Tech company Dell Technologies (DELL) is set to report its second-quarter earnings results on August 28 after the market closes. Analysts are expecting earnings per share to come in at $2.29 on revenue of $29.02 billion. This equates to 21.2% and 16% year-over-year increases, respectively, according to TipRanks’ data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is ideal because earnings per share should grow faster than revenue, as this demonstrates a high degree of operating and financial leverage in the business. It’s also worth noting that DELL has a solid record when it comes to beating earnings estimates. Despite missing in the last quarter, it had topped expectations in the 12 consecutive quarters prior.

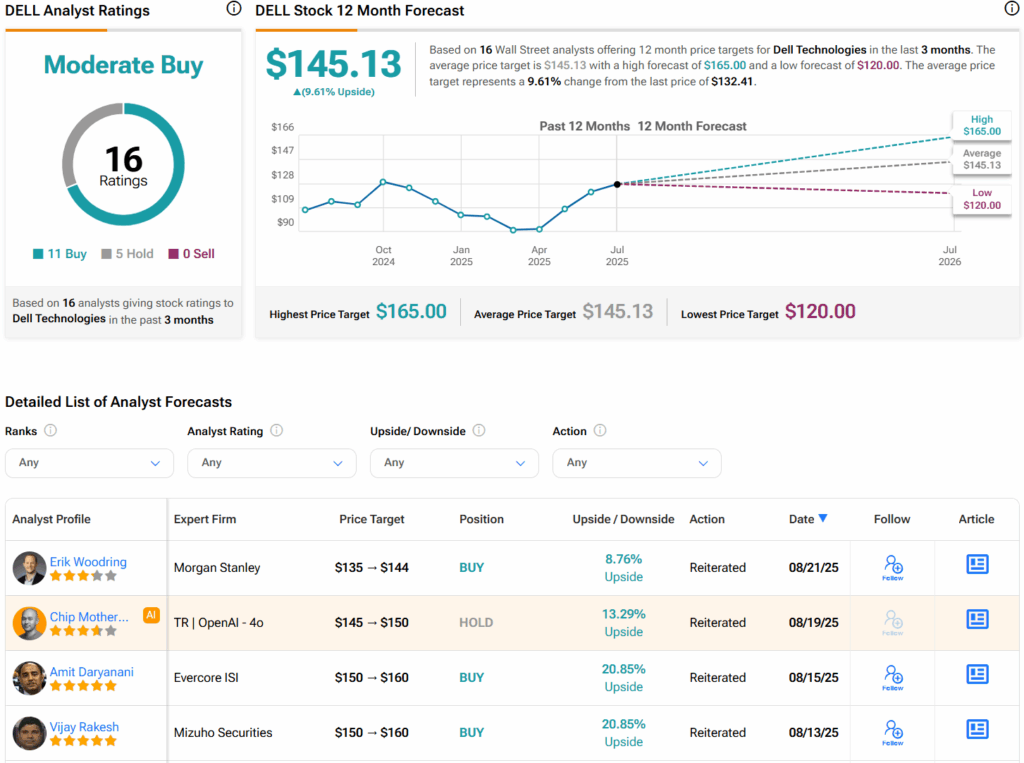

Interestingly, Morgan Stanley raised its price target on Dell from $135 to $144 while maintaining a Buy rating after saying the recent pullback makes the stock more attractive ahead of earnings. In a note to investors, the firm said that it expects Dell’s July quarter results to slightly exceed expectations, driven by strong AI spending and steady PC demand in Q2. Morgan Stanley also sees potential upside to Dell’s full-year outlook, which suggests that the company is well-positioned for more growth.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see that options traders are expecting an 8.4% move from DELL stock in either direction right after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement.

However, it is worth noting that DELL’s after-earnings price moves in the past 12 quarters have exceeded this expected 8.4% move seven times and by wide margins. This suggests that the options might present a speculative opportunity to profit from a large post-earnings swing.

Is DELL a Good Buy?

Overall, analysts have a Moderate Buy consensus rating on DELL stock based on 11 Buys and five Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average DELL price target of $145.13 per share implies 9.6% upside potential. At the same time, TipRanks’ AI analyst has a Neutral rating and a $150 price target.