Shares of sports betting platform DraftKings (DKNG) are up in today’s trading as investors await its Q4 earnings results on February 13 after the market closes. Analysts are expecting earnings per share to come in at -$0.16 on revenue of $1.4 billion. However, its following Q1 results seem like they will be better. In fact, DraftKings was a big winner during Super Bowl LIX, as many key bets went in its favor thanks to the Philadelphia Eagles’ victory.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

This included prop bets and parlays, particularly those involving players Saquon Barkley and Travis Kelce since they did not score touchdowns. As a result, the Super Bowl’s success could have a significant impact on DraftKings’ finances. Indeed, according to Bank of America analyst Shaun Kelley, the company’s strong performance could add up to $25 million in adjusted earnings in the next quarter.

DraftKings also dominated the market on Super Bowl Sunday, with 23% of active users and the most downloads. However, looking ahead, the company’s financial outlook may still be impacted by potential tax changes in Maryland and Ohio, as well as launch costs in Missouri. Therefore, this could lead to a conservative forecast when DraftKings releases its earnings report.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see that options traders are expecting an 8.6% move from DKNG stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

It’s worth noting that DKNG’s after-earnings price moves in the past 12 quarters have mostly been larger than the 8.6% that is expected. This implies that current option prices might be undervalued.

What Is the Target Price for DKNG Stock?

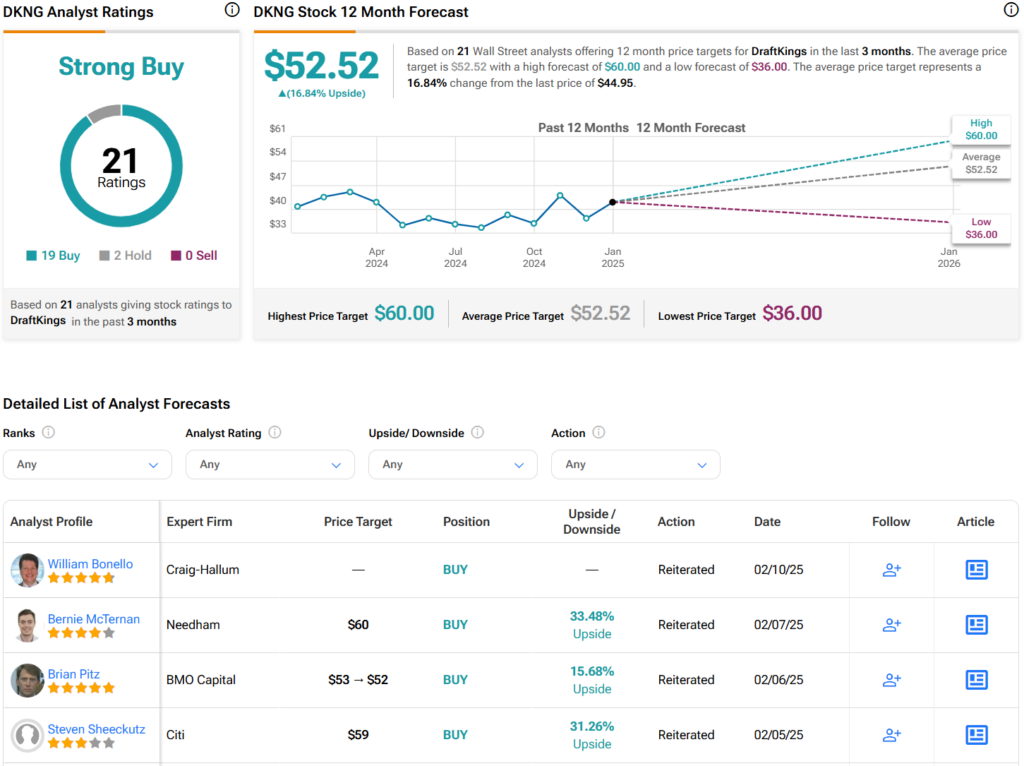

Turning to Wall Street, analysts have a Strong Buy consensus rating on DKNG stock based on 19 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 5% rally in its share price over the past year, the average DKNG price target of $52.52 per share implies 16.8% upside potential.