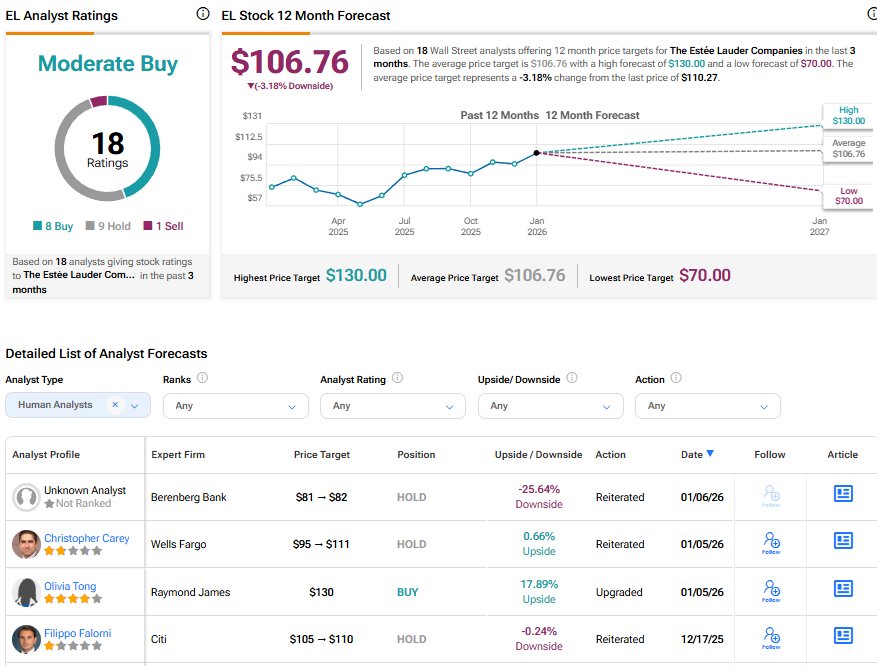

Turning to Wall Street, EL stock has a Moderate Buy consensus rating based on eight Buys, nine Holds, and one Sell assigned in the last three months. At $106.76, the average Estee Lauder stock price target implies a 3.18% downside risk.