CoreWeave (CRWV) is set to report its third-quarter fiscal 2025 results after the market closes on Monday, November 10. Investors will pay close attention to the company’s future roadmap primarily after Core Scientific (CORZ) shareholders rejected its proposed $9 billion takeover bid. CoreWeave had planned to cut $500 million in annual expenses by 2027 through the merger, mainly by reducing lease costs, but those expected savings are no longer achievable.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

CoreWeave is an AI cloud computing company specializing in providing cloud-based graphics processing unit (GPU) infrastructure to developers and enterprises. Since its IPO on March 31, 2025, the stock has surged more than 180%, making it one of this year’s most successful market debuts.

Expectations from CoreWeave

The Street expects CoreWeave to post a narrower adjusted loss of $0.40 per share, an improvement from the $0.89 per share in Q3 FY24. Sales are expected to jump 121% year-over-year to $1.29 billion.

A key focus will be on CoreWeave’s remaining performance obligations (RPOs), which means future revenue from contracts not yet completed. During the third quarter, CoreWeave signed several multibillion-dollar contracts with companies like OpenAI, Meta (META), and Nvidia (NVDA). Some analysts predict that due to these deals, RPOs could rise to about $60 billion, up from $30 billion in Q2FY25.

Nonetheless, there are ongoing concerns about CoreWeave’s dependence on a few large customers. Investors are seeking more details about customer diversification, as well as updates on capital expenditure, financing, and power supply for its AI infrastructure during the Q3 earnings call.

Citi Raises Price Target Ahead of Earnings

Heading into the Q3 print, Citi analyst Tyler Radke kept his “Buy” rating and raised his price target on CoreWeave from $164 to $192, implying 84.6% upside potential. Radke is encouraged by the continued demand for AI computing from CoreWeave’s Big Tech customers, which could speed up revenue growth in fiscal 2026.

He added that the company is choosing a safer path by working with more customers and signing longer contracts of five to six years, to help maintain stability.

Radke added that increased power access and large-scale customers could help CoreWeave execute on its demand backlog and beat sales estimates in excess of $100 million in both Q3 and Q4. He anticipates heavier capital spending as the company expands its deployment of Nvidia’s new Blackwell chips.

Is CRWV a Good Stock to Buy?

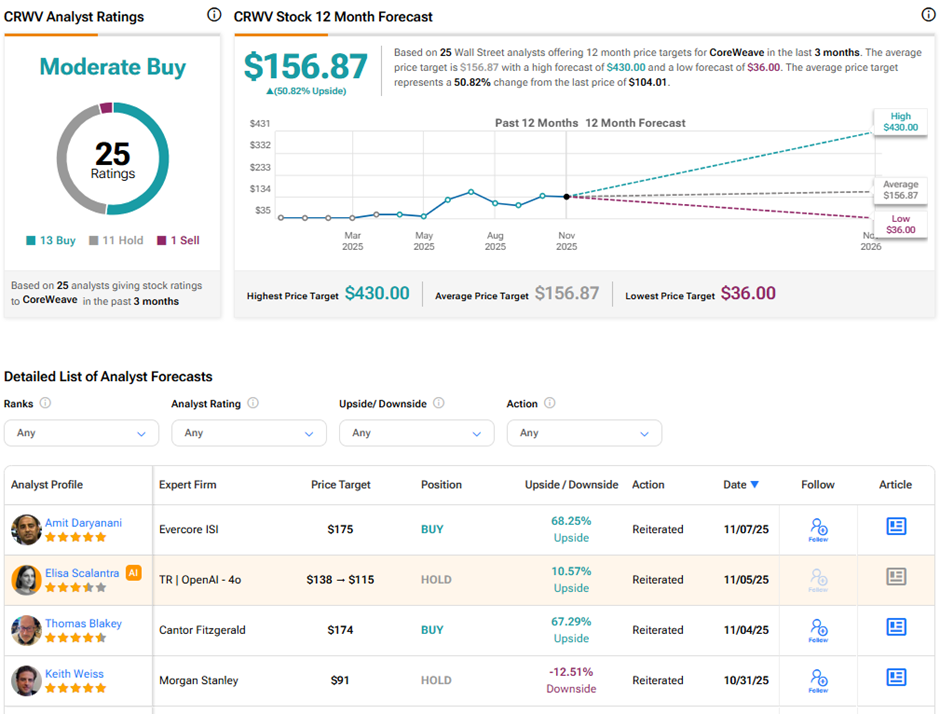

Analysts remain divided on CoreWeave’s long-term outlook. On TipRanks, CRWV stock has a Moderate Buy consensus rating based on 13 Buys, 11 Holds, and one Sell rating. The average CoreWeave price target of $156.87 implies 50.8% upside potential from current levels.