Delta Air Lines (DAL), an airline carrier, is set to report its Q3 2025 earnings on October 9. The stock has rallied nearly 54% over the past six months, driven by steady travel demand and stronger corporate bookings. However, shares are still down about 5% year-to-date as investors weigh fuel cost pressures and global economic uncertainty. Even so, analysts remain largely positive on Delta’s outlook ahead of the results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent Event Ahead of Q3

Earlier this month, two regional jets operated by Delta Air Lines collided on a runway at New York City’s LaGuardia Airport. The collision injured a flight attendant, damaged a cockpit, and tore part of a wing in what the airline called a “low-speed collision.” The incident adds to a growing list of crashes, collisions, and near-miss events across U.S. airports this year, as experts point to increasing air traffic and aging air traffic control systems as key concerns.

On September 11, 2025, Delta reaffirmed its earnings outlook for both the September quarter and full year. The airline expects revenue growth of 2% to 4% year-over-year for the quarter, supported by strong operations, steady demand, and tighter industry capacity.

What to Expect from DAL on October 9

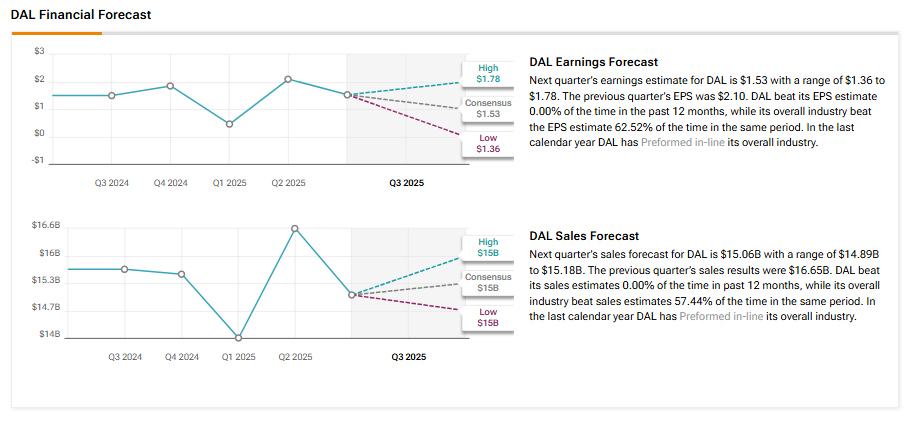

Wall Street analysts expect Delta Air Lines to report earnings of $1.53 in Q3, up 2% from the same quarter last year. Meanwhile, analysts project Q3 revenues of nearly $15.06 billion versus $15.7 billion in the year-ago quarter, according to the TipRanks Analyst Forecasts Page.

Analysts Remain Bullish on DAL’s Growth Prospects

Ahead of Delta Air Lines’ Q3 report, TD Cowen analyst Tom Fitzgerald said the airline is one of the best placed in the industry, helped by steady demand from business travelers. He noted that Delta continues to gain from firm trends in corporate travel, premium seats, and international routes that have picked up since the summer. Fitzgerald added that passengers still value comfort both on flights and in airport lounges, especially on longer routes.

In addition, six other top analysts have reiterated their Buy ratings on the stock this month, reflecting continued confidence in Delta’s performance and outlook.

Is DAL Stock a Buy or Sell?

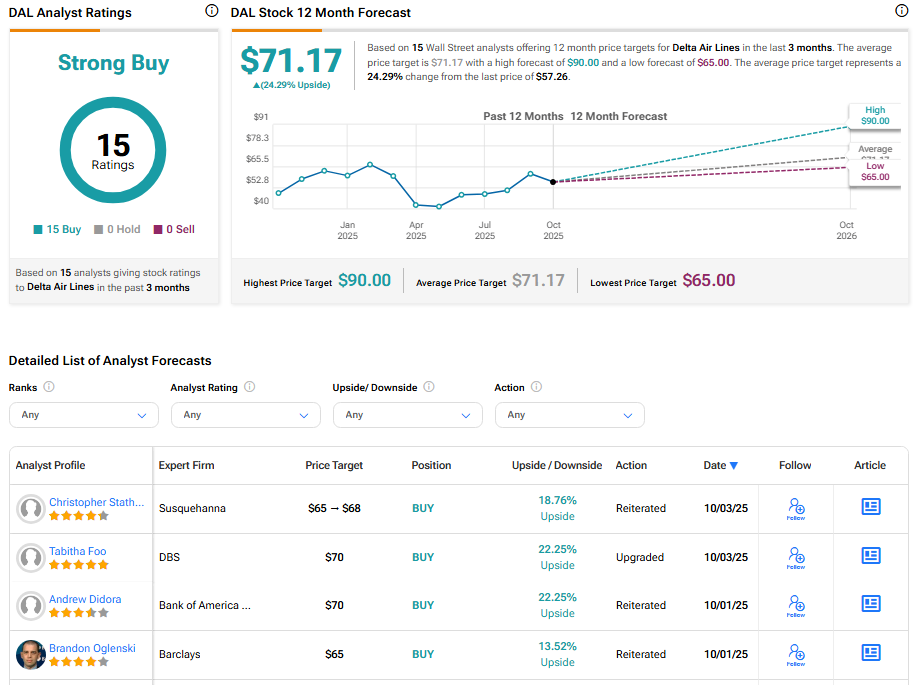

Analysts remain bullish about Delta Air Lines’ stock trajectory. With 15 unanimous Buy ratings, DAL stock commands a Strong Buy consensus rating on TipRanks. Also, the average DAL price target of $71.17 implies 24.29% upside potential from current levels.