Healthcare firm CVS Health (CVS) is set to release its Q1 earnings report before markets open on Thursday. This has some investors wondering whether it’s a good idea to buy shares of CVS stock beforehand.

What Does Wall Street Expect?

Wall Street is expecting CVS Health’s revenue to grow 5.4% year-on-year to $93.18 billion, improving from the 3.7% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.67 per share, up 27.5% year-on-year.

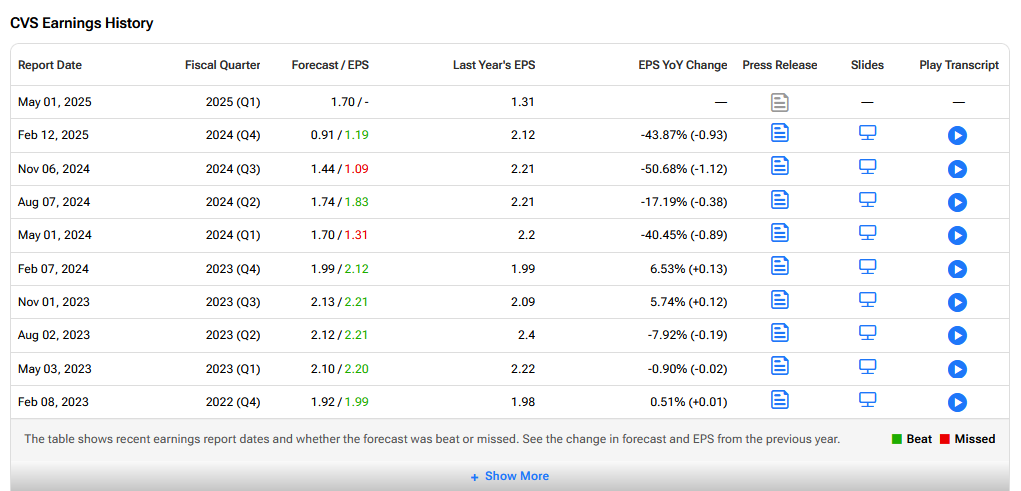

Will CVS be able to beat these estimates? As one can see below, it has a healthy record of doing just that in recent quarters.

Analyst Comments on CVS Stock Prior to Earnings

Analyst Leerink Partners recently reiterated a Buy rating on CVS Health boosting the price target to $79.00.

It said that CVS is expected to recover its earnings power over the coming years, with management confident in meeting or exceeding their guidance for fiscal year 2025. This optimism is bolstered by improvements in the performance of health insurance provider Aetna driven by product and geographic changes.

Additionally, its Pharmacy Benefit Management (PBM) segment is anticipated to maintain its positive growth trajectory, supported by strong demand for specialty drugs. While there are challenges such as macroeconomic pressures, it said that CVS Health appears capable of navigating these issues effectively.

Morgan Stanley raised its price target on CVS to $80 from $68 and kept an Overweight rating on the shares. While policy will be “front and center” with varying degrees of exposure, or lack there of, across the Healthcare Services and Technology space, the focus in Q1 will also be on “indications of underlying utilization trends across distributors, providers, labs, animal and dental.”

Baird analysts said they do not expect guidance raises in the report as it believes companies will maintain 2025 “conservatism and cushion” given potential economic headwinds.

Is CVS a Good Stock to Buy Now?

On TipRanks, CVS has a Strong Buy consensus based on 17 Buy and 3 Hold ratings. its highest price target is $90. CVS stock’s consensus price target is $75.65 implying an 14.19% upside.